Find the Primewire.TF Alternative: A Deep Dive into the Next-Gen Fixed Income Data Platform

Find the Primewire.TF Alternative: A Deep Dive into the Next-Gen Fixed Income Data Platform

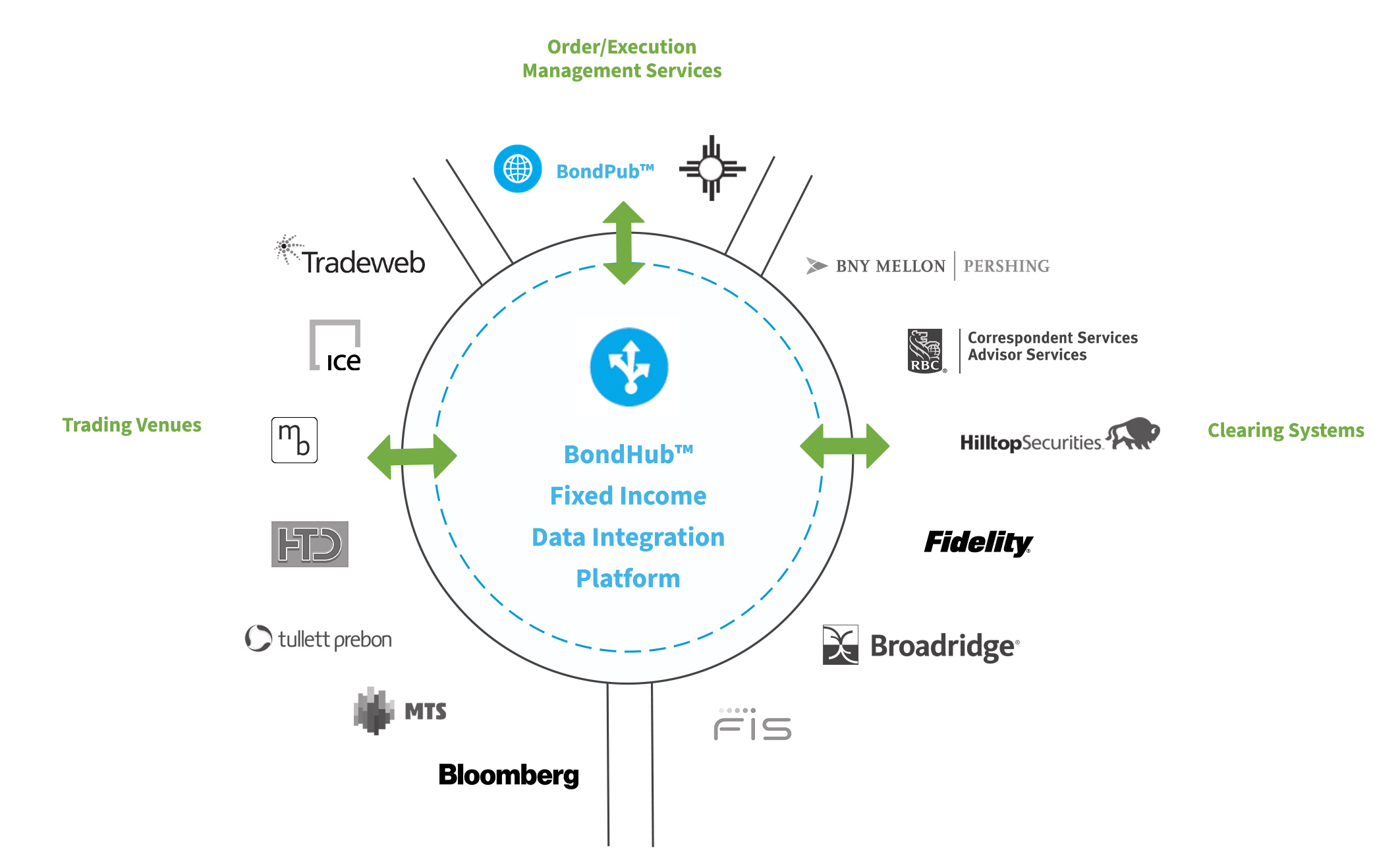

In the evolving landscape of fixed income trading and investment analytics, forward-thinking institutions demand reliable, scalable, and real-time data infrastructure—something Primewire.TF delivered with precision. However, as market needs grow more complex and competition intensifies, the search for a Primewire.TF alternative is no longer optional but strategic. Enter a new generation of fixed income data platforms reshaping how dealers, hedge funds, and asset managers access, analyze, and act on market intelligence.

These alternatives combine advanced technology, enhanced transparency, and seamless integration—key pillars for surviving in today’s data-driven financial ecosystem.

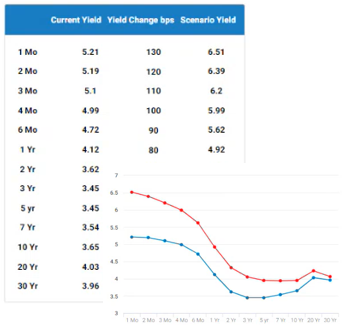

At the heart of any fixed income data platform lies core functionality: real-time pricing, trade execution, risk analytics, and comprehensive market transparency. Primewire.TF stood out for its low-latency feed delivery and robust API architecture, enabling high-frequency traders and institutional analysts alike to automate strategies and monitor portfolio exposures with granular accuracy.

But as procurement teams and data officers evaluate vendor suitability, cost efficiency, scalability, and customization ability become decisive factors.

Why Organizations Seek a Primewire.TF Alternative

Market dynamics have shifted dramatically. With increasing fragmentation in bond markets, pressure from regulatory reporting, and the rise of alternative trading venues, institutions require platforms that do more than just aggregate data. The ideal alternative must:- Deliver Low-Latency, High-Quality Data Streams: Even millisecond delays impact algorithmic performance and trade execution.

Platforms must ensure sub-second data refresh across global bond markets.

- Support Multi-Asset Integration: Modern fixed income strategies span sovereigns, corporates, MBS, and derivatives. A coherent platform should unify these without silos.

- Offer Flexible, Developer-Friendly APIs: Equitable access for internal engineering teams and third-party vendors demands scalable, documented, and secure API ecosystems.

- Provide Granular Compliance & Audit Capabilities: Regulatory scrutiny around data lineage and trade reporting makes traceability non-negotiable.

- Ensure Cost-Effectiveness at Scale: Subscription models must justify ROI through performance, uptime, and feature depth, especially for large asset managers.

These demands have catalyzed the emergence of several strong contenders capable of replacing or augmenting Primewire.TF’s role.

Top Contenders: High-Performance Primewire.TF Alternatives Under Comparison

Several platforms are now recognized for delivering robust fixed income solutions tailored to institutional needs. Among the most prominent are Bloomberg Fixed Income API, Salesforce Fixed Income Cloud, and Refinitiv’s Eikon.

Each offers distinct advantages, shaped by their data aggregation models, technological stacks, and market positioning.

Bloomberg Fixed Income API – The Industry Benchmark

The Bloomberg Fixed Income API remains a gold standard for data completeness and real-time market access. Instituted years ago, it powers thousands of quantitative models and enterprise trading systems worldwide. Its primary strengths lie in:- Proprietary, consensus-driven pricing across global bond markets

- Deep integration with proprietary analytics, news feeds, and trading barrages

- Unmatched latency and uptime for mission-critical applications

However, pricing remains a significant factor—enterprise licenses often require substantial annual commitments.

For organizations seeking broader multi-asset integration beyond fixed income, Bloomberg’s platform sometimes demands supplemental tools. Yet, when deep market coverage and regulatory reliability are paramount, Bloomberg’s ecosystem retains unmatched authority.

Salesforce Fixed Income Cloud – The SaaS Disruptor

Building on Salesforce’s proven CRM leadership, the Fixed Income Cloud introduces a modern, cloud-native approach with a developer-centric API suite. Key differentiators include:- A low-code interface that accelerates onboarding and internal mobility

- Seamless integration with Salesforce’s ecosystem—sales, risk, and finance teams share unified taxonomies and workflows

- Machine learning-enhanced analytics for predictive market indicators and credit risk scoring

While newer, this platform excels in organizational collaboration and user experience but may lag behind Bloomberg in raw data depth, particularly for niche or hard-to-borrow bond segments.

Cost transparency and long-term vendor stability remain considerations for risk-aware clients.

Refinitiv Eikon – The Cross-Asset Data Hub

Refinitiv’s Eikon consolidates fixed income information with equities, commodities, and macro data in a single interface. Advantages include:- Holistic asset-class visibility enabling cross-market risk analysis

- Api-first architecture designed for hybrid trading and portfolio construction

- Comprehensive ESG and macroeconomic data layers increasingly critical in ESG-driven investing

Eikon’s multi-asset strength makes it ideal for firms requiring holistic market views, though its fixed income component, while extensive, may not yet match Primewire.TF’s agility in fixed income-specific algorithmic execution. Integration complexity can also pose hurdles for legacy system environments.

Fintelligence – The Agile, Analyst-Focused Alternative

Emerging from the fintech space, Fintelligence offers a nimble, pay-as-you-go model optimized for institutional analysts and portfolio managers.Notable traits:

- Lightning-fast, curated fixed income data with proactive anomaly detection

- Intuitive, search-driven data interface that reduces onboarding time

- Transparent pricing and minimal lock-in—appealing for agile teams needing rapid experimentation

Designed to empower users without heavy API dependency, Fintelligence balances affordability with precision—ideal for teams prioritizing speed-to-insight over enterprise-scale infrastructure.

Each platform reflects evolving market priorities: speed, depth, integration, and balance between open access and proprietary power. For organizations replacing Primewire.TF, the choice hinges on strategic alignment—whether price sensitivity, data focus, or ecosystem fit takes precedence.

Key Implementation Insights for Financial Institutions

Transitioning to a new fixed income data platform is more than a technical upgrade—it’s a strategic shift affecting operational efficiency,

Related Post

Tate McRae Measurements: A Precision Analysis of Her Height, Weight, and Physical Profile

Tricia Flavin: The Rising Star Redefining Entertainment Across Screens

How the Right Battery Charger App Transforms Power Management for Every Device

CTU Login: Your Unlocked Gateway to Campus Resources