Non-Major Ports in India: Unveiling the Quiet Engines of Coastal Trade

Non-Major Ports in India: Unveiling the Quiet Engines of Coastal Trade

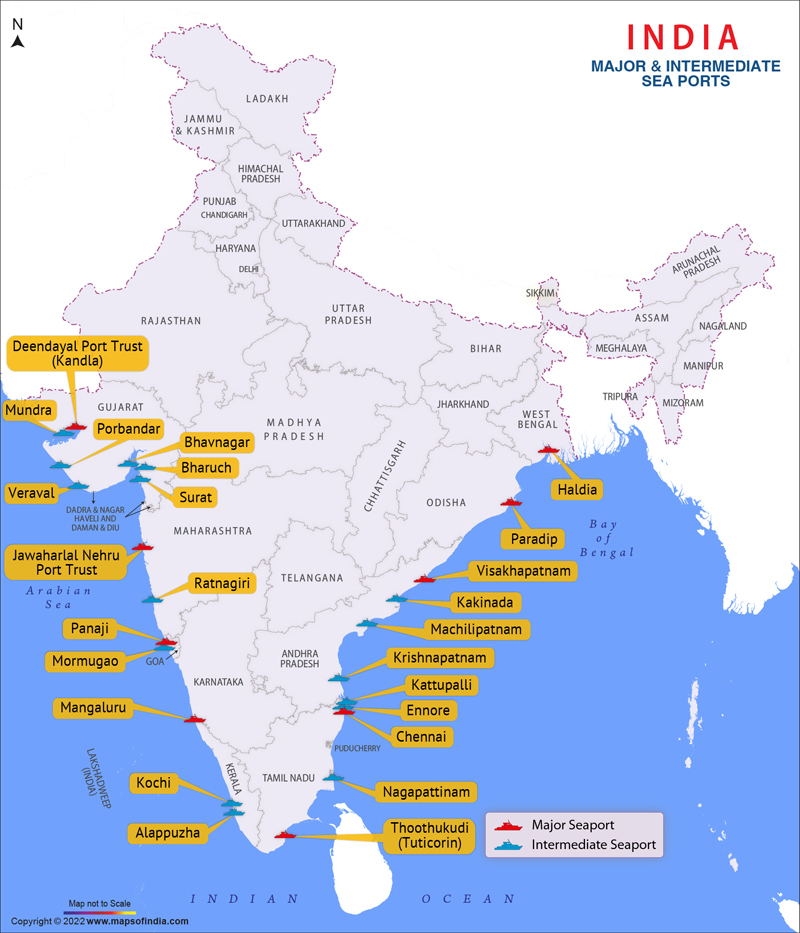

India’s maritime economy thrives on a robust network of major global gateways, yet a parallel ecosystem of non-major ports quietly drives regional development, supports inland logistics, and strengthens domestic trade resilience. These lesser-known maritime hubs, though not part of national headlines, are indispensable nodes in the country’s evolving port strategy. Located across India’s extensive coastline—from Gujarat’s rugged western shores to the labyrinthine deltas of the east—these facilities optimize supply chains, ease congestion at primary ports, and unlock economic potential in underdeveloped regions.

Unlike the global spotlight focused on Jawaharlal Nehru Port or Chennai, non-major ports operate with understated efficiency, proving that trade does not hinge solely on size. This comprehensive overview highlights their strategic locations, operational roles, infrastructure strengths, and growing economic impact.

Geographic Distribution and Strategic Placement

India’s coastline spans over 7,500 kilometers, and its port network extends across 13 major and minor facilities, each chosen for specific geographic and economic advantages.Non-major ports are often concentrated in regions with untapped trade potential and proximity to key industrial corridors. Key concentrations include: - **West Coast and Gulf of Khambhat (Gujarat):** Ports such as Pipavav and Dahej serve as critical gateways for petrochemicals, iron ore, and steel. Their location inland from the Arabian Sea reduces shipping distances for central and western India’s manufacturing zones.

- **East Coast and Delta Regions (Odisha & West Bengal):** Ranriday Port in Odisha and Haldia (while major, the surrounding zone features mid-tier facilities) support coal export and fisheries, linking eastern industrial clusters to international markets through efficient coastal logistics. - **Southwest and Lakshadweep:** Though few, isolated ports like Minicoy’s meereur Amts point to India’s efforts to integrate remote island economies into the broader maritime framework. These ports occupy strategic chokepoints and hinterland junctions, optimizing connectivity where major ports face saturation or distance.

Hordernings ait highlights Ran欲欲port—situated near the industrial hub of Dahej—to illustrate the synergy between port location and economic zone. Its deep-water berths and specialized handling systems allow dedicated handling of bulk commodities, reducing transfer times and boosting throughput efficiency. Such precision positioning makes non-major ports critical for regional supply resilience.

Functional Roles Beyond Shipping: Economic Multipliers

Non-major ports do more than dock cargo—they catalyze local development through direct and indirect channels.They serve as linchpins in multimodal logistics networks, integrating rail, road, and inland waterway systems to move goods efficiently inland. For example, Pipavav Port in Gujarat connects seamlessly with the Dahej Refinery and nearby factories, enabling just-in-time deliveries and minimizing warehousing costs. Diversified Commodity Handling These ports handle a broad spectrum of goods beyond containerized cargo.

Pipavav specializes in bulk exports—lignite, iron ore, and fertilizers—while Dahej focuses on coal and minerals, crucial for India’s energy and steel sectors. Smaller ports also support fisheries, agro-commodities, and plastics, fostering sector-specific industrial clusters. Boosting Local Economies The presence of non-major ports drives employment in construction, warehousing, transportation, and maintenance.

Employment in port-adjacent zones has risen significantly, with hundreds of thousands of indirect jobs tied to port operations and supply chain services. Moreover, local entrepreneurs benefit from increased trade volumes, spawning new logistics firms, customs brokerage services, and warehousing ventures.

Infrastructure Developments and Technological Upgrades

India’s government and port authorities continue investing in modernizing non-major facilities to enhance competitiveness.Recent infrastructure upgrades include:

Deepening and widening berths to accommodate larger vessels, though not always full-sized container ships, improving clearance and turnaround times. Pipavav, for instance, has extended its berth length to support NE-vi modern cargo carriers, enabling direct exports without transshipment.1 Expansion of Rail and Road Connectivity Efforts to integrate ports with national logistics corridors are pivotal. Pipavav links directly to the Mumbai-Gujarat industrial belt via dedicated freight corridors, while Dahej interfaces with National Highway 16 and rail lines feeding the Inner Line Enclaves of central India.

Such seamless intermodal links reduce cargo dwell time and enhance delivery reliability. Digitalization and Automation Many ports now deploy digital platforms for vessel scheduling, cargo tracking, and customs clearance—streamlining operations and cutting administrative bottlenecks. Smart port technologies, though still emerging, are gradually reducing delays and improving transparency in cargo handling.

Challenges and Limitations in Growth Trajectory

Despite their strategic value, non-major ports face persistent hurdles:Infrastructure Gaps persist even amid ongoing investments. Many terminals still rely on older equipment, limiting cargo throughput despite recent upgrades. Upgrading cranes, storage yards, and automation remains capital-intensive and logistically complex, particularly in remote locations.

Struggles with Volume and Competition With limited exposure to global shipping networks, these ports often operate below capacity. Their cargo throughput—typically a fraction of India’s top 10 ports—restricts scale-driven returns. Additionally, competition from adjacent major hubs sidelines smaller facilities in trade routing decisions, reinforcing dependence on regional demand alone.

Administrative and Regulatory Hurdles Complex coastal governance involving multiple agencies—central and state-level—slows project approvals and investment. Inconsistent policy support, coupled with bureaucratic red tape, discourages private sector participation crucial for rapid modernization and expansion.

Future Prospects and Strategic Importance

The future of non-major ports in India lies in leveraging niche advantages and aligning with national economic corridors.By focusing on specialized cargo, enhancing intermodal integration, and accelerating digital adoption, these facilities are poised to become critical enablers of inclusive growth. Regional Integration and Industrial Linkages Ports like Pipavav are increasingly integrated into industrial corridors such as the Delhi-Mumbai Industrial Corridor. This alignment ensures steady domestic demand, shielding non-major ports from volatility tied to global trade cycles.

Such strategic positioning builds long-term usage resilience. Expanding Role in Coastal and Inland Development Beyond trade, non-major ports will strengthen coastal livelihoods, support blue economy initiatives, and enable sustainable aquaculture and renewable energy projects—offshoots less visible but vital for balanced regional progress. Policy and Private Sector Synergy Emphasis on public-private partnerships and streamlined regulatory frameworks will unlock private investment in maintenance and innovation.

Such collaboration is essential to close infrastructure gaps and elevate operational efficiency.

In sum, non-major ports in India are quietly redefining trade efficiency and regional development. Their strategic locations, growing infrastructure, and specialized operations underscore a quiet yet transformative trend—moving beyond the spotlight to become essential threads in India’s maritime and economic fabric.

1 Indian Ports Association, Annual Infrastructure Report, 2023.

Related Post

Tinker Bell Films In Order: A Complete Guide to the Fairy Adventures That Captivated a Generation

Bagaimana Cara Melestarikan Sumber Daya Alam? Praktik Klima yang Efektif dan Berkelanjutan

Gay Little Monkey In The Apple Store: A Whimsical Adventure Through Orchard Aisles