Mastering Global Currency Exchange: How Western Union Currency Converter Rates Shape Global Transactions

Mastering Global Currency Exchange: How Western Union Currency Converter Rates Shape Global Transactions

For travelers, businesses, and instant travelers alike, real-time currency conversion isn’t just a convenience—it’s a necessity. At the core of this global financial precision lies the Western Union Currency Converter Rates, a dynamic benchmark used across continents to facilitate seamless international transfers and everyday exchange. These rates dictate the real-time value of one currency in another, enabling billions of transactions every day with transparency and speed.

Understanding how these rates work—and how Western Union leverages them—empowers users to optimize costs and timelines in an increasingly borderless economy. Western Union’s currency converter rates are derived from a complex blend of real-time market data, spanning spot exchange values, forex liquidity, and global economic indicators. Unlike static conversion tools, Western Union’s rates reflect live market shifts driven by central bank policies, geopolitical events, and shifts in supply and demand.

Tracking these movements requires more than passive observation—financial professionals and individual users alike rely on up-to-the-minute data to avoid hidden fees and exchange overruns. The foundation of Western Union’s conversion system rests on the network infrastructure built over more than a century, connecting hubs across North America, Europe, Africa, Asia, and Latin America. This global footprint ensures that conversion rates remain responsive, even during periods of high volatility.

As Neil Shafer, a freelance financial analyst, notes, “Western Union’s real-time rates bridge the gap between fluctuating markets and the need for stable, reliable transfer values—especially critical when lives depend on timely remittances.”

The Western Union currency converter operates on a tiered structure, blending regulated spot rates with proprietary spread margins that reflect operational costs and risk exposure. When users convert currencies via Western Union, the displayed rate typically includes a small margin—common in the financial forex space—but the actual exchange value depends on which intermediary platforms and clearinghouses are engaged. This nuance makes it vital to compare rates not just numerically, but contextually—considering timing, transfer method, and additional fees.

A practical example illustrates the importance of precision: transferring USD to EUR using Western Union today may yield a rate differing from a midday window due to Fed policy signals or currency sanction developments. “Markets move fast—especially post economic announcements,” says financial strategist Laura Chen. “User-friendly tools that auto-refresh rates help mitigate unpredictability.” Western Union’s platform integrates such automation, refreshing rates frequently and integrating trusted feeds from Bloomberg and Reuters to maintain accuracy.

To navigate the rates effectively, users should recognize key influencing factors:— - **Global forex liquidity**: Major currency pairs like EUR/USD move swiftly based on central bank interventions and economic data releases. - **Transfer speed vs. cost**: Same-day transfers often carry a premium; delayed options reduce fees but delay access.

- **Fee breakdowns**: Western Union discloses dynamic transfer fees, currency conversion charges, and potential recipient fees—not just the headline rate. - **Market volatility spikes**: Geopolitical tensions or inflation data can shift rates within hours, affecting conversion outcomes. Another essential detail is how Western Union’s converter accounts for cross-border regulatory environments.

Countries impose varying capital controls, taxes on remittances, and reporting thresholds, which can alter effective exchange values behind the scenes. The company complies with international standards while adapting operational policies to local realities, ensuring legal adherence without sacrificing usability.

Businesses engaged in cross-border trade face unique challenges shaped by Western Union’s currency conversion landscape.

For importers and exporters, even a 0.1% difference in exchange rates compounds into significant financial impact over quarterly volumes. “Precision in conversion is non-negotiable,” emphasizes supply chain expert Miguel Torres. “Western Union’s API integrations allow integrated planning, aligning payment schedules with optimal market conditions.” Their business-focused tools offer bulk conversion quoting, real-time API rates, and hedging alerts—features that transform raw currency data into strategic advantages.

For individual users, especially those sending remittances abroad, understanding the full picture means more than scanning a conversion rate. It involves assessing cost-effectiveness, delivery reliability, and sender/receiver experience. Western Union’s web and app platforms display clear breakdowns: - Source currency and target currency - Exchange rate (spot or committed) - Total fees applied - Estimated delivery time - Recipient notification options This transparency builds trust and prevents unexpected charges—critical for users sending funds to family in regions dependent on remittances.

According to the World Bank, over $600 billion flows annually via platforms like Western Union, with timing and accuracy directly affecting beneficiary outcomes.

Technological evolution continues to reshape how convert rates are accessed and applied. Real-time API integrations let platforms sync with market movements instantly, while machine learning helps forecast rate trends and flag anomalies.

Western Union invests heavily in these capabilities, ensuring its conversion engine adapts swiftly to evolving market dynamics.

In an era where currency volatility is the norm, mastering Western Union’s converter rates means mastering financial agility. Whether for urgent remittances, international trade settlements, or everyday travel, these rates form the invisible backbone of global mobility.

As markets grow ever more interconnected, accurate, timely conversion remains indispensable—and Western Union’s ongoing commitment to precision positions it as a cornerstone of modern currency exchange. The future of cross-border finance hinges not just on rates, but on how well users understand and leverage them. With expert tools at their fingertips, informed decisions become second nature, turning financial complexity into manageable clarity.

Related Post

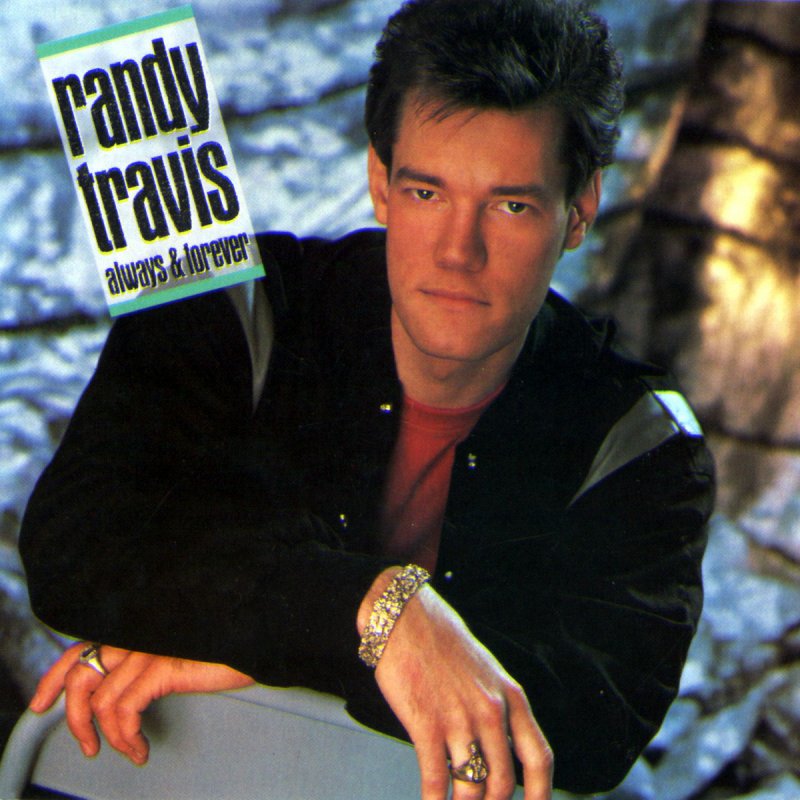

Forever and Amen: Unpacking Randy Travis’ Timeless Anthem “Forever and Ever Amen” Through Its Resonant Lyrics

Joel Osteen Pastor Church Bio Wiki Age Wife Books and Net Worth

Definitive Guide to the Year-End Thirtieth Celestial Symbol: Unveiling the Goat-Fish Ego

Meaning Possessions: How What We Own Defines Our Identity and Belonging