Mathis Brothers Unveils The Complete Guide to Payment Options — From Everyday Payments to Enterprise Solutions

Mathis Brothers Unveils The Complete Guide to Payment Options — From Everyday Payments to Enterprise Solutions

In an era defined by digital transformation, payment options have evolved beyond simple cash or card swipes into a multifaceted ecosystem designed to serve businesses and consumers alike. Mathis Brothers’ latest guide dissects this dynamic landscape, offering a comprehensive, expert commentary on everything from frictionless in-store transactions to sophisticated SaaS billing models. Whether you’re a small merchant managing daily sales or a corporate leader architecting global payment infrastructures, understanding the full spectrum of available payment solutions is no longer optional—it’s essential for competitiveness and customer satisfaction.

At its core, Mathis Brothers’ framework emphasizes that no single payment method fits all scenarios. The guide meticulously categorizes payment options based on use case, security, speed, and scalability, equipping readers with actionable insights to align choices with business objectives. From traditional credit card networks and mobile wallets to blockchain-based cryptocurrencies and recurring subscription models, every payment type is assessed not just in isolation, but in ecosystem context.

Understanding the Foundation: Core Payment Methods Explored

The guide begins by grounding readers in the essential building blocks of modern payment systems.Cash remains a universal baseline, but digital forms now dominate daily transactions. Credit and debit cards, facilitated through networks like Visa, Mastercard, and American Express, continue to anchor global commerce, supported by robust fraud detection and chargeback protections.

Unlike older models, today’s card payments are increasingly integrated with real-time authorization, reducing friction and enabling same-day settlement in many environments. Cashless systems are further enriched by digital wallets—such as Apple Pay, PayPal, and Cash App—that offer convenience, contactless speed, and enhanced user authentication through biometrics or tokens.

“Payment methods have shifted from being transactional ledgers to integrated experiences,” notes a senior analyst at Mathis Brothers.

“Consumers expect speed, security, and welcome when payment fits their rhythm—whether that’s tapping to pay or setting up automatic renewals.”

These traditional and digital forms converge in business contexts, where point-of-sale (POS) terminals, e-commerce gateways, and payment processors work in tandem, each governed by strict compliance standards like PCI DSS to protect sensitive data.

Mobile & Contactless: The Future of On-the-Go Payments

The rise of mobile payment platforms has reshaped consumer behavior, with smart devices now central to daily financial activity. Digital wallets and mobile banking apps enable instant, secure payments through near-field communication (NFC), QR codes, or one-tap authorization.Brands from Starbucks to major transit authorities leverage these tools to drive loyalty and streamline checkout.

What sets modern mobile payments apart is their integration with broader digital ecosystems. Beyond one-time purchases, they support: - Mobile inventory purchases with split payment options - Peer-to-peer transfers that streamline B2B and personal distributive flows - Integration with loyalty programs and discount offers - Real-time transaction history accessible via intuitive dashboards Mathis Brothers highlights that success with mobile payments hinges on three pillars: user experience, security, and seamless backend integration. Retailers adopting contactless solutions reported up to 40% faster transaction times, directly improving customer satisfaction and queue management during peak hours.

Moreover, innovations such as “buy now, pay later” (BNPL) embedded within apps extend purchasing power while maintaining control over cash flow—bridging gaps between immediate needs and financial planning.

Enterprise-Grade Solutions: Scaling Payments Beyond the Transaction Page

While consumer-facing apps capture attention, Mathis Brothers underscores the critical role of enterprise-grade payment infrastructure, particularly in subscription-based and service-oriented industries. Recurring billing platforms now power software-as-a-service (SaaS), streaming services, telehealth platforms, and thousands of other recurring-revenue models.Key considerations for businesses implementing these systems include: - Automated recurring payment enforcement with built-in grace periods and catch-up mechanisms - Multi-currency, multi-tiered billing structures to support global operations - Detailed reporting and reconciliation tools to ensure cash flow visibility - Robust compliance with standards such as PCI DSS and e-PCI, minimizing breach risks A case in point: a leading healthcare SaaS provider reduced payment failure rates from 12% to under 3% within six months by deploying a customized recurring payment engine integrated with health portal authentication and automated dunning workflows. Such precision transforms payment cycles from cost centers into revenue stabilizers.

For large organizations, the choice extends to white-label payment gateways, embedded finance APIs, and customizable frontend designs—anything that allows payment functionality to blend seamlessly with brand identity without compromising performance or security.

Emerging Frontiers: Cryptocurrency, Cross-Border Innovations, and Embedded Finance

As the digital financial landscape matures, Mathis Brothers identifies three transformative trends reshaping payment options: cryptocurrency adoption, frictionless cross-border solutions, and embedded finance ecosystems.Bitcoin, Ethereum, and stablecoins now feature in merchant transactions, treasury management, and fundraising, offering alternatives to fiat and inflation-hedging mechanisms. While volatility and regulatory uncertainty persist, institutional acceptance is growing, with major payment processors integrating crypto settlement rails to meet evolving customer demand.

Cross-border payments—long hampered by slow settlements and hidden fees—now benefit from real-time platforms leveraging blockchain rails, smart contracts, and correspondent-free settlement. Services like RippleNet and SWIFT’s new gpi enhance speed and transparency, cutting transaction times from days to seconds.

Embedded finance further blurs the lines between payments and core business functions.

E-commerce platforms, SaaS providers, and gig economy apps now offer integrated payment options—loans, invoicing, and merchant services—without third-party intermediaries. This trend reduces dependency on legacy banking partners and unlocks new revenue streams through embedded financial value.

Security, Compliance, and the Trust Factor in Payment Engineering

Underpinning every technology or model is an uncompromising focus on security and regulatory compliance.Mathis Brothers emphasizes that the most advanced payment systems falter without rigorous adherence to data protection laws and fraud deterrence frameworks.

- **PCI DSS Compliance**: All card-based processing must meet Payment Card Industry standards, requiring encrypted storage, regular vulnerability testing, and strict access controls.

- **Fraud Detection**: Machine learning algorithms analyze transaction patterns in real time to flag anomalies, reducing false declines and false acceptances.

- **Consumer Trust**: Transparent fee structures, instant dispute resolution, and proactive communication build loyalty and reduce churn.

- **Extra Security Protocols**: Tokenization replaces sensitive card data with non-sensitive tokens, while biometric authentication and 3D Secure 2.0 add layers of identity verification. “Security is not an add-on—it’s the foundation of payment trust,” states a Mathis Brothers systems architect. “Businesses that prioritize integrated, layered security minimize risk, protect brand reputation, and gain a competitive edge in an era of heightened cyber threats.”

Choosing the Right Tools: A Smart Approach to Payment Architecture Design

Selecting optimal payment options requires strategic alignment with business scale, customer base, and operational goals.Mathis Brothers advocates a modular approach: start with core transaction capabilities, layer in value-added features like fraud diversion or recurring billing, and scale with embedded finance and cross-border tools as needed.

Critical considerations include: - Transaction cost structures across channels (credit card fees vs. net settlement models) - Customer acquisition and retention incentives built into payment flows - Integration flexibility with existing ERP, CRM, or POS systems - Scalability to accommodate future growth without architectural overhauls Real-world success stories cited by the guide show small retailers doubling conversion rates with mobile POS adoption, SMBs saving 25% in payment processing costs via BNPL integration, and enterprises boosting global revenue by 15% through automated cross-border settlement.

Ultimately, the goal is to build a payment ecosystem that is not only technologically advanced but also intuitive, secure, and deeply integrated into daily business operations—transforming money flows from logistical hurdles into growth accelerators.

As digital ecosystems expand and consumer expectations reach new heights, Mathis Brothers’ exhaustive guide empowers businesses to navigate the ever-evolving terrain of payment options with clarity and confidence.

From frictionless mobile taps to global B2B value networks, the future of payment lies not just in speed and convenience—but in intelligent, responsive infrastructure built for trust and scalability.

Related Post

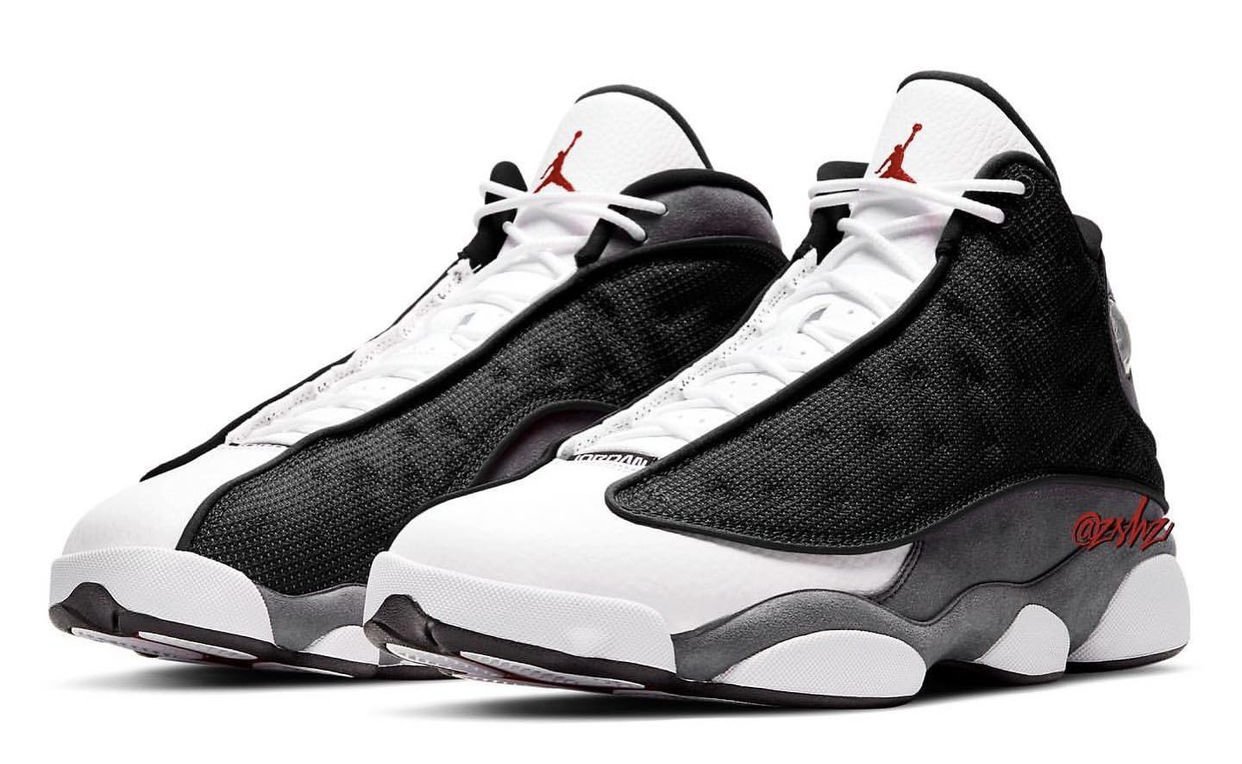

The Flint of Legends: A Deep Dive into the Air Jordan 13 Retro

Mihlali Ndamases Net Worth in 2023 and the House She Lives In

Meet the gorgeous Katie Osborne Ace Sportcaster and Reporter for FOX ESPN and NBC