IRS Stimulus Check: How to Track Your Payment from the Quickest and Safest Ways

IRS Stimulus Check: How to Track Your Payment from the Quickest and Safest Ways

For millions of Americans, the arrival of an IRS stimulus payment feels like a financial lifeline — a direct infusion of cash that can ease debt, cover essentials, or simply restore stability amid economic uncertainty. With the growing frequency of pandemic-era relief measures, many now rely on these payments, but tracking them often raises confusion. As disbursements unfold through direct deposits and checks, knowing exactly where your stimulus funds stand—and how to monitor them—is critical.

This article dissects the most reliable methods for tracking your IRS stimulus check, combining official guidance, real-world tools, and expert insights to ensure no taxpayer misses their payment.

Understanding the IRS Stimulus Program: When and How Payments Are Distributed

The IRS stimulus checks are not a single, universal check but a series of relief payments triggered by federal relief laws, primarily through the American Rescue Plan Act. These payments were distributed in 2021, 2022, and occasional supplemental disbursements in 2023 and early 2024, depending on eligibility and processing timelines.A receiver receives a payment if they owed no substantial tax liability and met income thresholds at the time the program was active. Importantly, different forms—such as direct deposit or paper checks—may arrive at different times. Direct deposits typically process faster, but physical checks sometimes take a week or more due to fulfillment logistics.

The IRS emphasizes that no single method is guaranteed; delays vary by bank, state, and individual circumstances. Understanding which form you received helps tailor your tracking strategy.

Track Direct Deposit: Real-Time Updates at Your Fingertips

For those receiving funds via direct deposit, visibility is built into the system.The IRS partners with major financial institutions to deliver seamless updates. - **Bank Transfers Typically Show Instantly (Sometimes):** When deposited into a bank account, most transfers reflect within 1–3 business days. Financing institutions often sync with the IRS to flag new deposits automatically.

This means your checking or savings account should show the stimulus amount shortly after processing. - **Use Bank App Notifications:** Without waiting, check your bank app or online portal. Many institutions send instant transaction alerts for deposits above a threshold—common practice for direct-to-consumer payments like stimulus checks.

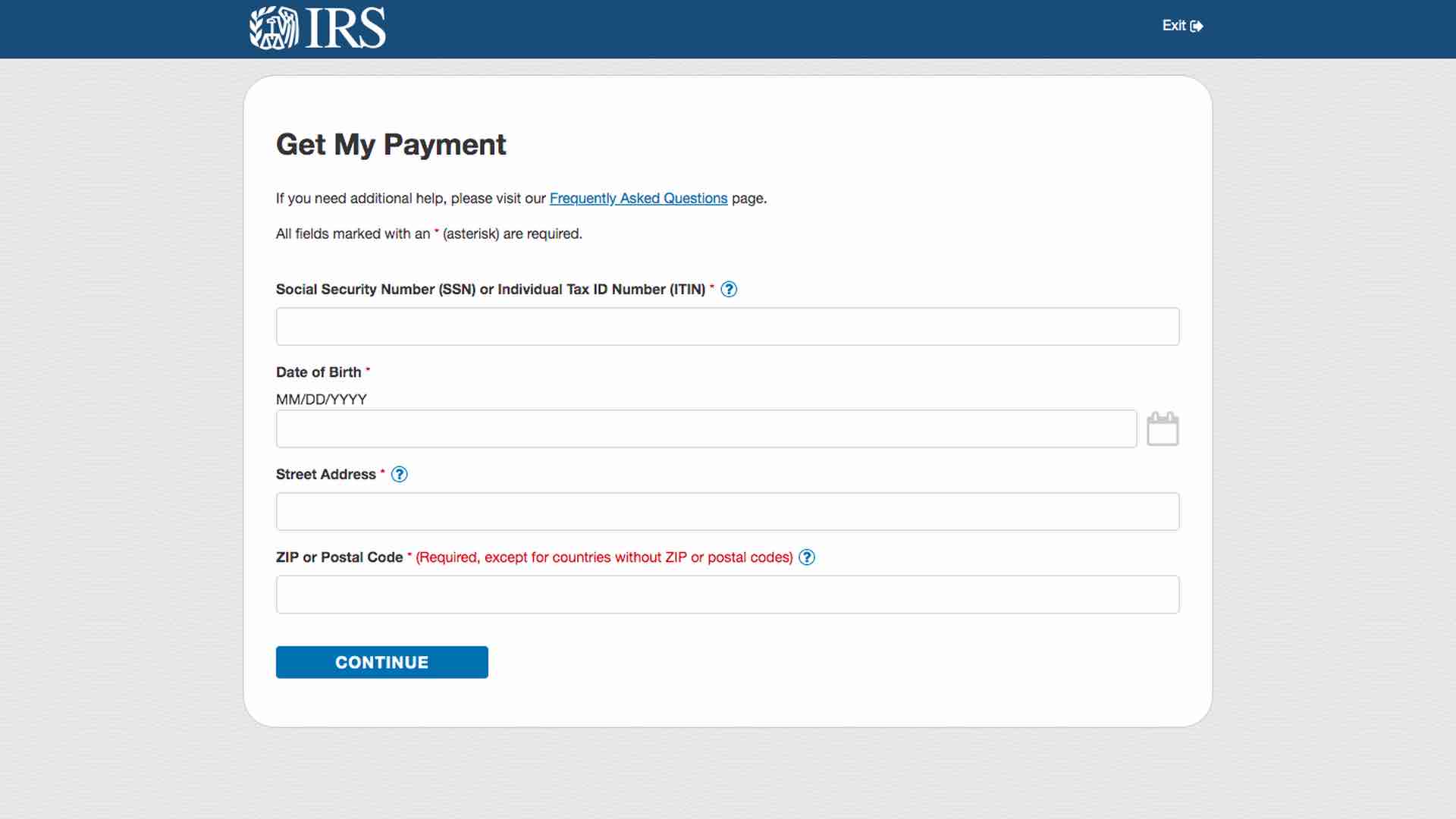

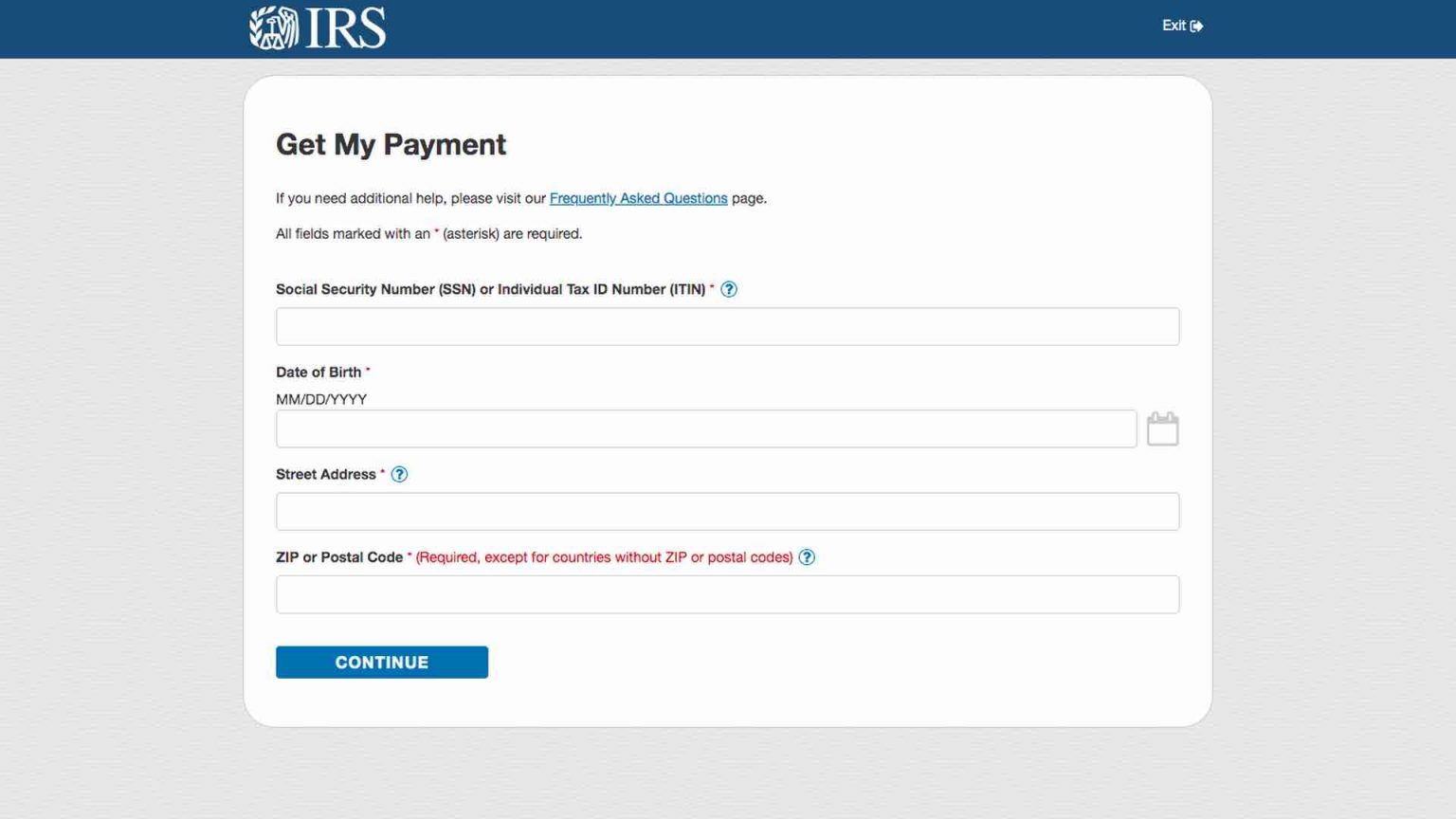

- **Log Into the IRS Website for Real-Time Status:** The IRS offers a free “Refund Status” lookup tool that lets users check if their payment is processed, delivered, or pending. Search “IRS Refund Status” in your browser and verify eligibility, timelines, and account details in seconds. The IRS also publishes regular updates on their official website about processing milestones and common delays.

> “Timeliness is key,” notes tax expert Sarah Lin, CPA and author of *Financial Relief in Uncertain Times*. “Direct deposits reflect the efficiency of both the IRS and banking partners—but discrepancies still occur. Monitor your statements daily.”

Track Paper Checks: Physical Checks Require Tracking & Confirmation

If you received a paper stimulus check, tracking shifts from digital automation to physical follow-up.- **Check For Folded “Ready for Deposit” Slips:** Most direct checks come with blank or pre-filled instructions. A folded note stating “Ready for Deposit” with a secure hold ensures the check is held at the bank pending direct deposit. Verify this note is intact—if missing, contact your financial institution immediately.

- **Use the IRS’s Check Tracking Feature:** The IRS advises that while there’s no formal public tracker for individual stimulus checks, banks use internal systems to monitor checks before credit. But you can call your bank’s customer service and reference your check’s tracking number (often printed on the document) to request confirmation. - **Watch Mail Patterns & Log Receipt Dates:** Paper checks typically arrive within 2–4 weeks after disbursement.

Set a calendar reminder for 3 weeks post-program end (e.g., early summer, mid-fall) to verify mail receipt, especially if trusted by delivery services like USPS Priority Mail. > “Physical checks demand proactive verification,” reminds tax attorney David Chen. “Missing a paper stimulus check isn’t a failure—it’s a signal to confirm with your bank promptly.”

Remote Monitoring Tools and Digital Platforms to Stay Informed

Beyond official IRS channels, several digital resources empower timely tracking: - **Third-Party Bank Portals:** Most online banks display transaction histories in real time.Log in to use “Quick Look” or alert features to flag new deposits instantly—ideal for monitoring direct deposits without waiting. - **IRS Direct Debit Status Tools:** Through IRS Secure Access, users can check status updates for direct deposits, especially useful if multiple payments arrive at once or if cancellation notices come through. - **Mobile Apps from Financial Institutions:** Banks like Chase, Bank of America, and credit unions now offer push notifications for new deposits over $100, making ongoing surveillance effortless.

Enable alerts for stimulus payments specifically if available. > “Technology transforms passive waiting into active oversight,” says financial consultant Mark Delgado. “Using alert systems reduces stress and personalizes tracking precision.”

What to Do if Your Payment Is Delayed or Missing

Even with meticulous tracking, delays can occur—due to bank processing lags, account freezes, or system errors.- **Wait 6 Weekly Check-Ins:** Most refunds processed quickly; allow up to 14 weeks from disbursement dates to confirm delivery. - **Contact Your Bank Immediately:** Provide your check ID, verification number, and timestamp of suspicion to initiate investigations. Banks usually resolve about 95% of disputes within days.

- **Reach Out to the IRS:** File a verification request online or via phone to confirm no liabilities or errors blocked the payment. The IRS Resident Consumer Services Line is available during business hours. - **Escalate If Necessary:** For unresolved issues, request a formal review through the IRS’s Office of Appeals, though this requires documentation and persistence.

> “Don’t panic,” stresses tax advocate Maria Torres, “but stay persistent. Every delay is an opportunity to prove your claim.”

Key Takeaway: Empower Your Payment Tracking with Confidence

Tracking an IRS stimulus check is no longer a passive chore but an active step toward financial control. Using direct deposit monitoring, paper check verification, and trusted digital tools ensures transparency and accountability.Armed with clear instructions, real-time updates, and proactive follow-up, taxpayers can confidently manage their relief funds, turning uncertainty into security. Understanding each channel—official, bank, and remote—turns a potential source of stress into a reliable financial advantage. Moving forward, as new forms of economic aid emerge, replicating this structured, informed approach will remain essential.

The IRS stimulus experience has shown that timely access to government relief depends not just on eligibility—but on knowledge, vigilance, and efficient use of available tools. Stay informed, stay alert, and use your next payment as a stepping stone to greater financial resilience.

Related Post

Egg Shooter: The Unstoppable Force Redefining Action in Gaming

The Zoey 101 Cast That Defined a Generation: Beyond the San Fernando Valley Iconics

Unveiling the True Story of Luke Beasley: Age, Origins, and the Rise of a973 Legionnaire

WhatsApp Fiber: The Next Frontier in High-Speed Messaging – What Users Need to Know