Money Capital Defined: Unlocking Its Types, Applications, and Critical Role in Modern Finance

Money Capital Defined: Unlocking Its Types, Applications, and Critical Role in Modern Finance

Money capital stands as the lifeblood of economic activity, serving as the essential financial fuel that powers business growth, innovation, and development across industries. Far more than just raw cash, money capital encompasses a structured framework of funding mechanisms that enable enterprises to acquire assets, operate efficiently, and expand sustainably. From venture-backed startups to blue-chip corporations, understanding the definition, classification, and strategic importance of money capital is fundamental to navigating today’s complex financial landscape.

This article unpacks the core types of money capital, their transformative functions, and why their proper deployment remains indispensable for long-term success.

The Core Definition: What Is Money Capital?

Money capital refers to the pool of financial resources invested or deployed to generate income, support operations, or fund growth across economic sectors. Defined broadly, it includes both equity and debt instruments used to provide liquidity and catalyze productivity.Unlike personal savings or operational working capital, money capital is typically sourced externally—through investors, lenders, or institutional financial markets—and channeled strategically into productive ventures. At its essence, money capital acts as a bridge between surplus funds and productive use. It enables entities to acquire machinery, finance research and development, acquire real estate, or expand market reach—all without relying solely on retained earnings.

According to financial economist Dr. Elena Torres, “Money capital is not just money; it’s the structured availability of funds that transforms potential into tangible economic outcomes.” This distinction underscores its role as a dynamic enabler rather than a static reserve.

Types of Money Capital: From Equity to Hybrid Instruments

Understanding the spectrum of money capital types reveals its multifaceted nature.Each category serves distinct strategic functions, offering businesses flexible pathways to secure funding tailored to their growth stage, risk appetite, and financial objectives. **1. Equity Capital** Equity capital represents ownership stake in a company, raised primarily through issuing shares to investors.

Unlike debt, equity does not require repayment, but it dilutes control and profits proportionally. Venture capital, angel investing, and initial public offerings (IPOs) are common equity sources. For early-stage startups, equity funding is often the only viable option, providing not just capital but mentorship and market access.

“Equity capital accelerates innovation by aligning investor incentives with long-term growth,” notes finance analyst Rajiv Mehta. Equity financing typically supports high-growth sectors like technology, biotech, and renewable energy, where scalable potential justifies shared ownership. **2.

Debt Capital** Debt capital consists of borrowed funds obligated to be repaid with interest, commonly sourced via loans, corporate bonds, or bank facilities. This form offers companies full ownership retention while enabling predictable financial planning. Senior debt, mezzanine financing, and senior bonds are prevalent across industries.

“Debt allows businesses to preserve equity while leveraging borrowed resources,” explains credit specialist Laura Finch. However, high leverage increases financial risk, making debt funding most suitable for stable, cash-flow predictable operations. **3.

Mezzanine Capital** A hybrid instrument blending equity and debt features, mezzanine capital sits between senior debt and pure equity. It typically includes subordinated debt with warrants or conversion options, offering higher returns to investors in exchange for added risk. Mezzanine financing is favored by mature companies pursuing large acquisitions or expansions seeking flexible, non-controlling capital.

It enables growth without ceding too much control—bridging the gap between traditional debt and equity dilution. **4. Convertible Instruments** Convertible debt or preferred shares provide repayment as debt initially, then convert into equity under predefined conditions—often during a future financing round.

This flexibility appeals to startups managing valuation uncertainty, allowing them to defer equity dilution while securing early-stage funding. Investors gain downside protection through debt features, making these instruments a balanced bridge between risk and reward. **5.

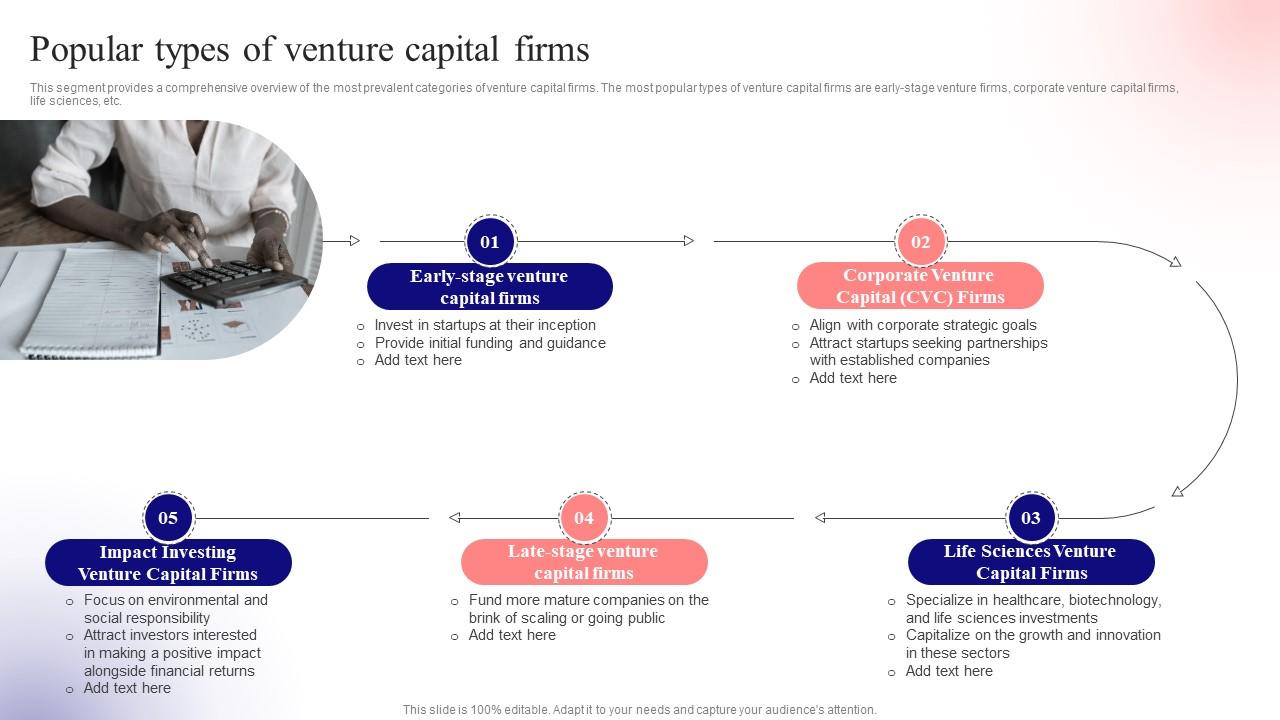

Venture Capital and Private Equity** While subsets of equity capital, these specialized funds target specific stages: venture capital supports high-risk, high-reward startups; private equity acquires or revitalizes established companies. Both bring capital, expertise, and strategic networks to drive value creation—though with significant influence over company direction. Each type carries distinct advantages, risks, and implications for governance.

Selecting the right capital structure depends on a company’s lifecycle stage, growth ambitions, and risk tolerance. The choice is not merely financial—it shapes strategic direction, ownership dynamics, and long-term resilience.

The Strategic Importance of Money Capital in Business and Markets

Money capital’s significance extends far beyond balance sheets, serving as a catalyst for innovation, competitiveness, and systemic economic vitality.Its role permeates corporate strategy, market evolution, and macroeconomic stability. For entrepreneurs and emerging firms, access to money capital determines survival and scalability. Startups backed by venture capital, for example, are often able to survive critical early years, test disruptive business models, and capture market share through rapid iteration.

“Without timely capital infusion, many breakthrough technologies would never leave the lab,” observes industry expert Nathan Cole. Large corporations rely on structured debt and equity markets to fund capital expenditures, mergers, and international expansion—key levers for maintaining global competitiveness. On a structural level, money capital fuels economic progress.

When industries receive adequate funding, productivity rises, employment grows, and innovation accelerates. “Capital availability turns vision into infrastructure,” highlights economic analyst Maria Chen, discussing how targeted investment in green energy and digital infrastructure drives national competitiveness. Public-private partnerships amplify this effect, where government-backed funds de-risk private investment in social or strategic sectors.

Moreover, efficient capital allocation improves financial system health. Active capital markets enhance liquidity, price discovery, and investor confidence. When funds flow productively—toward viable projects rather than speculative ventures—economies grow more sustainably.

Conversely, capital misallocation or oversupply risks bubbles and market instability. Regulatory frameworks and credit assessments aim to balance access with prudence, ensuring money capital serves its intended productive function. Von capital’s role also extends into risk management.

Instruments like derivatives and structured finance allow institutions to hedge exposures, stabilize cash flows, and navigate market volatility. In essence, money capital transforms financial uncertainty into strategic opportunity—empowering decision-makers to act boldly while managing downside exposure.

Money capital, in its diverse forms, remains the engine that drives enterprise evolution and economic advancement.

From seed funding for innovators to sophisticated debt structuring for multinationals, its proper identification, deployment, and oversight shape the trajectory of businesses and markets alike. In an era of accelerating technological change and shifting global dynamics, mastering the nuances of money capital is not optional—it is imperative.

Related Post

<h1>The Curious Case Of Bill Walton’s Wife Lori: Age, Mystery, and the Quiet Power Behind Her Silence

Greenville County Sc Property Tax: The Shocking Truth About Where Your Money Is Going