Financing Offers That Move Markets: IPSE, PSEI, IBM WSE & SESE Redefine Corporate Capital Access

Financing Offers That Move Markets: IPSE, PSEI, IBM WSE & SESE Redefine Corporate Capital Access

In an evolving financial landscape, corporations and governments alike are leveraging specialized financing instruments to unlock strategic capital at favorable terms. Among the most compelling instruments driving investment and infrastructure growth today are the financing offers from IPSE, PSEI, IBM WSE, and SESE—each offering distinct advantages tailored to distinct sectors and operational needs. These financing frameworks are reshaping how entities fund innovation, expand operations, and secure long-term economic resilience.

Understanding their structures, benefits, and emerging trends reveals not only current opportunities but also the broader transformation taking place in global capital markets.

IPSE financing, often associated with innovative project funding and infrastructure development, provides tailored debt and equity solutions designed to de-risk large-scale ventures. By linking capital to specific performance metrics, IPSE instruments enable issuers to align funding with measurable outcomes, enhancing investor confidence.

This project-based approach has gained traction particularly in renewable energy and smart city initiatives, where upfront capital demands are high but long-term returns are substantial. As one industry analyst noted, “IPSE mechanisms transform speculative infrastructure into bankable assets through structured risk allocation and outcome-based covenants.”

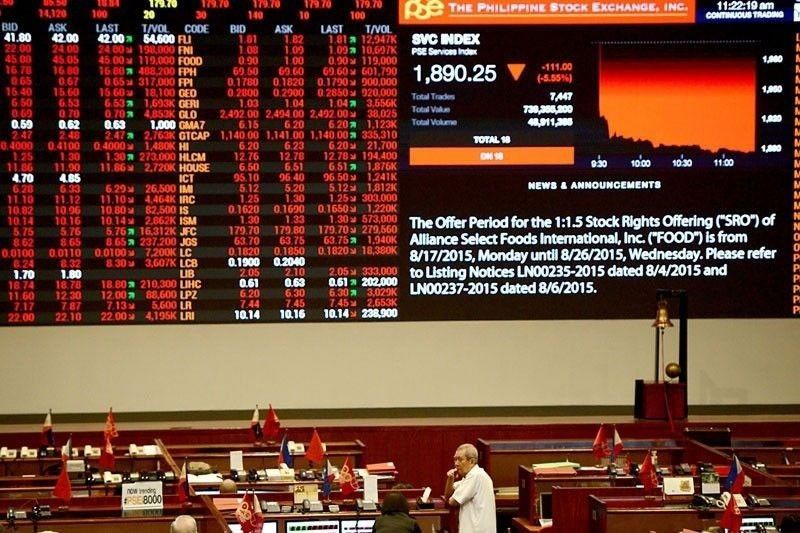

PSEI: Precision Financing for Public and Emerging Market Projects

The PSEI financing model stands out for its focus on public-private partnerships and development finance, especially in emerging markets. PSEI—short for Public-Private Economic Investment—delivers blended capital structures combining concessional loans, grants, and private investment to bridge funding gaps in critical sectors such as transportation, utilities, and digital infrastructure.These offerings are pivotal in accelerating economic development where traditional financing remains constrained.

Key features of PSEI financing include: - Concessional terms with extended grace periods and deferred interest payments - Technical assistance embedded within project financing to strengthen institutional capacity - Agile structuring tailored to local regulatory and fiscal frameworks - Risk-sharing mechanisms involving multilateral development banks Participants benefit from enhanced creditworthiness and international investor access, transforming otherwise unviable projects into sustainable ventures. For emerging economies, PSEI addresses a crucial financing void, with recent examples including broadband rollouts across Sub-Saharan Africa and urban transit modernization in Southeast Asia.

IBM WSE: Accelerating Transformation Through Fintech and Digital Capital

IBM’s WSE (Weellow Strategic Exchange) financing platform represents a bold fusion of corporate strategy and financial innovation. Designed primarily for high-growth technology firms, WSE offers non-dilutive capital, revenue-based financing, and digital liquidity solutions that align with rapid innovation cycles. This approach addresses a longstanding challenge: providing financing without sacrificing control or long-term flexibility.WSE financing offers several distinguishing advantages: - Revenue-sharing models that align repayment with cash flow, reducing liquidity pressure - Integration with IBM’s broader ecosystem of AI, cloud, and data analytics for real-time financial monitoring - Access to specialized investors with expertise in tech scalability and growth metrics - Flexible terms that accommodate volatile revenue streams common in software and digital platforms For startups and scale-ups, WSE transforms capital access from a high-stakes gamble into a predictable financial river. By prioritizing growth sustainability over rigid repayment schedules, IBM positions WSE as a catalyst for innovation-driven enterprises navigating complex scaling phases.

SESE: Sovereign Green Bonds Driving Climate Finance

SESE financing marks a strategic evolution in environmental, social, and governance (ESG)-aligned capital deployment, particularly through sovereign green bond programs.These long-term debt instruments are dedicated exclusively to financing climate mitigation and adaptation projects—such as reforestation, clean energy infrastructure, and sustainable water management—under stringent transparency and reporting standards.

SESE offers distinct benefits: - Access to a growing pool of ESG-conscious institutional investors willing to accept lower yields for verified impact - Enhanced national credit profiles through transparent, climate-aligned commitments - Alignment with global frameworks like the Paris Agreement and EU Taxonomy - Opportunities for co-financing with international climate funds and multilateral banks Recent SESE launches in Latin America and Eastern Europe highlight how sovereign green bonds combine fiscal responsibility with transformative investment, attracting capital that supports both environmental outcomes and macroeconomic stability.

Synthesizing Opportunities Across IPSE, PSEI, IBM WSE & SESE

While each financing offer responds to unique market demands—ranging from infrastructure and emerging markets to tech innovation and climate action—their collective impact is unified: democratizing access to capital in an increasingly targeted, outcome-oriented financial ecosystem.Investors gain stronger risk-adjusted returns through structured, measurable payouts, while issuers achieve greater financial resilience and strategic agility.

Key takeaways include: - Structured, performance-based financing enhances accountability and reduces default risk - Sector-specific design ensures capital aligns with real economic and environmental value - Cross-border collaboration enables scalable solutions in high-impact domains - Blended finance models reduce reliance on traditional debt, fostering sustainable growth As corporations, governments, and investors seek smarter, more responsible capital deployment, IPSE, PSEI, IBM WSE, and SESE exemplify the next generation of financing—blending financial innovation with tangible, long-term outcomes that extend far beyond balance sheets. In the end, these financing models are not just tools for fundraising—they are engines of transformation, driving progress across sectors, regions, and generations.

The future of strategic capital lies not in volume, but in velocity, precision, and purpose—and these four pillars are leading the charge.

Related Post

Alexis Fawx Unveiling The Life And Career Of A Rising Star: From Niche Beginnings to Mainstream Recognition

How Did Stacy Van Dyke Pass Away? A Tragic Story of Resilience and Silence

Jimmie Walker Bio Wiki Age Height Wife Movies House and Net Worth