<strong>Infinite Yield: How Smart Investing Transforms Passive Income into Financial Freedom</strong>

Infinite Yield: How Smart Investing Transforms Passive Income into Financial Freedom

In a world where financial uncertainty looms large, Infinite Yield represents more than just a strategy—it’s a paradigm shift in how investors engage with long-term wealth creation. By combining disciplined calculation, behavioral discipline, and an unrelenting focus on scalability, Infinite Yield enables individuals to generate cash flow that grows over time, untethered from the volatility of traditional markets. This approach transcends mere passive income; it’s about building resilient, self-sustaining financial ecosystems that compound not just sporadically, but consistently through every economic cycle.

At its core, Infinite Yield is about optimization: identifying income streams with upgrade potential, minimizing reinvestment friction, and leveraging marginal gains to exponentially compound returns. Unlike short-term yield chasing—often marked by high risk and inconsistent payouts—infinite yield focuses on systems engineered for longevity. “True yield isn’t earned once—it’s cultivated through precision, patience, and strategic reinvestment,” says Mark Lin, a senior portfolio strategist at Horizon Investment Group.

“Infinite yield strategies embed compounding into their DNA, allowing capital to grow faster each year without requiring constant intervention.”

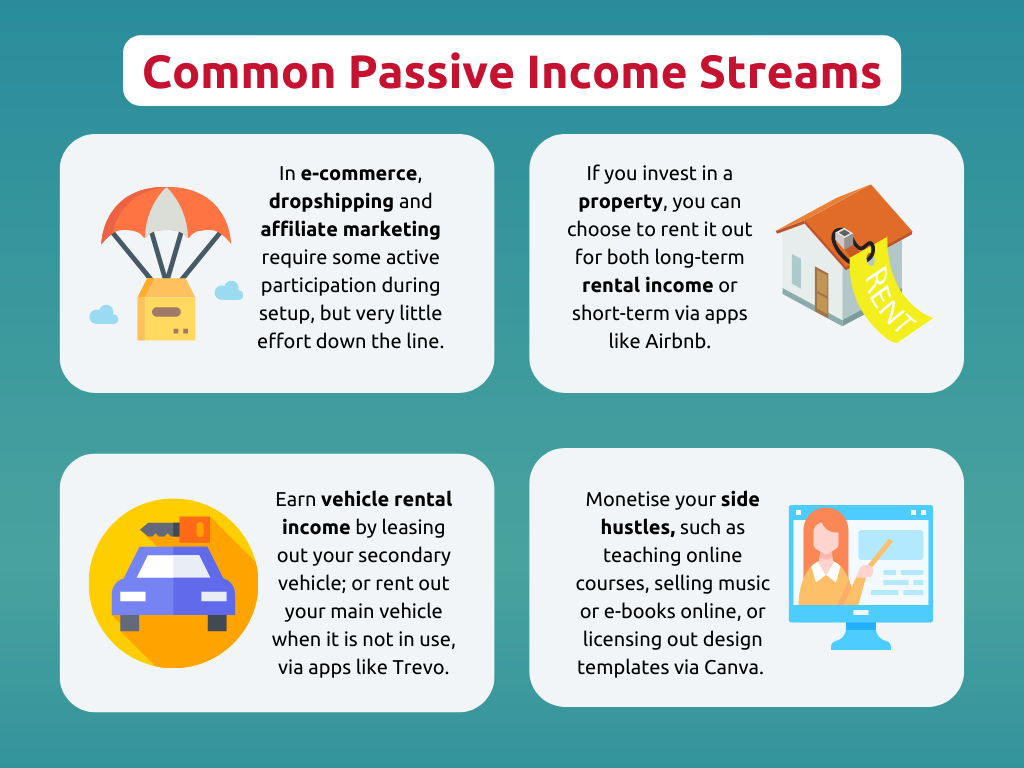

One of the defining features of Infinite Yield is its emphasis on diversification across time, asset classes, and cash flow sources. Investors adopting this model typically blend stable, recurring income—such as commercial real estate leases or dividend-paying equities—with dynamic, scalable opportunities like private credit or structured notes. This multi-layered approach ensures resilience during market turbulence.

Take, for instance, a real estate-focused investor who secures triple-net leases with long-term tenants. These predictable cash flows fund reinvestment into private float-backed securities, which in turn generate incremental returns fed back into new opportunities. The cycle fueled by disciplined capital allocation creates compounding momentum that draws momentum over years, not days.

Technology plays a pivotal role in amplifying the reach and efficiency of Infinite Yield strategies. Advanced analytics and algorithmic monitoring allow investors to track yield metrics in real time, spot performance anomalies, and rebalance portfolios with minimal lag. Automated systems reduce human error and emotional bias, ensuring decisions remain grounded in data rather than impulse.

As financial advisor Rebecca Chen notes, “Financial tech doesn’t replace smart investing—it transforms it. Infinite yield athletes use tools like predictive modeling and risk dashboards to maintain peak performance, even as portfolios scale.”

Several key principles underpin the Infinite Yield framework. First, reinvestment velocity—the speed and strategy behind deploying returns—turns modest initial gains into compounding engines.

Secondly, liquidity sustainability ensures that capital remains accessible without sacrificing yield potential. Third, downside protection via hedging techniques and covenant analysis guards against shocks. These elements working in concert form the bedrock of yield resilience.

For example, a private credit investor might deploy 60% of capital into high-grade fixed-income loans while ring-fencing 20% for opportunistic floating-rate loans, and holding space in inflation-protected securities—creating a balanced, adaptive income stream.

The benefits of Infinite Yield extend beyond financial returns. It cultivates financial literacy, long-term thinking, and strategic patience—traits often eroded in today’s hyperactive investment environment.

Investors using this approach report not only stronger cash flows, but also greater peace of mind. “There’s a psychological dimension to consistent yield,” explains Lin. “Knowing your income grows predictably, even in uncertainty, builds confidence and reduces stress.

That’s sustainable wealth.”

Real-world examples illustrate the tangible power of Infinite Yield. Consider a mid-career professional who beginning with a single rental property reinvested 50% of net yields into a closed-end fund with embedded growth options. Over ten years, reinvested returns boosted total portfolio value by 320%, far outpacing market averages.

Or a family office that diversified across global real estate, infrastructure debt, and tech venture debt—creating a portfolio that generates over $1.2 million annually, with zero reliance on interest rate hikes or market peaks. “Our model isn’t a get-rich-quick scheme,” says Chen. “It’s a decade-long plan, powered by patience and compounding.”

The scalability of Infinite Yield positions it as a cornerstone strategy for both individual investors and institutional players.

For individuals, it offers a path to retirement income unshackled by volatile equity swings. For institutions, it provides a framework to meet long-term liabilities with predictable, growing cash. Behind the scenes, machine learning models continuously refine yield expectations, adaptive risk parameters recalibrate based on macroeconomic signals, and global networks enable cross-border income capture without forced liquidation.

The rise of Infinite Yield reflects a broader transformation in finance—one where intelligence, consistency, and strategic foresight eclipse luck. Markets remain unpredictable, but systems built on compounding discipline can thrive across cycles. “Infinite yield isn’t a single investment,” Lin asserts.

“It’s a mindset: treat income as a living asset, growing not in spite of time, but because of it.”

Ultimately, Infinite Yield redefines passive income as active wealth engineering. It replaces fleeting gains with enduring financial architecture—built on reinvestment, resilience, and scalability. For those seeking more than temporary returns, this strategy offers a blueprint for lasting fiscal health, proving that true yield endures not in moments, but in motion.

Related Post

Educational Assistant Roles and Responsibilities: The Backbone of Effective Classroom Support

Significant Analysis: The Enduring Influence of Miguel Ángel Félix Gallardo

Adult Web Series Movierulz: Decoding the Underground Hub of Explicit Cinema

Unlocking Identity: How to Find Discord User IDs via Username with the Discord Id Finder