Max Mobile Deposit: How Wells Fargo Is Redefining Digital Check Deposits

Max Mobile Deposit: How Wells Fargo Is Redefining Digital Check Deposits

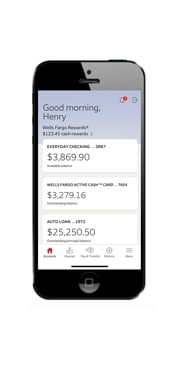

Max Mobile Deposit, Wells Fargo’s cutting-edge mobile check-deposit platform, is transforming how Americans handle their finances—fast, secure, and without ever stepping into a bank branch. Designed for convenience and powered by advanced image recognition technology, the service enables users to deposit checks using just a smartphone, streamlining everyday banking into seconds. Whether you’re catching the bus or swiping through your morning routine, Wells Fargo’s mobile deposit puts financial control right in your pocket.

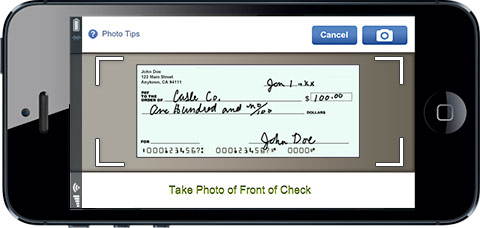

Wells Fargo’s Max Mobile Deposit leverages sophisticated mobile deposit technology, including Optical Character Recognition (OCR) and Artificial Intelligence, to automatically extract account and payment details from check images. This process is not only swift but highly accurate, reducing errors and fraud risks. The system scans checks in real time, verifying account numbers, amounts, and signatures before routing the deposit directly to your Wells Fargo account—often within 24 hours, and sometimes instantly.

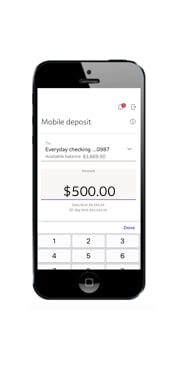

At the core of Max Mobile Deposit’s functionality is the seamless integration of mobile banking with secure financial infrastructure. Users begin by uploading a clear image of their check—whether fresh or old—via the Wells Fargo app. The platform processes the document instantly, categorizes transactions, and confirms deposits, all while encrypting data to protect sensitive information.

“Our goal is to make checking deposit as frictionless as possible,” says a Wells Fargo product messaging specialist. “There’s never been a simpler way to manage cash flow, especially for busy professionals and everyday users who value speed and security.”

Key benefits of Max Mobile Deposit extend beyond speed. The service eliminates the hassle of drive-thru banking lines, lost checks, or late-night ATM runs.

Deposits made between 2 a.m. and midnight are processed as quickly as day deposits, thanks to automated workflows operating 24/7. This round-the-clock processing keeps financial life in sync—even on weekends.

Users receive immediate notifications when deposits are confirmed, complete with receipts and transaction history accessible instantly within the app.

For error detection and fraud prevention, Max Mobile Deposit employs multi-layered verification protocols. The system scrutinizes check authenticity, flags unusual patterns, and cross-references transactions against spending history to prevent unauthorized activity.

“Security is non-negotiable,” explains the Wells Fargo technology division. “Every uploaded image undergoes rigorous analysis to ensure only valid deposits move forward—protecting both the customer and the bank from potential fraud.”

Key Features That Make Max Mobile Deposit Stand Out

Certain capabilities set Max Mobile Deposit apart from traditional banking tools, reinforcing its role as a modern financial utility.

Instant Deposit Confirmation: Deposits often post within minutes to hours—most schneller among peer mobile apps—giving users immediate visibility into funds. This rapid settlement supports better personal budgeting and reduces cash-handling risks.

On-the-Go Accessibility: Available across iOS and Android devices, the app works seamlessly across regions and time zones, supporting rural and urban users alike.

Even network disruptions don’t delay deposits—most transactions sync once reconnected.

Free and Loop-Free Math: Unlike fee-heavy alternatives, Max Mobile Deposit processes all deposit transactions at no extra cost, with no minimum balance requirements or check plain-writing fees. This transparency builds trust and long-term user loyalty.

Integrated Budgeting Tools: Deposits automatically sync with linked Wires Fargo budgeting dashboards, offering real-time insights into income and spending. This synergy empowers users to make informed financial decisions.

24/7 Customer Support: In cases of missing deposits or technical glitches

Related Post

Brighton Butler’s Insights Reveal the Silent Role of Lifestyle Chatter in Divorce Dynamics

Pay Gottes Play Egypt: Your Ultimate, Effortless Guide to a Seamless App Experience

What Industry Leaders Are Saying About The Hannahowo Leak Aftermath: Crisis, Response, and the Path to Rebuilding

Bill Hemmer and His Marital Journey: Insights from the Fox News Anchor’s Private Life