Indonesia’s Palm Oil Market: A Deep Dive into the Engine of Global Vegetable Oil

Indonesia’s Palm Oil Market: A Deep Dive into the Engine of Global Vegetable Oil

Indonesia stands as the undisputed global leader in palm oil production, supplying over 55 percent of the world’s supply. This dominance shapes not only the nation’s economy but also global commodity flows, trade policies, and sustainability debates. The Indonesian palm oil market is a complex ecosystem—vast in scale, deeply intertwined with rural livelihoods, and increasingly scrutinized under environmental and social accountability.

A closer examination reveals how policy, productivity, and global demand converge to define one of the most influential agricultural sectors of the 21st century.

At the heart of Indonesia’s dominance lies a combination of geography, institutional support, and decades of investment in yield optimization. With mature cacao forests across Sumatra, Kalimantan, and Papua, Indonesia’s tropical climate provides ideal conditions for oil palm cultivation.

According to data from the Ministry of Agriculture, total planted area exceeded 21 million hectares in 2023, delivering over 58 million tons of palm oil—more than double many nations’ domestic consumption. The sector supports more than 4.5 million direct and indirect jobs, making it a cornerstone of rural Indonesia’s economic resilience. “Palm oil is not just a product—it’s a lifeline,” notes Dr.

Siti Zara, economist at Jakarta’s Center for Agricultural Policy Research. “It powers smallholder incomes, drives regional development, and anchors supply chains from local mills to multinational buyers.”

Key to production gains has been deliberate government intervention through infrastructure development, research investment, and trade incentives. The national policy framework, including the National Palm Oil Scheme and the Biochemical Oil Mandate Program, has incentivized vertical integration—from plantation to processing—strengthening domestic value chains.

“State-backed support has enabled farmers to access high-yield varieties, modern harvesting equipment, and irrigation systems,” explains agro-industry expert Ir. Budi Santoso, formerly with the Indonesian Palm Oil Association (GETUP). “This upward pressure on productivity translates into sustained global supply leadership.”

Growth, however, has not come without ecological and social challenges.

Scrutiny over deforestation, peatland conversion, and labor rights has pushed Indonesia to adopt stricter sustainability standards. The nation’s commitment was institutionalized via the Indonesian Sustainable Palm Oil (ISPO) certification scheme and alignment with international frameworks such as the Roundtable on Sustainable Palm Oil (RSPO). “Balancing expansion with preservation remains the sector’s defining challenge,” says Dr.

Zara. “We now see 70 percent of oil palm certified under ISOP or equivalent schemes—a major shift from a decade ago, driven by both domestic regulation and pull from European and North American markets.”

Economically, palm oil is a vital foreign exchange earner, contributing over $20 billion annually to government revenues through export duties, taxes, and corporate licensing. In 2023, direct palm oil exports reached $24 billion, accounting for nearly 13 percent of Indonesia’s total merchandise exports.

This revenue stream fuels public investment in roads, education, and health infrastructure, amplifying palm oil’s role beyond commodities into national development.

Producer dynamics are evolving as large agribusiness groups coexist with thousands of smallholders. While multinational corporations like Cargill, Wilmar, and Unilever dominate downstream processing and global trade, smallholder cooperatives manage over 40 percent of cultivated land.

“Smallholders are the backbone,” states Ir. Santoso. “Yet many struggle with access to finance, technology, and market transparency.

Bridging this gap is key to sustaining growth without social friction.”

Technological innovation continues to reshape cultivating practices. Precision farming tools—drones, satellite monitoring, and soil sensors—are helping farmers boost yields by 20–30 percent while reducing environmental impact. Innovations in oil extraction and by-product utilization, such as palm kernel oil for cosmetics and biodiesel from mill residues, are expanding value-added opportunities.

“Circular economy models in palm oil are emerging fast,” explains Farid Kusnadi, director of renewable resources at APRIL Group. “Every tonne of crude oil now unlocks multiple revenue streams—fiber, biomass, biofuels—enhancing both profitability and sustainability.”

Despite its strength, the market remains sensitive to global price volatility and regulatory shifts. Fluctuations tied to Chinese and Indian demand, weather events in Brazil and Africa, and evolving EU climate laws test Indonesia’s export resilience.

“We’re responding with forward-thinking policies: carbon pricing pilots, reforestation bonds, and digital traceability systems,” Dr. Zara notes. “The sector isn’t just producing oil—it’s evolving into a model of integrated, accountable agribusiness.”

In essence, Indonesia’s palm oil market is far more than a commodity story; it’s a dynamic force shaping rural futures, international trade, and environmental stewardship.

As nations demand cleaner, more transparent supply

Related Post

Discover the Best Anime Streaming Platforms to Catch Every Episode You Love

Texas Roadhouse Early Dine Menu & Prices: Deals You Can't Miss! — The Ultimate Guide to Steakhouse Savings

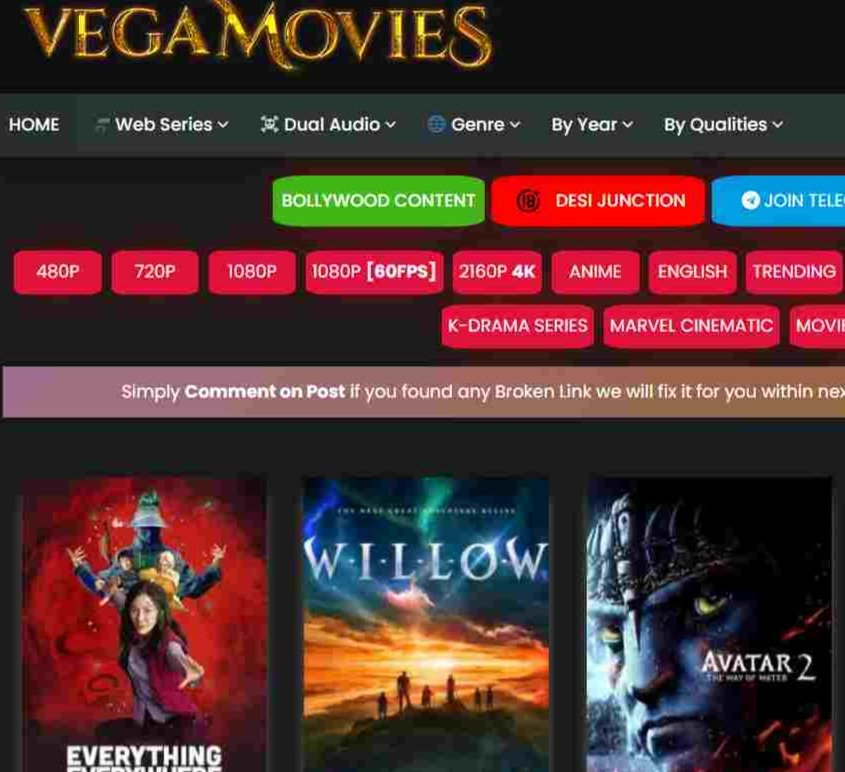

Understanding Vegamovies.to: Your Ultimate Gateway to Seamless Movie Streaming Online

Profile Picture Makeup: The Precision Behind a Perfect Shot