Inflasi 2023: The Hidden Cost of Rising Prices That’s Shaping Every Asian Economy

Inflasi 2023: The Hidden Cost of Rising Prices That’s Shaping Every Asian Economy

In 2023, inflation didn’t just cross thresholds—it shattered expectations. From soaring energy costs to persistent food shortages and wage stagnation, the year unfolded as a financial reckoning across Inflasi 2023, with price surges reshaping household budgets, straining national economies, and redefining monetary policy across Asia. What began as a global post-pandemic rebound spiraled into a complex crisis defined not just by numbers, but by real-life human impact.

Behind the headline inflation rates lies a intricate web of causes—supply chain fractures, energy volatility, and monetary expansions—and far-reaching consequences affecting consumption, employment, and long-term growth prospects. This deep dive explores the key drivers behind Inflasi 2023, unpacks the root causes, and reveals the tangible damage wrought across the Asia-Pacific region—where billions are adjusting to a new era of sustained economic pressure.

At the heart of Inflasi 2023 stood a confluence of macroeconomic shocks, with global supply chain disruptions remaining a persistent thorn long after pandemic lockdowns eased.

Freight bottlenecks, container shortages, and labor shortages in logistics hubs sent shipping costs soaring, directly inflating prices for imported goods. In countries like Indonesia and Vietnam, where import dependency for consumer goods exceeds 30%, this translated into visible jumps in retail prices. Additionally, volatility in energy markets—driven by geopolitical tensions in the Middle East and Europe—left fuel and electricity costs spiraling.

In Thailand, electricity prices rose by 28% year-on-year in Q4 2023, instantly increasing household utility bills and raising produção costs for small businesses alike. “Energy prices in 2023 weren’t just high—they were catastrophic,” notes Dr. Mei Lin, senior economist at the ASEAN Economic Research Institute.

“From manufacturing plants to kitchen tables, energy drove inflation through every link of production and distribution.”

Compounding these supply shocks was the a slow-motion crisis in global food supply. Persistent droughts in key agricultural regions and export restrictions from major grain producers disrupted grain markets, pushing up basic commodity prices. The Philippines, already grappling with imported inflation (over 80% of food is imported), saw rice prices climb 35% from early 2023 to year-end.

In India and Bangladesh, staple cereals rose over 25%, forcing lower-income families to reallocate a larger share of their income just to feed themselves. “It’s not just about quantity anymore—it’s about affordability and access,” says Amina Rahman, a trade analyst at Mumbai-based Centaur Insights. “When essentials consume half or more of a family’s income, consumption slumps, weakening domestic demand and slowing economic momentum.”

Monetary policy responses throughout the year reflected both urgency and dilemma.

Central banks across Asia adopted tighter lending standards and subjected interest rate hikes to keep inflation in check, yet each move risked deepening economic strain. In Indonesia, the central bank raised rates seven times in 2023, peaking at 5.75%, but growth decelerated to 4.7%—the lowest in over a decade. Meanwhile, the Bank of Japan maintained ultra-loose policy longer than expected, allowing inflation to remain surprisingly dormant at 2.6%, though deflationary mindsets persisted among consumers.

“Monetary tightening can cool prices, but if done too aggressively, it deepens recessions without ending price pressures,” warns Dr. Lin. “Inflation in 2023 wasn’t just about too much money—it was about structural mismatches between supply and demand.”

Supply chain fragility emerged as a defining thread of the crisis.

The fallout from prolonged disruptions revealed a harsh truth: globalization’s efficiency had come at the cost of resilience. Just-in-time manufacturing models, pushed to extremes during the pandemic, faltered under sudden shocks. Semiconductor shortages delayed electronics production while port congestion in China and Australia halted exports.

For countries reliant on just-in-time imports—like Malaysia and South Korea—delays stretched deliveries by weeks, halting assembly lines and inflating consumer waits. “The crisis exposed how over-optimized supply chains are vulnerable,” explains logistics expert Rajesh Patel from Singapore’s Port Authority. “Diversification and localized production aren’t just buzzwords—they’re survival strategies.”

Beyond production, labor market pressures added another layer.

Post-pandemic wage growth lagged behind inflation, eroding purchasing power. In the Philippines, real wages fell by 2.1% in 2023 despite rising prices, forcing households to cut discretionary spending. Japan, facing labor shortages yet frozen wages, saw consumer confidence dip to a five-year low.

“When your pay doesn’t keep up with rising costs, you aren’t just searching for jobs—you’re looking for ways to stretch every yen,” says survey respondent Lina Tan, a Jakarta office manager. This erosion of real income dampened retail sales, restaurant traffic, and tourism recovery, compounding the slowdown.

Monetary tightening and supply shocks converged to strain public finances.

Governments spent billions on subsidies and price controls, stretching fiscal budgets thin. In Pakistan, food subsidy programs ballooned to 15% of GDP—yet periodic shortfalls left millions unprotected, exacerbating inflation’s social toll. Fiscal buffers eroded as revenue growth stalled, limiting future policy flexibility.

“Balancing inflation control with social stability was the defining tightrope for governments,” notes policy analyst Fatima Hussain of the Tokyo International Forum. “In many cases, subsidies masked deeper structural issues rather than fixing them.”

Age of energy transition brought conflicting pressures. As global coal and natural gas prices spiked, many Asian nations accelerated renewable investments—solar in Vietnam, wind in Thailand—holding long-term promise but short-term costs.

Co-branded battery storage and grid upgrades soared, yet initial investments raised electricity tariffs. In Myanmar, rising energy costs hit rural populations hardest, cutting off access to power and slowing rural development. “The green transition fuels inflation today while promising long-term relief,” states energy consultant Linus Wang.

“Policies must protect vulnerable groups during this shift.”

The impact on households reshaped social dynamics. Consumer confidence plummeted across ASEAN, with survey data showing 62% of adults worried about affordability in 2023—the highest in a decade. “People are scrambling,” observes Maria Santos, a senior market researcher in Manila.

“Priorities shift: education savings, healthcare, even borrowing. The future now feels uncertain.” Mental health challenges surged, particularly among young adults and fixed-income earners, reflecting inflation’s deep psychological toll.

Looking forward, 2023 set a grim precedent.

Central banks now face an unwinnable dilemma—restoring price stability without deepening recessions. Structural reforms—diversifying supply chains, boosting domestic production, investing in resilient infrastructure—are urgent but politically difficult. The crisis also highlighted disparities: high-income nations leveraged reserves and central bank credibility, while lower-income countries struggled with debt and import burdens, risking prolonged instability.

“Inflazione 2023 is not just about numbers on a dashboard—it’s measured in sleepless nights, value-unstable budgets, and fragile futures,” concludes Dr. Lin. “Solving it demands policy foresight, not just short-term fixes.”

In the aftermath, businesses adjusted, governments recalibrated, and households adapted—but the echoes of 2023’s inflation remain deeply embedded.

From every rising rice price to every higher energy bill, the period reshaped economic daily life across Asia, leaving an indelible mark on how economies—and people—navigate uncertainty. The road ahead demands more than inflation targets; it demands structural change, resilience, and a renewed focus on inclusive growth.

Related Post

/vidio-media-production/uploads/video/image/7353831/biang-keringat-bikin-gatal-begini-cara-mengatasinya-fa2be9.png)

Skincare Bikin Gatal? Unmask the Hidden Causes Behind Troublesome Bikini Line Gitals

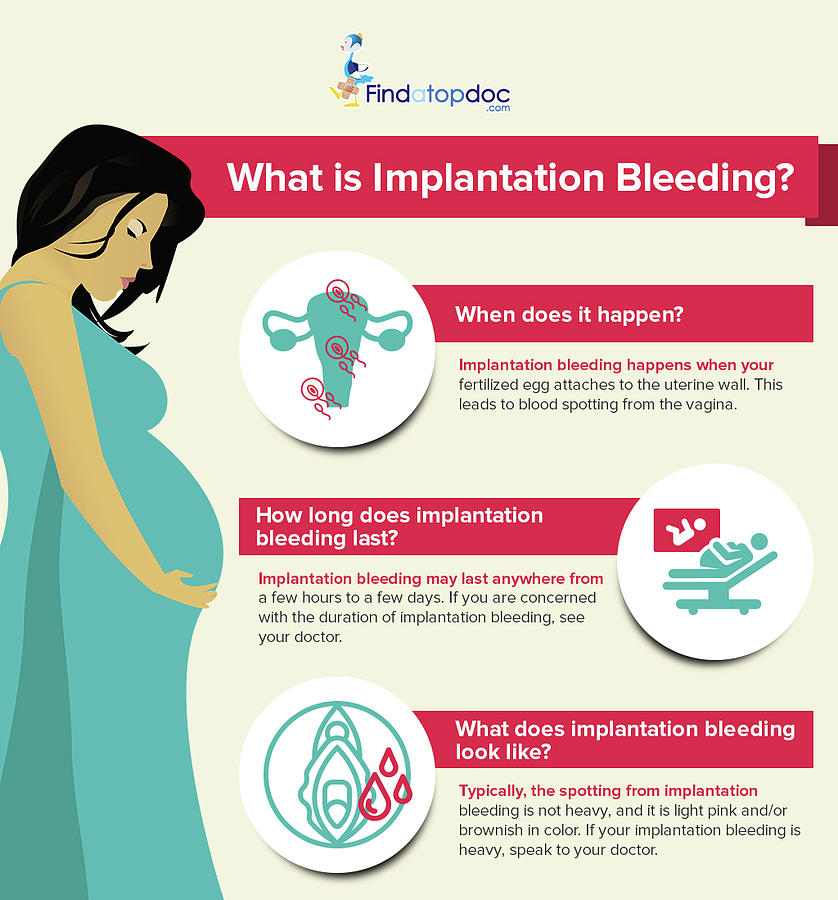

Why Does Baby Period Bleeding Happen? Unveiling the 10 Key Causes Like Menstruation and Hormonal Shifts

Penyebab Excel Not Responding: Unraveling the Technical Troubles Behind Crashes and Freezes

Sultan Agung’s Siege of Batavia: A Tumultuous Clash That Shaped Java’s Destiny