Log In to Unlock Your Future: Mastering the Santander Car Loan Experience

Log In to Unlock Your Future: Mastering the Santander Car Loan Experience

Navigating the digital journey of a Santander car loan begins with a critical first step—logging into your account securely and efficiently. For borrowers seeking timely financing, the Santander Car Loan Login portal serves as the gateway to personalized loan management, transparent tracking, and seamless financial control. Accessing this platform with ease not only accelerates decision-making but also ensures users remain fully informed throughout their automotive funding journey.

As financial technology evolves, so do the expectations around convenience and personalization in banking services—especially for time-sensitive products like auto loans. The Santander Car Loan Login interface was specifically designed to meet these modern needs, offering a streamlined path from application to approval and beyond. But beyond its user-friendly design lies a robust system built on security, clarity, and user empowerment.

The login process is the foundation of a safe and efficient borrowing experience. When initiating access via the official Santander website or mobile app, customers are guided through a multi-layered authentication system that prioritizes both security and usability. Upon entering login credentials—typically a combination of a unique username or registered email and a strong password—users are directed to a secure dashboard tailored to their loan status.

What sets Santander apart is its emphasis on a frictionless yet secure login flow.

Unlike generic banking logins, the Santander Car Loan portal integrates biometric authentication options where available, supports one-click access for returning users, and automatically remembers trusted devices. “Our goal is to make managing your car loan as effortless as possible—without ever sacrificing the integrity of your personal data,” a Santander spokesperson emphasized in an internal briefing. “Every click is designed to connect you swiftly to what matters: real-time access, clear disclosures, and control.”

### Key Features of the Santander Car Loan Login Interface The login experience combines intuitive navigation with advanced security protocols, starting with a clean, responsive design optimized for both desktop and mobile.

Users access a centralized hub containing: - Loan balance and repayment schedule updates - Payment history and upcoming due dates - Documentation uploads and status tracking - Secure messaging with customer support The dashboard dynamically refreshes data in real time, ensuring you’re never working with outdated information. This immediacy reduces uncertainty and enables proactive financial planning—critical when managing a car loan, where timely payments affect credit scores and long-term costs.

### Step-by-Step: Logging In for a Smooth Experience Beginning the login journey is straightforward: 1.

Open the Santander mobile app or visit the official website at www.santander.com/cars. 2. Select “Car Loan” under the Personal Finance center, then click “Log In.” 3.

Enter your registered credentials—be it username, email, or customer ID paired with a secure password. 4. For enhanced protection, complete any optional multi-factor authentication steps.

5. You’re instantly directed to your personalized loan portal, where updated status, forecasts, and control panels await. This carefully orchestrated process minimizes user friction while reinforcing trust through visible security measures like encrypted connections and session alerts.

Security at the Core: Protecting Your Loan Data

Santander recognizes that digital trust is non-negotiable when handling sensitive financial information. The Car Loan Login system employs end-to-end encryption (SSL/TLS 1.3+), regular security audits, and strict compliance with global data protection standards such as GDPR. Rarely, users receive automated notifications when login locations or device activity deviate, adding a layer of behavioral protection that catches potential fraud in real time.> “We treat every login not just as authentication, but as a moment of trust,” says a senior security architect at Santander. “Our engineers constantly refine risk-based authentication systems to detect anomalies without interrupting legitimate users.”

Moreover, the interface encourages users to enable two-factor authentication (2FA) via SMS, authenticator apps, or biometrics—offering customizable security tiers based on personal preference. This granular control empowers borrowers to align protection with lifestyle, fostering long-term confidence in the platform.

Real-Time Transparency and Personalized Insights

In a market where delays and opacity can frustrate borrowers, the Santander Car Loan Login portal delivers real-time clarity. Customers pull up detailed breakdowns at a glance: current loan balance, monthly payment amounts, compounded interest, and projected total repayment. These elements are updated automatically as statements process, ensuring accuracy mirrored across fintech benchmarks.Interactive features further enhance engagement: - **Amortization schedules**: Visual tables showing principal and interest allocation per payment. - **Payoff alerts**: Customizable reminders hundreds of days before loan completion to avoid late fees. - **Custom reports**: Exportable PDFs of full loan histories, useful for tax filings or financial audits.

Perhaps most impactful is Santander’s push for education: embedded tooltips and youth-targeted financial tips guide first-time borrowers through loan terms, down payments, and budgeting—transforming a transactional interface into a learning platform.

“The Santár priorities aren’t just on speed—they

Related Post

Unveiling Ihttp Ipchicken: How Your Real IP Address Is Exposed at Ipchicken.com

Christian Farr NBC 5 Bio: Age, Height, and the Journey Behind the Air

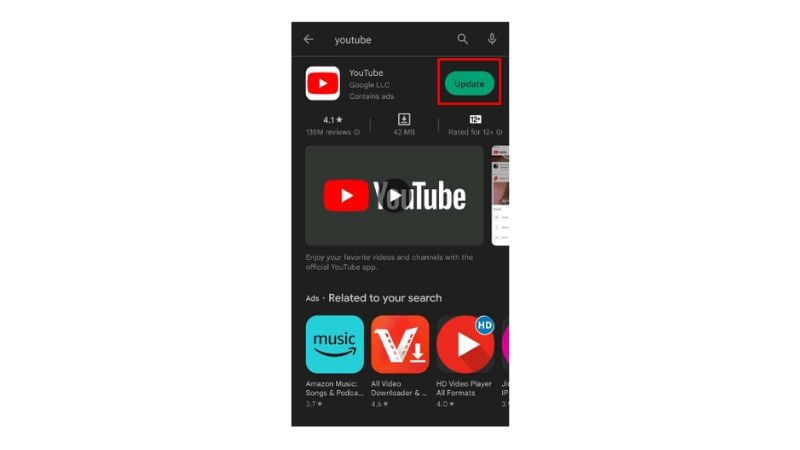

Youtube Something Went Wrong

Judy Byington: Shaping Modern Computational Thinking Through Vision, Innovation, and Education