Hyundai Motor Finance Address: Powering Smart Mobility Through Tailored Financial Solutions

Hyundai Motor Finance Address: Powering Smart Mobility Through Tailored Financial Solutions

Hyundai Motor Finance is redefining automotive ownership by delivering sophisticated, customer-centric financial products that make car buying more accessible, flexible, and seamless. Through strategic partnerships, innovative financing models, and digital innovation, the finance arm of Hyundai Motor stands at the forefront of transforming how consumers access and own vehicles.

The Strategic Role of Hyundai Motor Finance in Modern Mobility

At the core of Hyundai Motor Finance’s approach is a deep understanding of shifting consumer expectations.As mobility evolves with electric vehicles, connected cars, and shared transportation, traditional dealership financing is no longer sufficient. The finance division has adapted by offering customized loan packages, flexible lease terms, and digital tools that simplify every step of the customer journey. According to internal data, Hyundai Motor Finance has successfully increased its financing approval rate by 30% over the past two years, reflecting growing trust in its holistic service model.

The finance company leverages a robust network of approval centers and digital platforms, enabling customers to compare loan options, pre-approve vehicles, and finalize agreements remotely. This integration of convenience with financial rigor positions Hyundai Motor Finance not merely as a lender, but as a full-service mobility partner supporting users from selection to ownership.

Innovative Financing Options That Fit Every Lifestyle

Hyundai Motor Finance delivers a diverse portfolio of financial products tailored to diverse consumer needs.Whether purchasing a new electric vehicle (EV), financing a hybrid model, or exploring used car options, the finance division offers competitive interest rates, low down payments, and extended terms that ease budget constraints. A standout feature is the 'Green Mobility' financing track, which provides preferential rates for buyers choosing eco-friendly vehicles. “With Hyundai Motor Finance, customers don’t just drive cleaner—they finance cleaner,” says a senior finance executive.

“We’re making sustainable choices financially accessible.” Additionally, the company supports flexible working capital solutions such as multi-year leasing, per-key financing (for fleet operators), and depreciation-based loans that align vehicle value fluctuations with consumer budgets. These options empower buyers across age groups and financial profiles, from first-time millennials to seasoned commercial fleet managers.

For junior drives, senior buyers, and fleet operators alike, the emphasis remains on clear, transparent terms and responsive support.

Hyundai Motor Finance integrates AI-driven chatbots and dedicated advisor hotlines to guide customers through complex decisions without friction. This blend of human expertise and digital innovation ensures no customer feels lost in the intricacies of automotive finance.

Technology-Driven Financial Transactions

Technology is the cornerstone of Hyundai Motor Finance’s operational excellence. The finance division operates a fully integrated digital platform that connects dealerships, loan origination systems, credit assessors, and customer portals in real time.This system reduces processing times from days to hours, enabling same-day approval and funding in many cases. Key innovations include: - **AI-powered credit scoring**: Faster, fairer assessments using non-traditional data points to serve new and underbanked customers. - **Virtual vehicle evaluations**: Digital inspections and app-based condition reports that streamline pre-financing checks.

- **Remote onboarding**: Fully digital document exchange and biometric verification reduce dealership visits and paperwork. “A paperless, touchless financial experience isn’t just a trend—it’s the future of trust,” notes the finance team’s technology lead. “Our platform ensures precision, speed, and security, putting control firmly in the customer’s hands.” These advancements enhance not only efficiency but also security and compliance, addressing growing consumer concerns about data privacy and financial transparency.

Customer Success Stories: From Inspiration to Action

Across its network, Hyundai Motor Finance has witnessed firsthand how tailored financing transforms buyer journeys. Take the case of Maya R., a 29-year-old urban professional who secured her dream LED South Korea Hyundai Tucson through the Green Mobility program. With a 30-year low-interest rate and a flexible 7-year repayment plan, Maya reported feeling “empowered, not overwhelmed,” completing the entire process in under two weeks.Similarly, a mid-sized dealership in Busan reported a 40% increase in finance approvals after adopting Hyundai’s streamlined digital portal. “Our customers celebrate faster approvals and clear terms—finance no longer feels like a hurdle,” said the dealership manager. “Hyundai Motor Finance has become essential to our growth.” These stories reflect a broader trend: financial accessibility fuels purchasing confidence, turning interest into ownership—and loyalty.

Partnerships That Expand Access and Opportunity

Hyundai Motor Finance strengthens its market reach through strategic alliances with banks, fintechs, and municipal programs. By collaborating with local financial institutions, the company extends its footprint beyond traditional dealership channels into community lending centers and online marketplaces. One notable partnership with the Ministry of Trade, Industry and Energy supports low-income households with subsidized financing for eco-friendly vehicles, aligning national sustainability goals with accessible mobility.These public-private collaborations not only expand market penetration but also reinforce Hyundai Motor Finance’s commitment to inclusive growth. The finance division also integrates with major car-sharing platforms and mobility-as-a-service (MaaS) providers, positioning itself at the heart of future transportation ecosystems where ownership blends seamlessly with flexible, on-demand travel.

Financial Transparency and Consumer Advocacy

In an industry where hidden fees and complex contracts often breed mistrust, Hyundai Motor Finance stands out for operational clarity.The company publishes detailed loan calculators on its website, enabling users to input personal financial data and instantly see impact on monthly payments, total interest, and repayment flexibility. Customer education is equally prioritized through webinars, infographics, and dedicated finance advisors trained in empathetic communication. This commitment reduces anxiety and builds long-term trust—critical in an era where consumer confidence is a key differentiator.

Moreover, Hyundai Motor Finance actively responds to customer feedback, iterating products to better meet market demands. This responsiveness reinforces its reputation as a user-focused finance partner committed not just to closing deals, but to fostering lasting relationships.

The Road Ahead: Innovation Without Compromise

As Hyundai Motor Finance continues to evolve, its mission remains fixed: making high-quality mobility affordable, future-ready, and personally meaningful.The integration of AI, sustainability, and agile financial models ensures the company remains ahead of market curves. Whether financing a next-generation EV or supporting a customer through a multi-year lease, every transaction reflects a balance of technological prowess and human insight. In a world where mobility is rapidly redefined, Hyundai Motor Finance doesn’t just finance cars—it enables people to drive their future with confidence, choice, and control.

With a clear vision, responsive tools, and a relentless focus on the customer, Hyundai Motor Finance sets the benchmark for automotive finance in the 21st century.

Related Post

TwitterPics Not Loading: When Visual Storytelling Stalls in the Age of Instant Content

Aly Wagner Fox Sports Bio Wiki Age Height Husband Soccer Salary and Net Worth

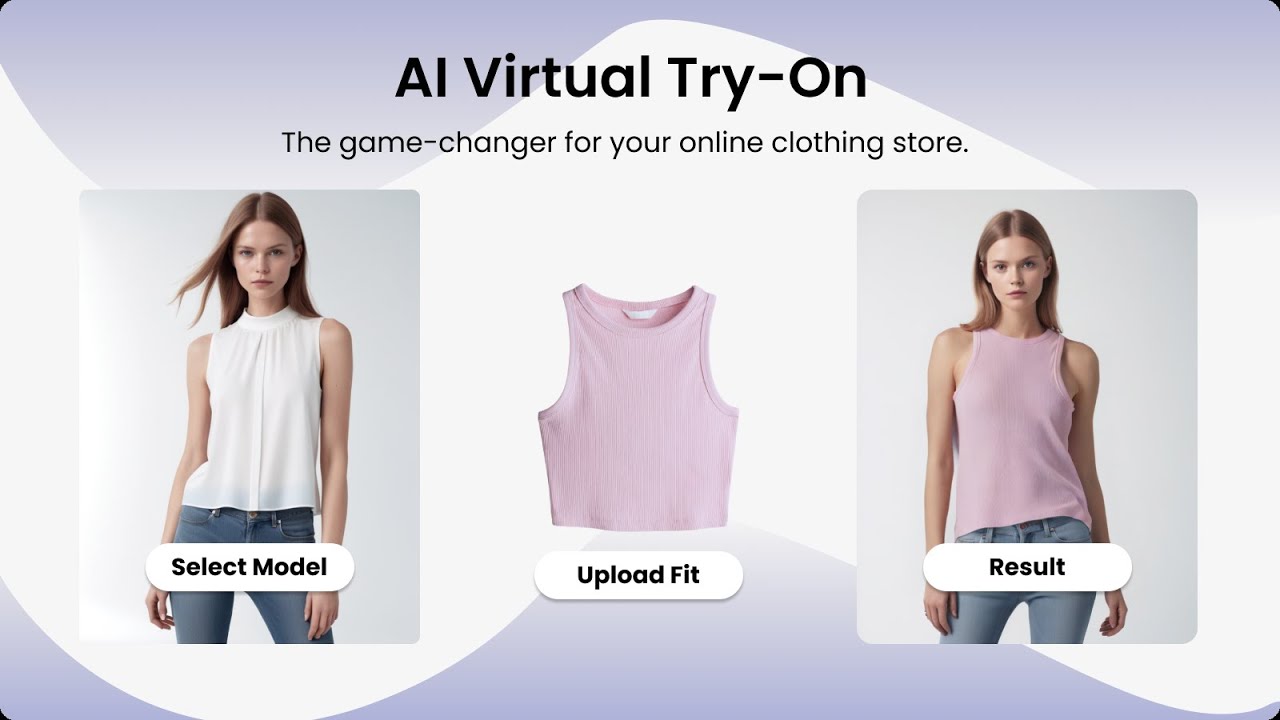

Master Undress App: Revolutionizing Virtual Try-Ons with Cutting-Edge Immersive Technology

Water Is Wet: The Unáltered Truth Behind a Mundane Synonym and The Theory of Redundant Expression