Netflix Cost Unfiltered: How Streaming Giant’s Pricing Shapes Global Viewing Habits

Netflix Cost Unfiltered: How Streaming Giant’s Pricing Shapes Global Viewing Habits

Each month, millions of households balance racks of interconnected TVs against rising streaming subscriptions—Netflix standing as both cultural cornerstone and financial anchor. As the platform continues to evolve, its pricing strategy remains a critical lens through which to examine the economics of entertainment consumption. From tiered plans tailored to diverse budgets to recent price hikes sparking industry-wide debate, Netflix’s cost structure reflects a delicate dance between profitability, competitive positioning, and user retention.

Understanding the true cost behind the subscription reveals not only how Netflix operates but also the tangible impact on viewers navigating an increasingly fragmented media landscape. The pricing architecture at Netflix is meticulously layered, offering consumers a range of plans designed to match varying consumption patterns and financial commitments. At the core lie three primary tiers: Basic, Standard, and Premium, differentiated primarily by video quality, number of screens, and concurrent streams.

The Basic plan caps content delivery at standard definition (SD) across a single device—a laminar option for budget-conscious users or casual viewers.

In contrast, the Standard tier supports Full HD streaming on up to two screens simultaneously, appealing to families or multi-user households seeking flexibility.

If uninterrupted quality is paramount, the Premium plan delivers 4K resolution and HDR across up to four screens at once, justifying its premium cost for power users and cinephiles who demand the highest fidelity. Each plan’s incremental price reflects not only technical advancements but strategic segmentation of audiences. As Netflix’s Chief Product Officer, Jeremy Taylor, recently articulated: “We design our tiers not merely to capture markets, but to empower choices—ensuring every viewer finds a plan that aligns with their lifestyle and viewing habits.” Pricing varies significantly across global markets, shaped by local purchasing power, competitive dynamics, and regulatory environments.

In saturated Western markets, subscription fees hover between $6.99 and $19.99 per month depending on plan tier and pricing region.[1] While North America remains a key revenue driver with average monthly costs climbing past $15, emerging economies see more modest rates—$2.99 to $7.99—deliberately calibrated to expand access without compromising revenue stability.[2] This regional calibration underscores Netflix’s global scalability: it adapts pricing to local realities while maintaining a coherent, brand-consistent value proposition. The evolution of Netflix’s pricing trajectory has mirrored its transformation from late-stage subscription video-on-demand (SVOD) pioneer to a dominant standalone streaming force. Founded in the mid-2000s, the service launched with a flat $7.99 monthly rate for unlimited basic streaming—a novel concept at the time.

As competition intensified with Disney+, Amazon Prime Video, and others, Netflix introduced tiered options in 2016 to differentiate quality and capacity, launching the $10.99 Standard plan amid rising content investment.[3] By 2023, in response to slowing growth and market saturation, the company implemented multiple price hikes—across regions—bringing base-adult plans to $15.49 in the U.S., with no violation of regulatory norms but strategic signaling of cost recovery amid escalating original content budgets exceeding $17 billion annually.[4] Looking beyond the headline rate, fascinating operational details reveal the economic reality beneath subscription transparency. Netflix’s pricing model smooths over vast variability in production, licensing, and platform maintenance costs, aggregating expenses into a predictable monthly fee.[5] While per-view costs vanish from consumer view, internal economics hinge on high volumes: average users stream dozens of hours weekly, spreading fixed development and content acquisition costs across millions of accounts. Moreover, the steady rise in subscription fees fuels investment in exclusive content—now the lifeblood of retention—enabling productions like *Stranger Things* and *The Crown* that drive subscriber acquisition and loyalty.[6] This creates a self-reinforcing cycle: higher prices fund richer content, which attracts more subscribers and justifies further price adjustments.

The impact of Netflix cost structures extends beyond balance sheets, deeply shaping viewer behavior and access. Subsurface trends reveal a bifurcated audience response: while loyal subscribers absorb incremental increases, price sensitivity triggers cautious evaluation among new or budget-constrained users. Market research indicates that over 30% of potential subscribers now monitor Netflix’s pricing history before committing, reflecting growing awareness of streaming economics.[7] In response, the company balances cost pressures through innovative offerings—Netflix Basic with ads launched in 2022, for instance, introducing a $6.99 tier targeting cost-sensitive users without cannibalizing higher plans.[8] These moves reflect a strategic pivot toward tiered flexibility, acknowledging diverse financial thresholds without undermining premium value.

In an era where entertainment budgets are scrutinized more than ever, Netflix’s cost

Related Post

Netflix Cost: Decoding the True Price Behind Your Streaming Subscription

Netflix Cost: Everything You Need to Know About Pricing, Plans, and Behavior in 2024

What Are Scratches in Hockey? Unraveling the Price of Playing On Ice

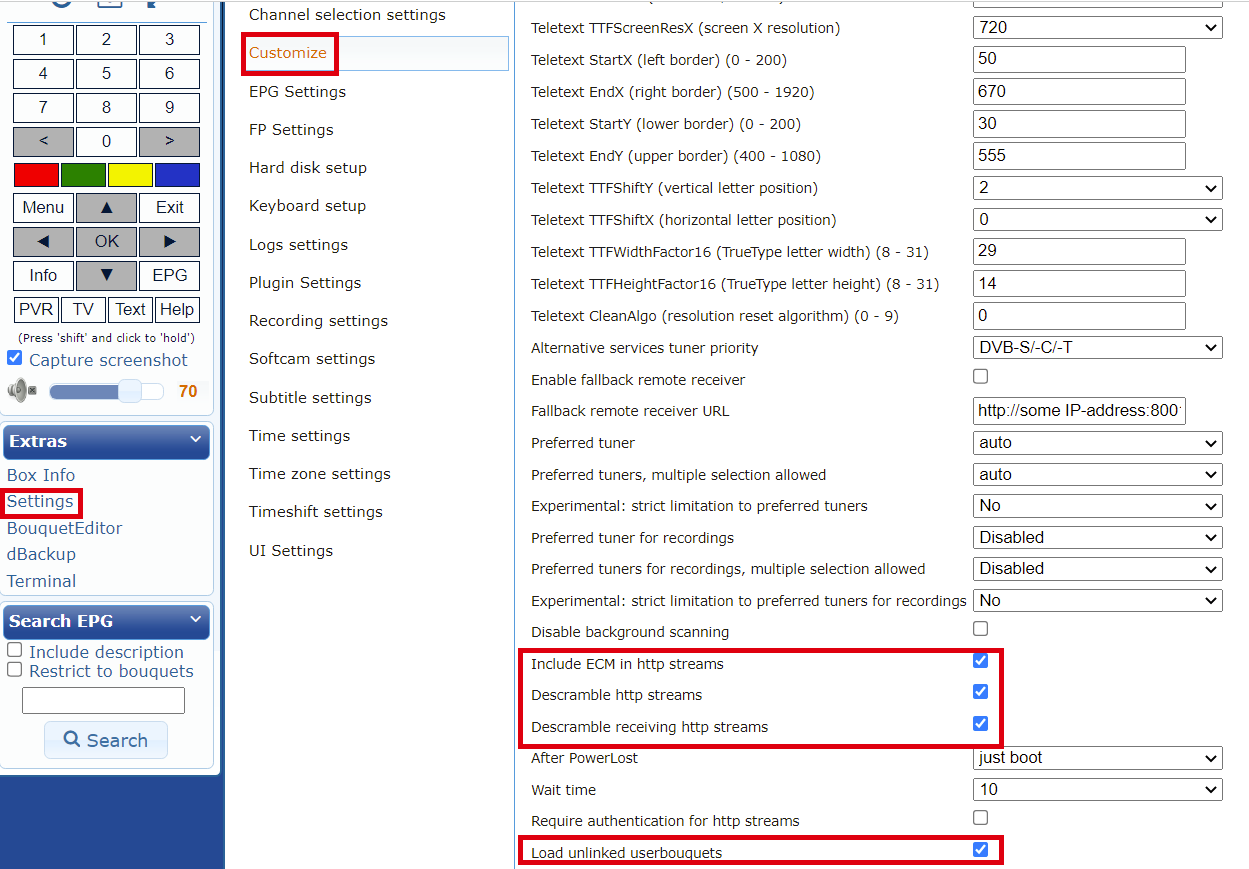

Master OpenATV 7.3 with OSCam ICAM: Your Ultimate Roadmap to Seamless Riding on Any Platform