Master Your 2021 Tax Return: The Freetaxusa Guide That Simplifies Filing

Master Your 2021 Tax Return: The Freetaxusa Guide That Simplifies Filing

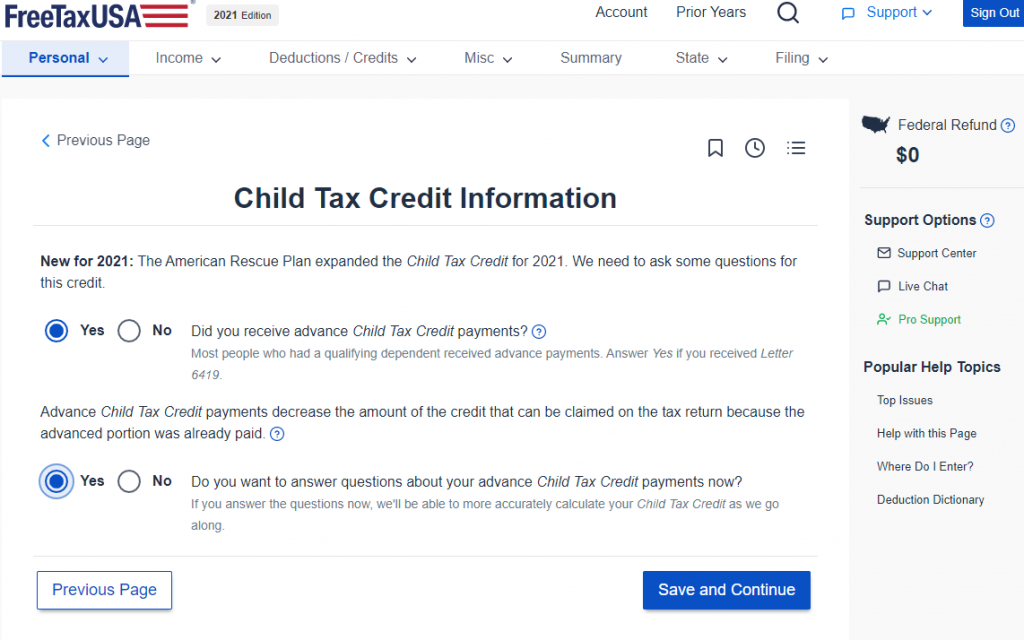

For millions of U.S. taxpayers, 2021 tax season unfolded amid pandemic uncertainty, shifting rules, and heightened digital reliance—making accurate, stress-free filing more challenging than ever. Freetaxusa’s comprehensive 2021 guide cuts through complexity with clear, actionable steps tailored to individual circumstances, ensuring compliance while maximizing allowable deductions and credits.

From understanding filing status to navigating software options, this authoritative resource transforms a traditionally overwhelming process into a manageable, even empowering experience. With structured planning and key deadlines front and center, taxpayers gain confidence in submitting accurate returns—avoiding costly errors and maximizing refunds—all grounded in the official framework Freetaxusa delivers. Based on the Freetaxusa 2021 Your Guide To Filing Taxes, successful tax filing hinges on a few critical dimensions: accurate personal information, proper categorization of income, precise deduction choices, and timely submission.

The form must reflect the correct filing status—Single, Married Filing Jointly, Head of Household, or Qualifying Widow—and align with IRS definitions to determine eligibility for key benefits like the Earned Income Tax Credit (EITC) or child tax credits. Misclassifying these details can delay processing or trigger audits, emphasizing the need for careful review.

Section 1: Essential Personal Information Before Filing

Every 2021 return begins with foundational data that shapes the entire filing journey.Taxpayers must compile Social Security Numbers, address details, and contact information, ensuring consistency across all supporting documents. The IRS requires matching addresses on W-2s, 1099s, and tax forms—discrepancies here can halt processing within days. Online verification tools via Freetaxusa streamline this phase, flagging inconsistencies before submission.

Beyond basics, accurate reporting of income sources is nonnegotiable. Income categories include: - Wages from W-2 forms, reported on Schedule W-2 Schedule B (for interest/dividends), and self-employment earnings via Schedule C. - Supplemental income from side gigs or freelance platforms, reported through 1099-NEC or 1099-K.

- Unreported or cash-based income requires special attention to minimize exposure—underreporting remains a top audit risk. Freetaxusa emphasizes matching taxable income with official IRS tables and retaining digital or printed records, a practice underscored by upcoming audit averages rising to 1 in 12 returns.

Section 2: Choosing Your Filing Status and Optimizing Deductions

Selecting the right filing status is a pivotal decision that directly impacts tax liability and credit eligibility.Freetaxusa outlines five standard statuses, each with distinct implications: - Single - Married Filing Jointly (+90% bonus for dual filers) - Head of Household (+50% bonus for unmarried caregivers) - Married Filing Separately - Qualifying Widow(er) Optimizing deductions begins once income is reported. The guide clearly delineates standard versus itemized deductions, advising taxpayers to evaluate which delivers greater savings. For instance, mortgage interest, state taxes, and charitable contributions—when combined—may exceed the standard deduction, especially for Head of Household filers or those with high medical expenses.

A standout recommendation: claiming the Fernseh Tax Credit (Expensing Rules Clarified) and the Residential Rent Credit for self-employed or renter-income filers, both detailed in Freetaxusa’s 2021 step-by-step framework. Strategic timing of large charitable gifts or pre-tax贡献 at year-end further enhances savings.

Section 3: Navigating Forms and Schedule Complexity

2021 tax forms met a mix of simplification and requirement expansion.Core forms include Form 1040, Schedule A (for itemized deductions), Schedule B (for interest and dividends), Schedule C (for business income), and Schedule D (for capital gains). Notably, Form 8863 for mortgage interest and William Shakespeare’s revised guidelines for 1099-B reporting demand meticulous attention—errors here often delay refunds or trigger compliance actions. Freetaxusa demystifies this landscape with visual flowcharts that map form interdependencies.

For example, freelancers earning $400+ through gig platforms fall under Schedule C, while independent contractors follow Schedule C with Schedule SE for self-employment tax. The guide emphasizes completing digital previews to detect mismatches—such as underreported 1099 income—before final submission. Part-time workers and gig economy contributors benefit from Freetaxusa’s breakdown of Reporting Thresholds: once income exceeds $400 from freelance platforms, detailed reporting becomes mandatory, not optional.

Section 4: Deadlines, Extensions, and Safe Filing Practices

Understanding deadlines prevents penalties and ensures timely refunds. For 2021, the federal tax deadline was April 15, 2022, though extensions pushed it to October 15, 2022—yet filing by the original date remains crucial. Freetaxusa stresses that extensions grant time, not permission, to omit missing income; taxes due by December 31 must still be settled, even if filing is delayed.Key dates to track: - January 1–March 31: Multiple extensions available via IRS Form 8857 (limited to 2 extensions, totaling 2 extra months). - April 15, 2022: Final filing date for 2021 returns - April 18, 2022: IRS cutoff for processed refunds - May 31, 2022: Late filing penalty (5% per month, capped at 25%) Freetaxusa highlights probationary risk: Unfiled returns face penalties before processing begins. The guide recommends direct upload to the IRS Free File system for free filing, avoiding third-party software fees and reducing exposure to phishing scams common in seasonal tax rushes.

Bonus Insight: How Freetaxusa’s Interactive Tools Redefine Compliance A defining strength of Freetaxusa’s 2021 guide is its integration of interactive tools designed to guide users through complex choices. Real-time calculations adjust deduction outcomes based on actual data entered—such as dynamically updating mortgage interest benefits when user-inputted figures deviate from averages. The platform’s validation engine cross-references entry against IRS 2021 rules, flagging potential misclassifications in

Related Post

Michael Angarano’s Height: The Athletic Stature Behind America’s Rise in Men’s Basketball

Deedee Blanchard Crime Scene: Unraveling The Tragic Tale That Exposed a Community’s Darkest Hour

<Redem>Redeeming the Future: How Modern Digital Redemption is Reshaping Commerce, Trust, and Consumer Behavior</Redem>

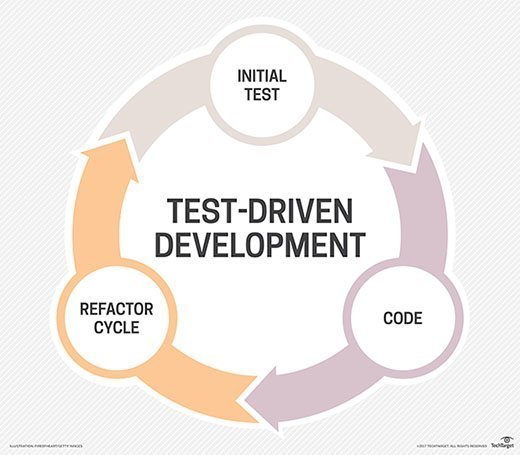

Test Driven Development by Example: Building Software with Discipline and Confidence