Navigating Insurance: Common Problems & Smart Solutions That Save Time, Money, and Stress

Navigating Insurance: Common Problems & Smart Solutions That Save Time, Money, and Stress

Insurance is designed to protect lives and assets—but rarely does it operate without friction. From policy confusion and claim denials to slow responses and hidden fees, navigating the insurance landscape can feel like traversing a minefield. Yet, with precise understanding and proactive strategies, individuals and families can avoid costly missteps and unlock smarter coverage.

This article dissects the most persistent challenges in insurance today and delivers tried-and-true solutions that empower better decisions, reduce friction, and maximize value.

One of the most common pain points is policy ambiguity. Insurance contracts are notoriously dense, packed with technical jargon and fine print that obscure coverage limits, exclusions, and conditions.

“Most people sign on the dot without fully grasping what’s covered—or more importantly, what’s not,” explains Maria Chen, a senior claims specialist with over 12 years in insurance services. “A policy might cover ‘natural disasters’ but exclude flood damage unless specifically added.” This disconnect often leads to unmet expectations, delayed claims, or disputes when coverage falls short during critical moments.

To combat unclear policy terms, policyholders should adopt an active approach: - Request plain-language summaries from agents or insurers.

- Ask for a coverage gap analysis, especially before renewing. - Document all discussions and confirm critical protections in writing. - Use comparison tools to benchmark policies side-by-side, focusing on exclusions as much as benefits.

Policyholders often face another major hurdle: claim denials—often due to procedural oversights, missed deadlines, or misclassification of incidents. “Denials are more common than most realize—up to 10% of claims are rejected annually,” warns industry expert Robert Fine, claims handler and deregistration coach. “Though insurers cite reasons like ‘lack of timely reporting’ or ‘invalid documentation,’ many denials stem from preventable errors on the claimant’s part.”

Common triggers of claim rejections include missed filing windows, failure to provide required medical records, or insufficient proof of damage.

Proactive claim management begins with strict timeline adherence—filing within grace periods—and meticulous record-keeping. Creating a centralized folder for proof of injury, damaged property, or accident reports ensures nothing critical is left behind. When facing denial, don’t accept it passively: appeal promptly, include supporting documentation, and consider engaging an independent insurance advocate.

Smart claimants remember that every denial is a chance to learn and improve future handling.

Another pressing challenge is premium affordability without sacrificing meaningful coverage. Rising costs—driven by inflation, increased claims frequency, and reinsurance expenses—have pushed many to reconsider policy types or coverage levels.

Yet dips in coverage can leave vulnerabilities exposed, especially in life, auto, or health insurance. Strategic Ways to Balance Cost and Coverage

Technological friction compounds these challenges. Slow digital platforms, obscured online tools, and poor customer service systems frequently frustrate policyholders during enrollment, claims submission, or renewal. “Insurance is one of the last traditional industries slow to adopt modern user experience,” says Chen.

“When a platform lacks clarity or automated guidance, even simple tasks become stress-inducing.”

Smart users demand better digital engagement: - Use insurer apps with real-time dashboards to track claims, modify coverage, or file reports. - Explore AI-powered chatbots or virtual assistants to clarify policies instantly. - Opt for providers integrating blockchain or machine learning to streamline underwriting and claims assessment.

- Take advantage of e-signatures and automated document uploads to eliminate paper delays.

Beyond digital tools, communication remains a cornerstone of effective insurance management. Ambiguous instructions from agents, untimely reminders about renewals, or inconsistent messaging from adjusters erode confidence and delay necessary actions.

Establishing clear channels—such as dedicated case managers or regular check-ins—ensures alignment and timely responses. Transparency in rate adjustments, coverage changes, or claim status builds lasting trust, turning reactive interactions into proactive partnerships.

Moreover, navigating insurance requires awareness of regulatory differences and market dynamics.

State-by-state variations in coverage mandates, consumer protections, and insurer licensing mean “one-size-fits-all” policies often miss critical regional needs. “An auto policy that satisfies requirements in Texas may fail to cover commercial trucking exposures in California,” Fine explains. Sho vinculeds to advocacy and education, consumers should engage state insurance departments, use public comparison platforms, and consult verified intermediaries who understand local regulations.

Education is equally vital. Many avoid insurance pitfalls not from complexity alone, but from lack of awareness. Understanding key concepts—like deductibles, co-pays, exclusions, and subrogation—empowers consumers to make informed choices.

“Awareness breaks down the barrier between overwhelm and empowerment,” Chen notes. “When people learn what their policy includes and excludes—and how to advocate for it—they shift from passive subscribers to active stakeholders.”

Real-world examples underscore the stakes. Consider a family caught off guard when a hurricane damaged their roof—only to discover their home insurance excluded “direct storm damage,” relying instead on separate flood coverage they hadn’t purchased.

Or a business owner frustrated by a denied premium increase, unaware their policy’s renewal clause triggered a rate hike due to broader underwriting shifts. Those stories reflect preventable losses—yet also opportunities. By mapping coverage gaps and validating claim accuracy, both scenarios could have been resolved swiftly and fairly.

Technology offers scalable remedies: mobile apps now simulate disaster impacts to help homeowners calculate potential losses; AI analyzes medical records to flag incomplete claim documentation before submission; and digital portals provide real-time updates, reducing anxiety and cycle times. Forward-thinking insurers are integrating these tools not as marketing gimmicks, but as genuine service enhancers.

Ultimately, navigating insurance is an ongoing process—not a one-time transaction.

It demands vigilance in policy review, discipline in maintaining documentation, agility in embracing new tools, and courage to ask questions. When individuals adopt smart habits—comparing thoroughly, maintaining records, leveraging digital efficiency, and advocating when needed—they transform insurance from a source of frustration into a reliable safety net. In a world of increasing unpredictability

Related Post

Black American Movie Actors: A Century of Cinematic Impact and Evolution

Decoding McDo Breakfast Meal Time: Operating Hours, Menu Changes, and Consumer Habits

2025 College Baseball World Series Champions Crown Indiana with Dominant Champion’s Performance

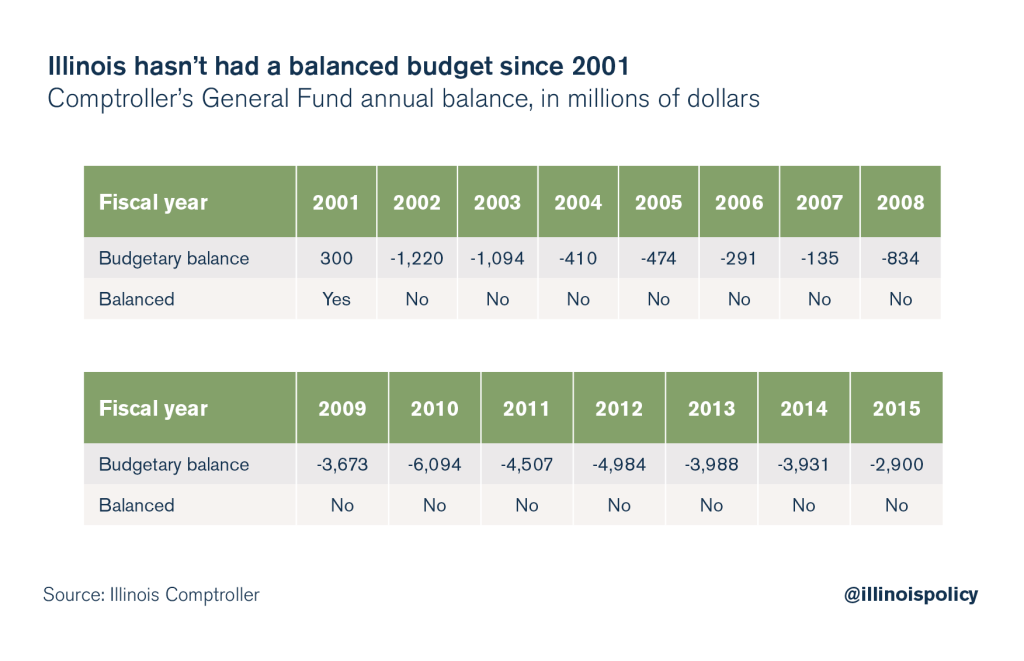

Chicago.gov Finance Reveals Critical Insights That Shape Illinois’ Fiscal Path