Navigating NYC Property Taxes: Mastering the NYC Department of Finance

Navigating NYC Property Taxes: Mastering the NYC Department of Finance

New York City property owners face one of the nation’s most intricate and consequential tax landscapes, with the Department of Finance serving as the authoritative guardian of property valuation and assessment. Understanding how the NYC Department of Finance operates is not just a bureaucratic necessity—it’s a financial imperative. As urban density increases and real estate values fluctuate, navigating property tax obligations requires clear insight into tax calculation methods, exemption programs, penalty rules, and appeals processes—all managed through a centralized but complex system.

This article details how to effectively engage with the Department of Finance to manage your obligations, minimize errors, and safeguard your investment. The NYC Department of Finance (DFF) is the city’s tax authority, responsible for assessing and collecting property taxes across all five boroughs. Its core mission is to maintain accurate, equitable property valuations that reflect current market conditions.

Every year, the DFF evaluates over five million properties using advanced data analytics, building surveys, and comparable sales. This rigorous process determines the annual taxable value—a figure that serves as the foundation for annual property taxes paid by homeowners, landlords, commercial tenants, and other property holders.

Understanding Property Tax Assessments: The Foundation of NYC Financing

Abstract: Property tax assessments form the bedrock of NYC’s municipal revenue system.Unlike simple market price checks, assessments consider location, size, condition, and recent sales history. – Property taxes in NYC fund schools, emergency services, infrastructure, and public transit—accounting for roughly 30% of the city’s annual budget. – Assessments are updated biannually, and property owners receive a reassessment notice typically 60–90 days before the new tax determination takes effect, usually each June, with payments due by late September.

– Conflicts arise when market values outpace official assessments or when inaccuracies go unchallenged. The DFF’s online portal and physical office support entities navigating these discrepancies. The assessment process integrates Geographic Information Systems (GIS), satellite imagery, and on-site inspections to ensure precision.

However, mismatches between subjectively perceived value and objective data often spark disputes. “Owners must understand that the city’s assessment isn’t a fixed number—it evolves with real market shifts and rigorous data validation,” explains Jennifer Marquez, a tax consultant with over a decade of expertise in NYC real estate. “A small renovation or nearby sale can prompt a reassessment; awareness and documentation are your strongest defenses.”

Calculating Your Tax Bill: Decoding the Numbers

Abstract: Tax bills reflect a complex formula balancing assessed value, tax rates, and eligibility for credits.The standard rate (currently 1.09% as of 2024) applies to most properties, but exemptions and supplemental assessments alter the final sum. – The Adjusted Joint Proper Tax (AJPT) is calculated using Form 290, incorporating exemptions, exemptions for seniors, veterans, and disabled occupants, and reflective tax caps. – Supplemental assessments may apply if zoning changes, zoning variances, or infrapending development impact property value.

– New buildings often enjoy tax abatements or deferrals for ten years—available through programs like the 421-a incentive or incentive programs targeting affordable housing. Residents must account not only for the base tax but also for supplemental levies such as the school and polio (constitutional) taxes. For example, a $1 million Midtown apartment with a $950,000 assessment falls under the citywide average rate, yielding roughly $10,350 annually—yet after claiming a full senior exemption and applicable local relief, the net tax can be drastically lower.

Transparent budgeting relies on clear interpretation of these variables, and the DFF’s interactive tax calculators offer real-time estimations based on property details.

Navigating Penalties and Late Fees: Avoid Financial Pitfalls

Abstract: Missing payment deadlines incurs escalating penalties and interest, sometimes reaching 10% above the assessed tax. – The grace period typically lasts 90 days from the due date, during which partial payments prevent full interest accruption.– After 180 days, fines compound weekly, and collections escalate to legal proceedings if unpaid. – The DFF allows bundling before penalties apply, and payment plans offer relief for financially strained taxpayers. “Penalties multiply like wildfires—understanding the timeline is the first step in prevention,” warns Michael Tran, a financial advisor specializing in NYC property ownership.

“A $5,000 tax due by September 30 pays on time; if neglected, the $5,000 becomes $5,500 with interest after 120 days.” The department’s automated reminders and online portal streamline payments, yet proactive management—such as setting calendar alerts and requesting installment agreements—remains paramount.

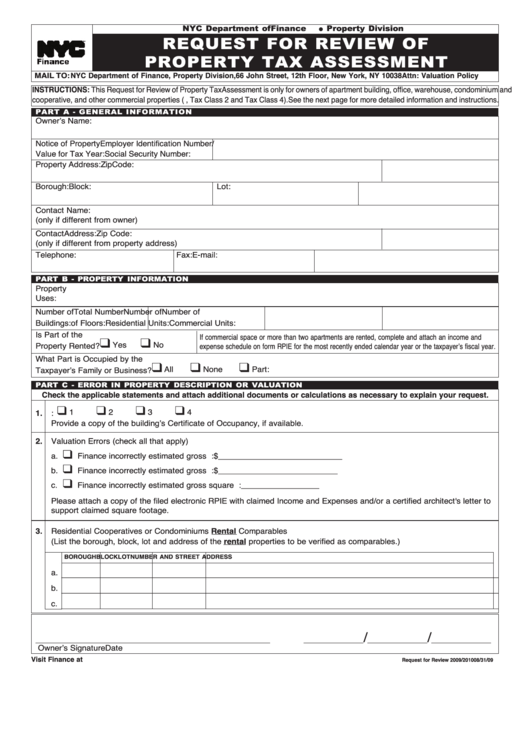

Filing an Appeal: Correcting Assessment Errors

Abstract: Up to three appeal cycles assist accurate valuations when property owners dispute assessed values based on documented evidence. – Appeals require filing Form AR-104 within 30 days of the notice, supported by sworn affidavits, comparable sales, professional appraisals, or photos.– A nine-person review panel evaluates claims without judicial oversight, offering swift resolutions—often within 60 days. – Disputed assessments affect roughly 15–20% of cases annually, reflecting challenges in bridging subjective appraisals with objective data. “An appeal is not an accusation—it’s a formal request for review grounded in facts,” notes Marquez.

“Gathering evidence such as recent third-party appraisals or sales of identical units significantly strengthens the case.” The department’s transparent algorithms and public appeal outcome records help taxpayers gauge chances before investing in formal proceedings.

Digital Transformation: How Technology Simplifies the Process

Abstract: The DFF’s online platforms now streamline nearly every tax-related function—assessment review, payment, and appeal filing—reducing friction in a traditionally paper-heavy system. – Real estate owners access their property’s history, ownership details, and tax projections via the MyNYC portal, with full document uploads and status tracking.– Mobile apps notify of upcoming deadlines and allow instant payment with integrated fiscal note support. – Public data dashboards reveal borough-by-borough assessment trends, empowering informed decision-making. “The shift to digital is transformative,” says Tran.

“Gone are the days of waiting in offices or deciphering sealed letters. Now, property owners receive automated updates, track disputes, and manage payments—all with a few clicks.”

Key Exemptions and Relief Programs: Financial Savings You Can Claim

Abstract: Strategic use of exemptions and abatements significantly reduces annual burdens, particularly for seniors, military veterans, low-income households, and historic properties. – Senior citizen exemptions lower taxable value by up to 50%—available for residents over 65.

Related Post

Pilar Rubio: Architect of Spain’s Diverse Identity in a Global Stage

From Mercury to Neptune: The Planets in Order as Astronomers See Them

Chick Fil A Is Supporting Israel — But How Deep Is the Connection?