Master Foreign Exchange Candlestick Patterns: Unlock Profitable Trades with Master Forex Candlestick Patterns: Your Essential PDF Guide

Master Foreign Exchange Candlestick Patterns: Unlock Profitable Trades with Master Forex Candlestick Patterns: Your Essential PDF Guide

In the high-stakes world of foreign exchange, where billion-dollar decisions are sealed in seconds, technical analysis remains a cornerstone of informed trading. Nowhere is this more evident than in mastering candlestick patterns—visual signals embedded within price charts that decode market psychology and anticipate shifts in currency valuations. authored as an enduring reference, *Master Forex Candlestick Patterns: Your Essential PDF Guide* distills decades of candlestick wisdom into a single, indispensable resource, empowering traders to interpret market moves with precision and confidence.

Candlestick patterns are far more than aesthetic chart annotations; they are statistical markers rooted in real-time behavioral shifts between buyers and sellers. Each candlestick reflects open, high, low, and close prices, but it is the structure—the shape, color, and formation—of these candles that traders analyze to predict short-term reversals, continuations, or trend finishes. “A single candlestick can encapsulate a story deeper than price action alone,” notes renowned trading instructor James R.

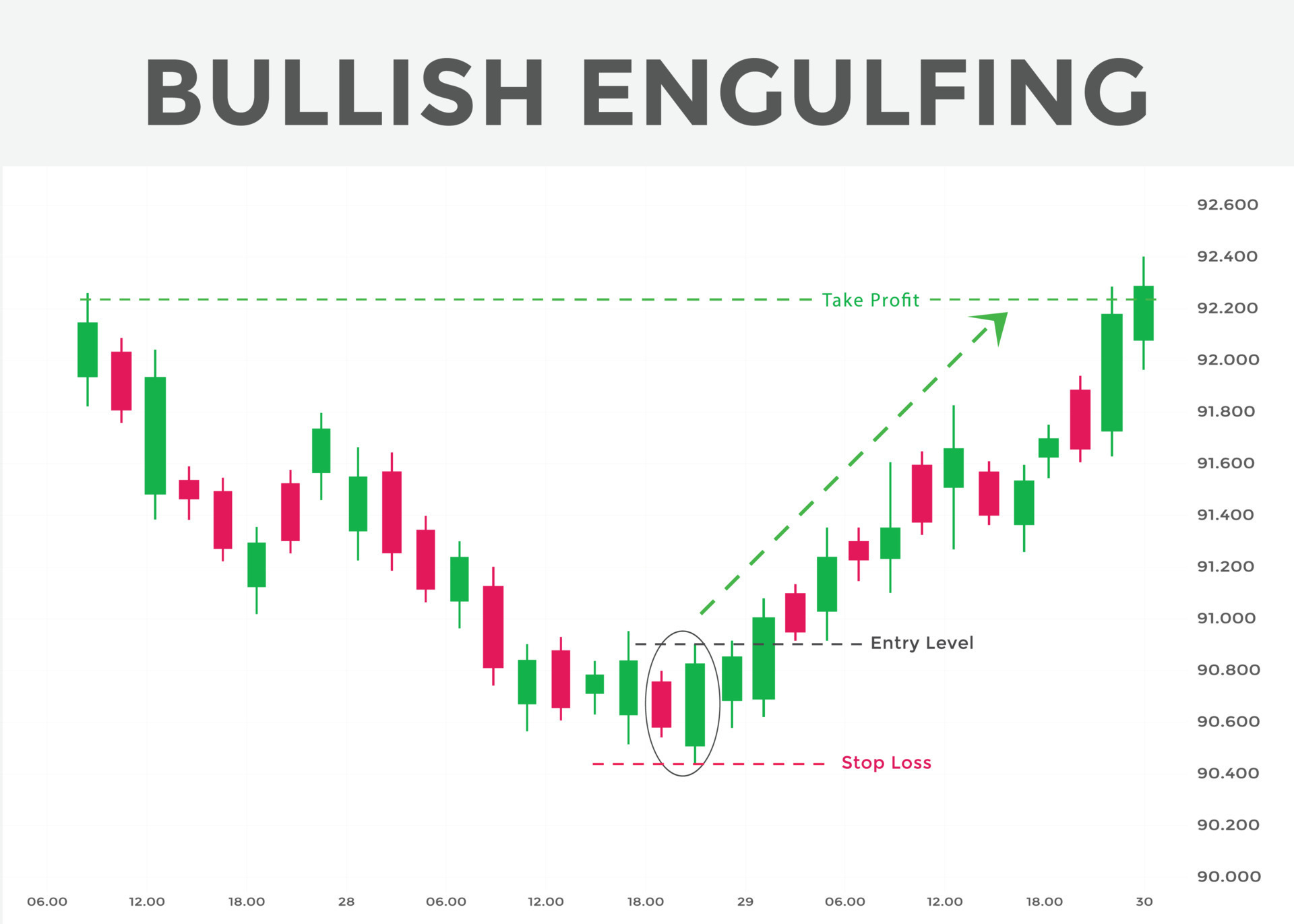

Robertson, “and this guide teaches how to read that full narrative.” NASA Epidemiology’s Robin Hanson’s concept of “partially seen information” applies here: candlestick formations reveal latent momentum invisible to basic line charts or volume alone. The guide systematically breaks down over 25 iconic patterns—17 reversal signals (like Hammer, Shooting Star, Dark Cloud Cover) and eight continuation spikes (such as Bullish Flag, Bullish Engulfing, and Morning Star)—with annotated examples derived from real FX market data. Each pattern is presented with: - Clear definitions and psychological context - Precise formation criteria to avoid misidentification - Replication strategies for consistent application across major currency pairs (EUR/USD, GBP/USD, USD/JPY) - Practical integration with technical indicators like RSI and Moving Averages for confirmation Through precise diagrams and step-by-step visual breakdowns, readers learn to distinguish between noise and signal in volatile forex markets.

For instance, the **Hammer pattern**—a small-bodied candlestick with a long lower wick and a tight body—signals potential upward reversal in downtrends, often emerging after sharp declines. Conversely, the **Bearish engulfing candle**—a large red candle followed quickly by a green candle covering previous day’s range—heralds serious short-term bearish pressure, particularly effective near key resistance levels. From Noise to Strategy: How Candlestick Patterns Shape Forex Trading Discipline

Traders who rely on random entries face consistent attrition; those who apply pattern signals within defined setups demonstrate higher win rates. The guide emphasizes that no pattern trades in isolation—confirmation via volume spikes or indicator trends elevates reliability. For example, a Morning Star pattern gains strength when the close breaks below a prior swing low, validating the nascent bullish reversal.

“The real edge in forex isn’t just knowing patterns—it’s knowing when to act and how to position risk,” stresses expert trader Emily Tran, who integrates candlestick signals into her automated systems. Her insight underscores the guide’s approach: pattern mastery fused with tactical execution. Step-by-step workflows are provided for placing entry points, stop-loss placement, and takedown targets—ensuring theoretical knowledge translates efficiently to live markets.

The formatting in headings breaks down the guide’s structured pedagogy, showing how patterns are categorized by function and market context: - Reversal Patterns – reverse direction signals that exploit momentum exhaustion, such as Dark Cloud Cover and Bearish Three White Soldiers.

- Continuation Patterns – indicate trend persistence, including Bullish Flags, Rising Triangles, and Strong Morning Stars.

- Neutral Patterns – highlight indecision, like Doji clusters and Wheeling Summers, useful for range-bound markets.

Real-world application examples draw from the guide’s curated case studies: - How a precise identification of a Hemging pattern (a rare, multi-candle reversal) in EUR/USD helped a trader avoid a false break before a sharp 200-pip pullback.

- Using elle 3-con elf formation ahead of a pivotal G7 release to capture a momentum rebound in AUD/USD. Each entry reinforces pattern reliability through data-backed performance metrics, with common pitfalls explicitly addressed—such as mistaking candle clusters for full-time patterns or ignoring volume context.

Central to mastery is consistent practice, and the guide provides structured exercises designed to accelerate learning.

Beginners start with pattern recognition drills using free charting tools, progressing to backtesting live historical data. Interactive PDF features—embedded chart jump-ups, animated reversal confirmations, and click-to-explore commentary—transform passive reading into immersive skill development. The result?

Traders not only memorize signals but internalize intuition, reducing decision fatigue and emotional interference.

Beyond individual profitability, the guide illuminates how pattern analysis contributes to broader market understanding. Currency pairs often move in synchronized waves—wearings of collective psychology manifest as recurring candlestick motifs. By decoding these echoes, traders gain insight into decisive levels and macro-trend turning points, enhancing strategic alignment with economic calendars and policy shifts.In sum, *Master Forex Candlestick Patterns: Your Essential PDF Guide* transcends a conventional trading manual—it serves as both a diagnostic tool and a behavioral compass. Equipping traders with the visual literacy to interpret currency drama, validate challenges with discipline, and execute with clarity, this resource redefines success in forex—where pattern fluency becomes the ultimate advantage. In markets driven by split-second psychology, mastery of candlestick signals is not just powerful—it is indispensable.

Related Post

Oz to L B S: Decoding the Hidden Potential of Australian Systems in Modern Innovation

Clauddine Blanchard Unravels the Crime Scene Mystery: Behind the Silence Where Evidence Speaks Louder