First Citizens Bank FDIC Insurance: What You Must Know Before Depositing Your Savings

First Citizens Bank FDIC Insurance: What You Must Know Before Depositing Your Savings

In an era where financial security is more critical than ever, understanding FDIC insurance—especially as it applies to First Citizens Bank—is essential for protecting your hard-earned money. With rising public engagement in banking safeguards, many consumers remain unaware of exactly how coverage works, what risks are protected, and how First Citizens’ FDIC insurance policies add a vital layer of confidence to everyday savings. This comprehensive guide uncovers the key facts, dispels common misconceptions, and equips you with actionable knowledge to confidently manage your finances.

FDIC Insurance Fundamentals: What It Really Protects

The Federal Deposit Insurance Corporation (FDIC), a U.S. government agency established during the Great Depression, ensures depositor protections for insurance up to $250,000 per depositor, per insured bank, for each account category. While the FDIC does not insure investments, retirement accounts, or brokerage holdings, it safeguards deposits in insured institutions—including banks like First Citizens.At First Citizens Bank, FDIC insurance applies to most traditional deposit accounts: checking accounts, savings accounts, money market accounts, MSME loans, and certain certified checks. These deposits are protected against bank failures, a critical safeguard that has held peers like Silicon Valley Bank and Signature Bank after recent industry turbulence. As former FDIC Chair J.

Thorographical noted, “The FDIC’s role is not to guarantee returns, but to restore confidence—keeping depositors safe when institutions falter.” For depositors, this means peace of mind: your money remains secure, even if a bank experiences financial distress. Key covered accounts include: - Checking accounts - Savings accounts - Money market deposit accounts (MMDA) - Retail ISA and IRA instrument accounts (where permissible) - Small Business Administrator (MSME) accounts with insured limits Accounts outside FDIC coverage—such as securities, mutual funds, or foreign bank accounts linked to First Citizens—are not protected, so users must maintain awareness of account types.

How FDIC Coverage Works at First Citizens Bank

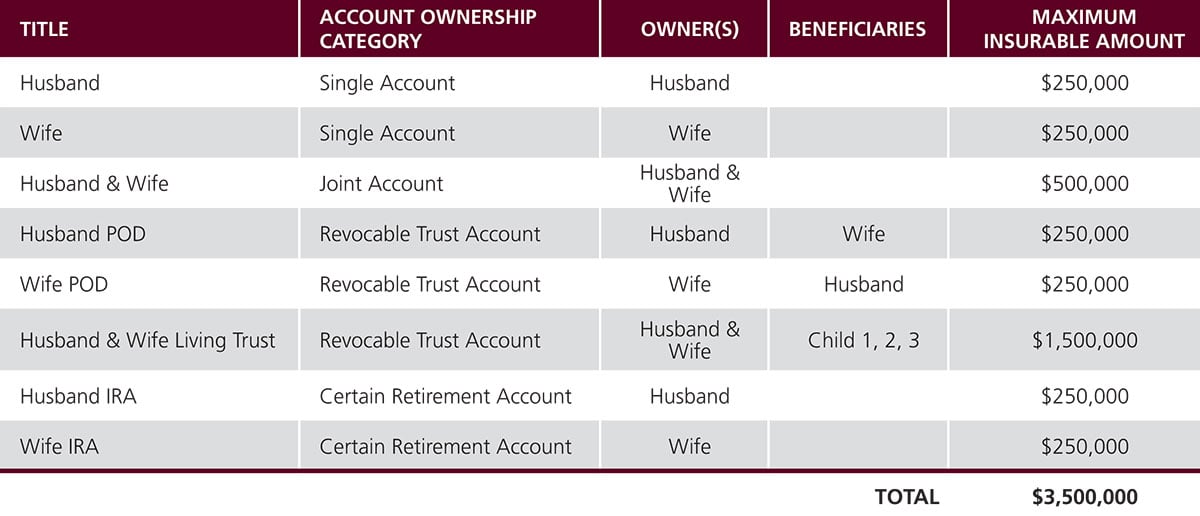

Every FDIC-insured account at First Citizens carries a clear, insured limit that resets automatically with new deposits.For instance, depositing $100,000 into a savings account establishes a $250,000 ceiling, meaning up to $250,000 is protected regardless of how much is added afterward—within the account category’s limits. The process is straightforward: when opening a qualifying account, customers receive a clear insurance notice from the bank confirming FDIC protection. Additionally, the bank maintains electronic records logged with the FDIC, enabling real-time coverage monitoring.

First Citizens’ FDIC reporting is transparent, and policyholders can verify their rights through the FDIC’s public lookup tool at https://www.fdic.gov/resources/consumers/bankfind/. Importantly, FDIC insurance applies to personal accounts only—joint accounts require all named signatories to be covered, each individually up to $250,000. This provides layered protection for shared finances, although legal liability may still apply.

The Scope and Limits of Insurance: What’s Protected—and What’s Not

Understanding the precise boundaries of FDIC insurance is crucial. The FDIC does not insure: - Stocks, bonds, mutual funds, or other securities - Retirement accounts (IRAs, 401(k)s) unless held in insured bank accounts - Cryptocurrency deposits or brokerage accounts - Life insurance policies, annuities, or alternative investments For First Citizens clients, this means safeguarding cash reserves and core savings, but not extending protection to investments. If you hold stocks through a brokerage account linked to your First Citizens checking account, only the cash component—up to $250,000—is insured, not the equity holdings.Similarly, loans and lines of credit offered by First Citizens are not FDIC insured; FDIC protection applies exclusively to deposits, not lending instruments. This distinction protects depositors from loss during bank closures but does not extend to investment growth or loan default risks. Despite these limits, FDIC insurance remains one of the strongest consumer safeguards in the modern banking system.

According to FDIC data, over 99% of U.S. deposits are fully covered, reinforcing trust in institutions like First Citizens.

Why First Citizens Stands Out in FDIC Protection Transparency

First Citizens Bank differentiates itself through clear, customer-first communication about FDIC coverage.Unlike banks that bury insurance details in fine print, First Citizens provides intuitive educational resources, deposit protection checkers, and dedicated staff support to explain coverage scope. This proactive transparency reduces anxiety and empowers depositors to make confident banking choices. The bank actively supports FDIC best practices, including timely reporting to the agency and quick dissemination of coverage updates to customers.

During past banking sector disruptions, First Citizens preserved depositor confidence by openly communicating which accounts were FDIC insured and how bank stability protections operated in real time. Quoting a recent banking compliance specialist, “What sets First Citizens apart is not just adherence to FDIC rules, but how clearly they communicate those protections to everyday customers—turning complex regulation into actionable peace of mind.”

Identity Theft, Fraud, and FDIC Insurance: Overlapping Protections All Customers Should Know

While FDIC insurance protects against bank insolvency, it does not guard against identity theft or fraud. First Citizens offers enhanced security tools—such as two-factor authentication, transaction alerts, and identity monitoring—to complement FDIC coverage.Together, these layers shield both deposited funds and personal data from cyber threats. For example, depositing $200,000 into a First Citizens savings account secures your cash under FDIC limits, but activating online banking alerts ensures immediate detection of suspicious activity. This dual strategy fortifies financial resilience in both institutional and behavioral risk landscapes.

{H2>Practical Tips for Maximizing FDIC Protection at First Citizens Bank} 1. Always verify FDIC status by logging onto the official FDIC BankFind tool—insurance applies only when depository records match exactly. 2.

Segregate account types: use insured accounts for core savings and non-insured investments, reducing exposure and confusion. 3. Understand your customer agreement: while FDIC limits apply temporarily, deposits are safe tenant-first regardless of bank problems.

4. Keep records of account numbers and insured limits for easy verification—especially for large balances. 5.

Stay informed: First Citizens periodically updates clients on FDIC changes and can clarify policy nuances. 6. Consider diversifying deposits across FDIC-insured banks to balance risk without overconcentration.

FDIC insurance at First Citizens Bank is more than a technical safeguard—it represents a promise: that your savings remain yours, even in uncertain times. By mastering what FDIC covers (and what it doesn’t), depositors transform passive savings into actively protected wealth. In a volatile financial environment, this clarity is invaluable, and First Citizens’ commitment to transparent, steadfast protection strengthens that foundation.

Related Post

Unlocking Human Movement: How Moviwrulz Is Revolutionizing Biomechanics and Performance Science

Ember Moon Talks Being Bullied In New QA Interview

What Holiday Is Today in the USA? Find Out Now — And Why It Matters

How the WBD Merger Might Influence WWE and AEW Television Agreements