Ganfeng Lithium Group Share Price: What Investors Should Know Before Buying In

Ganfeng Lithium Group Share Price: What Investors Should Know Before Buying In

Among global players dominating the lithium supply chain, Ganfeng Lithium Group stands out as a pivotal force shaping the electric vehicle and energy storage revolution. As one of China’s largest lithium producers and processors, its stock price reflects not only market conditions but also broader trends in clean energy adoption, geopolitical dynamics, and raw material volatility. For investors assessing opportunities in lithium—a critical component in batteries—understanding Ganfeng’s market position, financial health, and strategic trajectory is essential to making informed decisions.

Ganfeng’s stock, listed on the Shenzhen Stock Exchange under题材: Ganfeng Lithium Group Share Price: What Investors Should KnowShare Code: 000537.SZ, has experienced notable fluctuations driven by supply-demand imbalances, policy shifts, and global demand for EVs and energy storage systems. As lithium prices surged during the renewable energy boom, Ganfeng’s shares briefly reached multi-year highs, signaling investor confidence. However, market corrections and competitive pressures have introduced volatility, underscoring the importance of tracking real-time fundamentals before investing.

The Lithium Rush: Why Ganfeng Matters in the Energy Transition

Ganfeng Lithium Group plays a central role in the global lithium ecosystem, operating mining assets, refining facilities, and downstream battery material production across China and internationally.The company controls key assets, including lithium mines in Qatar, Argentina, and Inner Mongolia, processing plants producing lithium carbonate and hydroxide—both essential for battery cathodes. This vertical integration gives Ganfeng significant cost advantages and supply chain resilience.

With battery demand expected to exceed 2,000 gigawatt-hours by 2030, driven by EV adoption and grid storage investments, Ganfeng’s production capacity and cost structure position it as a bellwether for industry health. Investors tracking the stock should recognize that volume growth and margin stability hinge on several factors:

- Production Capacity Expansion: Ganfeng has aggressively expanded its processing capabilities, enabling it to supply major automakers and battery manufacturers globally.

Projects like the Indonesia-designed lithium hydroxide plant aim to tap rich brine resources and secure long-term contracts.

- Cost Efficiency: The company’s scale allows for lower production costs, critical amid price volatility. Its ability to manage hydroprocessing and recycling innovations improves overall profitability.

- Regulatory and Trade Shifts: U.S. Inflation Reduction Act incentives and EU battery regulations impact export flows and competitive positioning, directly affecting Ganfeng’s overseas revenue streams.

- Raw Material Security: Access to stable lithium sources—especially in politically sensitive regions—remains a strategic challenge requiring prudent risk management.

Market analysts closely monitor Ganfeng’s financial disclosures, including gross margins, production volumes, and capital expenditure.

Recent filings indicate steady growth in revenue driven by higher lithium carbonate prices, though net profits sometimes fluctuate due to refining costs and currency exchange effects.

Shares in Motion: Charting Ganfeng’s Price Trends and Volatility

Analyzing Ganfeng’s stock price over the past five years reveals a pattern shaped by multiple cycles: rapid ascent during lithium price peaks (2018–2022), followed by sharp corrections during global oversupply periods (2023). The shares closed 2023 down approximately 15% year-to-date, reflecting investor caution amid slowing EV demand growth in China and tighter liquidity globally.Seasonal and macroeconomic drivers further influence volatility:

- Q4 typically sees demand spikes from automakers ramping up production ahead of holiday sales, offering short-term volume boosts.

- U.S.-China trade tensions occasionally disrupt supply chain logistics, creating temporary downward pressure.

- M&A activity—such as strategic partnerships or potential asset divestitures—often triggers stock reactions, underscoring market sensitivity.

Despite headwinds, Ganfeng’s long-term outlook benefits from structural tailwinds: the International Energy Agency forecasts clean energy storage deployment will increase tenfold by 2030, with lithium demand outpacing supply for the foreseeable future.

Investor Considerations: Risks, Rewards, and Strategic Entry Points

For investors evaluating Ganfeng Lithium’s shares, a disciplined approach balances quantitative metrics with qualitative risks. The company’s dividend yield—historically around 4–6%—offers income appeal, but equity gains depend on execution aspects.Key risks include:

- Price volatility tied to lithium carbonate benchmarks (LME), which can swing 20–30% annually based on geopolitical or supply disruptions.

- Regulatory scrutiny in target markets, including potential export controls or environmental compliance costs.

- Exposure to raw material price swings; refining margins narrow if lithium supply floods global markets.

Conversely, strategic entry points arise when:

• Production Capacity Increases: Announced expansions and greenfield projects signal scalable future output.

• Regulatory Tailwinds: Policy support in key markets or stable cross-border trade agreements reduce operational risk.

• Supply Agreements Locked In: Long-term contracts with EV giants ensure revenue visibility.

What’s Next for Ganfeng: Outlook and Market Sentiment

Looking ahead, Ganfeng Lithium’s trajectory remains closely tied to global EV adoption curves and lithium market maturation.Leadership has signaled confidence in sustained demand growth, particularly in Asia, where electrification policies are tightening. The company’s reported R&D investments in next-generation cathode materials and recycling technologies suggest a move toward value-added solutions beyond sheer volume.

While short-term share price swings are inevitable, the long-term fundamentals remain strong. Ganfeng’s diversified asset base, cost leadership, and strategic geographic presence position it to navigate cyclical downturns and capitalize on decades-long energy transition trends.

For investors, monitoring production cost trends, contract economics, and geopolitical developments will be key to timing entry or accumulation.

Ganfeng Lithium Group is not merely a stock ticker—it is a tangible stake in the future of energy. As lithium moves from commodity to cornerstone of modern technology, understanding its financial dynamics and strategic positioning is no longer optional for informed investors. In a sector defined by disruption and transformation, Ganfeng’s share price reflects not just markets, but the momentum of a cleaner, battery-powered world.

Related Post

Sasha Morpeth Age Wiki Net worth Bio Height Boyfriend

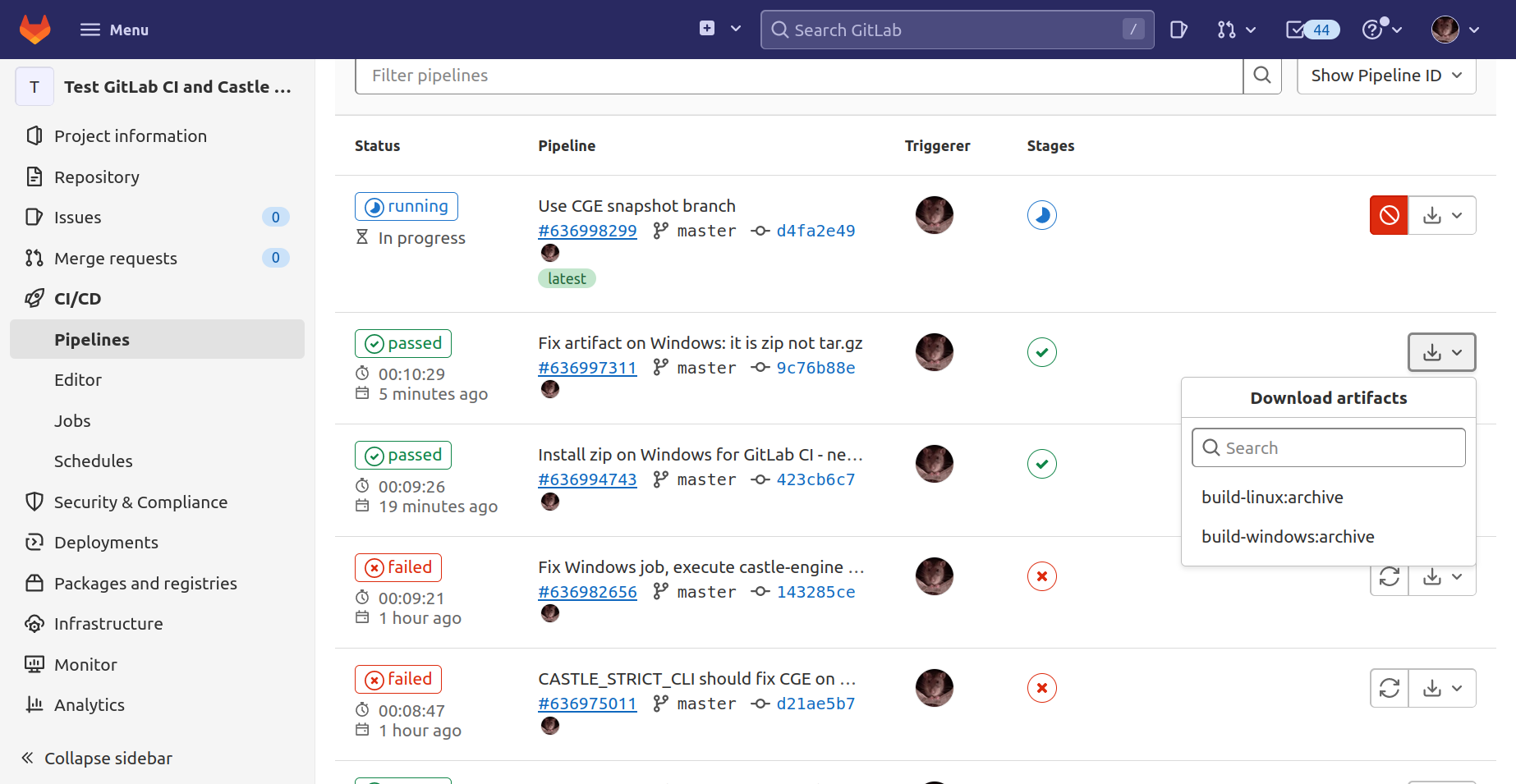

GitLab Moto X3M: The Engine Behind Flawless DevOps for Qualcomm’s Flagship Smartphone

Manual Car Wash Lift: The Powerful, Affordable Solution for Spotless Vehicles

Check out 40 charming bear tattoos and their meanings