Fidelity Cash Management Account: Reinventing Liquidity Management for Businesses and High-Net-Worth Investors

Fidelity Cash Management Account: Reinventing Liquidity Management for Businesses and High-Net-Worth Investors

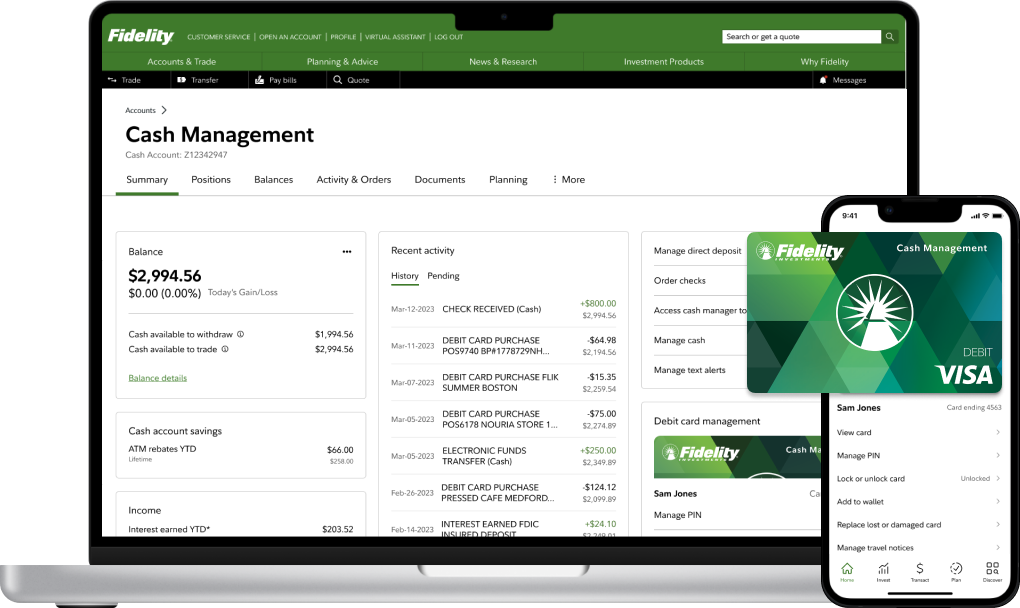

In an era where access to real-time liquidity, smart cash deployment, and seamless financial oversight are paramount, the Fidelity Cash Management Account emerges as a transformative tool for both corporate treasurers and affluent investors. This sophisticated financial instrument blends banking services with investment acumen, enabling users to actively manage idle cash—earning yield while maintaining full control and flexibility. For organizations navigating low-interest environments and individuals safeguarding wealth, Fidelity’s offering delivers more than passive deposits; it delivers precision, agility, and enhanced returns in a single, integrated platform.

At its core, the Fidelity Cash Management Account functions as a dynamic corporate cash vault coupled with strategic investment capabilities. Unlike traditional savings accounts or even standard money market funds, this tailored solution is designed for entities seeking both safety and active participation in short-term financial growth. Businesses with substantial idle balances and high-net-worth individuals managing diverse portfolios find the account particularly compelling due to its dual emphasis on liquidity preservation and smart capital allocation.

By leveraging Fidelity’s extensive financial infrastructure, users gain access to daily cash visibility, automated deployment options, and interest earning—all managed from a unified dashboard that bridges banking, treasury, and investment functions.

Key Features That Redefine Cash Management

Active Cash Positioning and Rapid Liquidity Access Fidelity’s account sets itself apart by offering real-time liquidity with immediate availability. Unlike conventional bank deposits that may lag in transfer processing, funds deposited into the Cash Management Account are typically accessible within minutes, empowering users to respond instantly to cash flow needs. This immediacy is critical for businesses managing unpredictable receivables or investors looking to reposition capital during volatile markets.

“Having capital available when needed—without forced waiting periods—changes the game for operational efficiency,” notes finance leader Sarah Chen, CFO of a mid-sized manufacturing firm using Fidelity’s service. “It’s like holding a liquid fortress you can tap directly.”

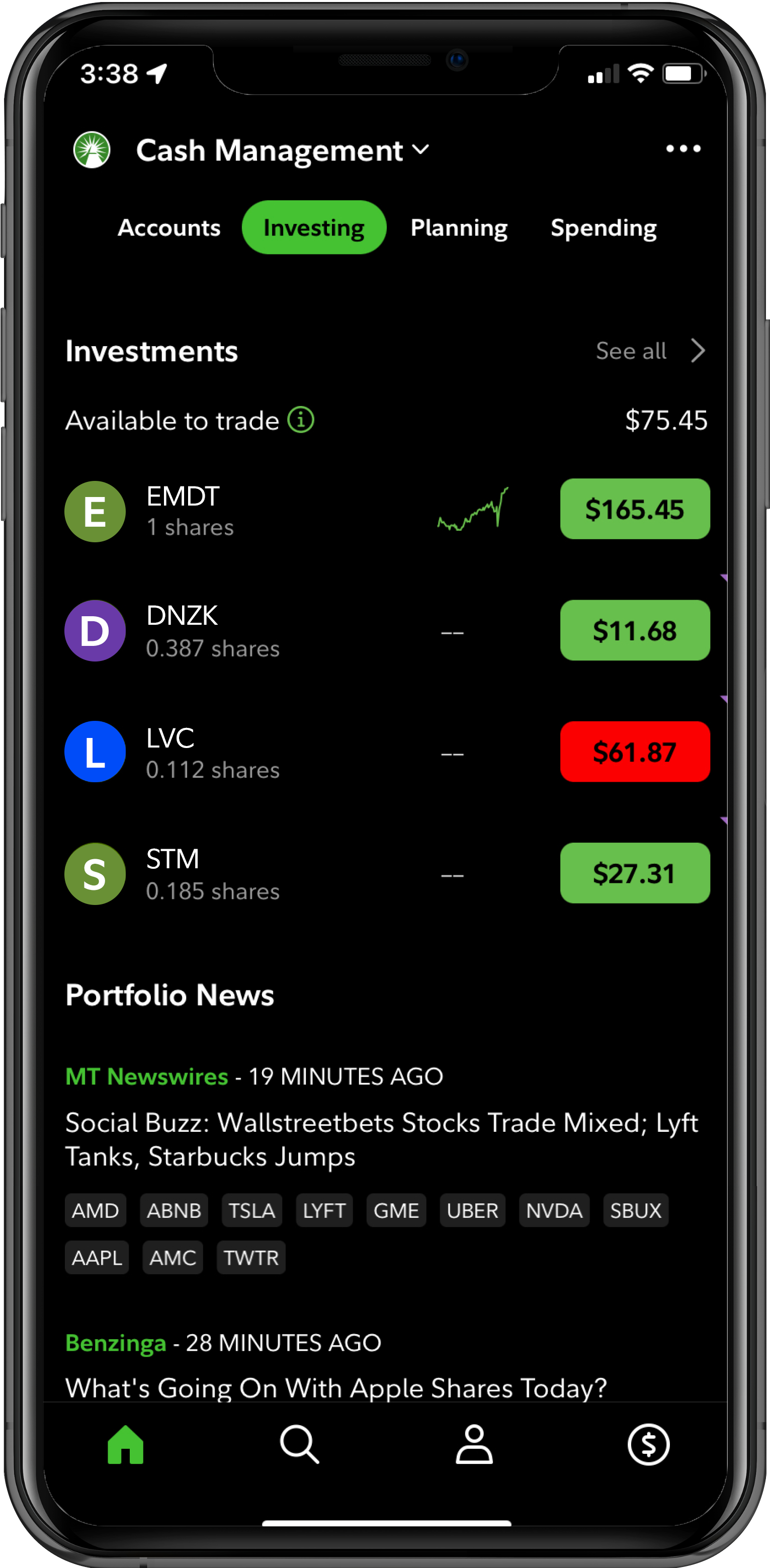

Intelligent Cash Allocation and Yield Optimization Beyond just holding cash, Fidelity empowers users with algorithm-driven tools to allocate funds strategically across short-duration, high-quality instruments. The platform dynamically shifts capital between cash balances, Treasury bills, money market securities, and other low-risk vehicles based on prevailing market conditions.

This adaptive approach ensures competitive yield generation while minimizing interest rate risk. For institutions holding millions in idle cash, even marginal improvements in returns compound significantly over time. “Fidelity’s automation models minimize human error and maximize returns on cash holdings in a rate-sensitive environment,” explains Andrew Patel, head of institutional client services at Fidelity.

“Our system evaluates millions of data points daily to optimize yield without compromising safety.”

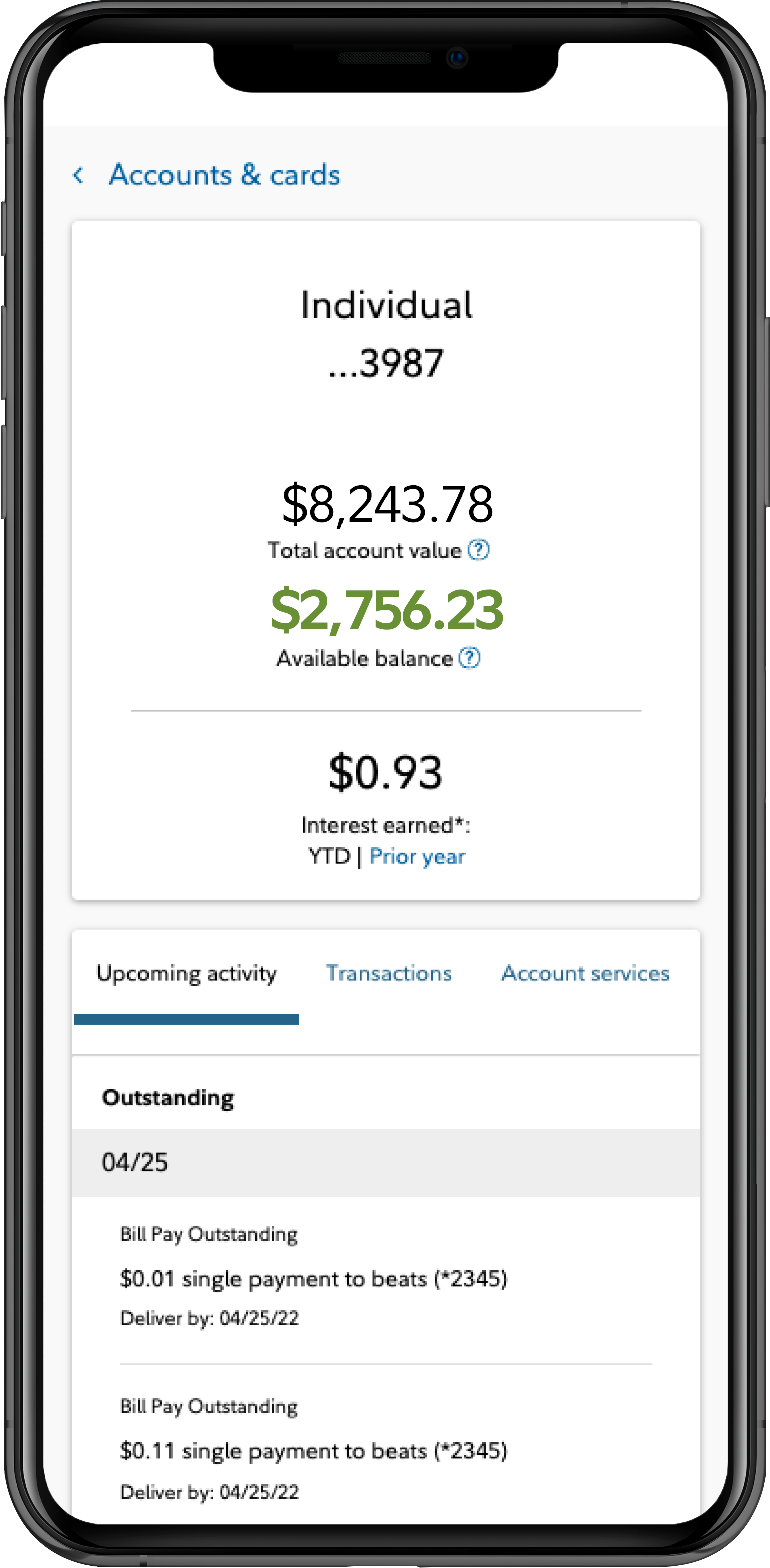

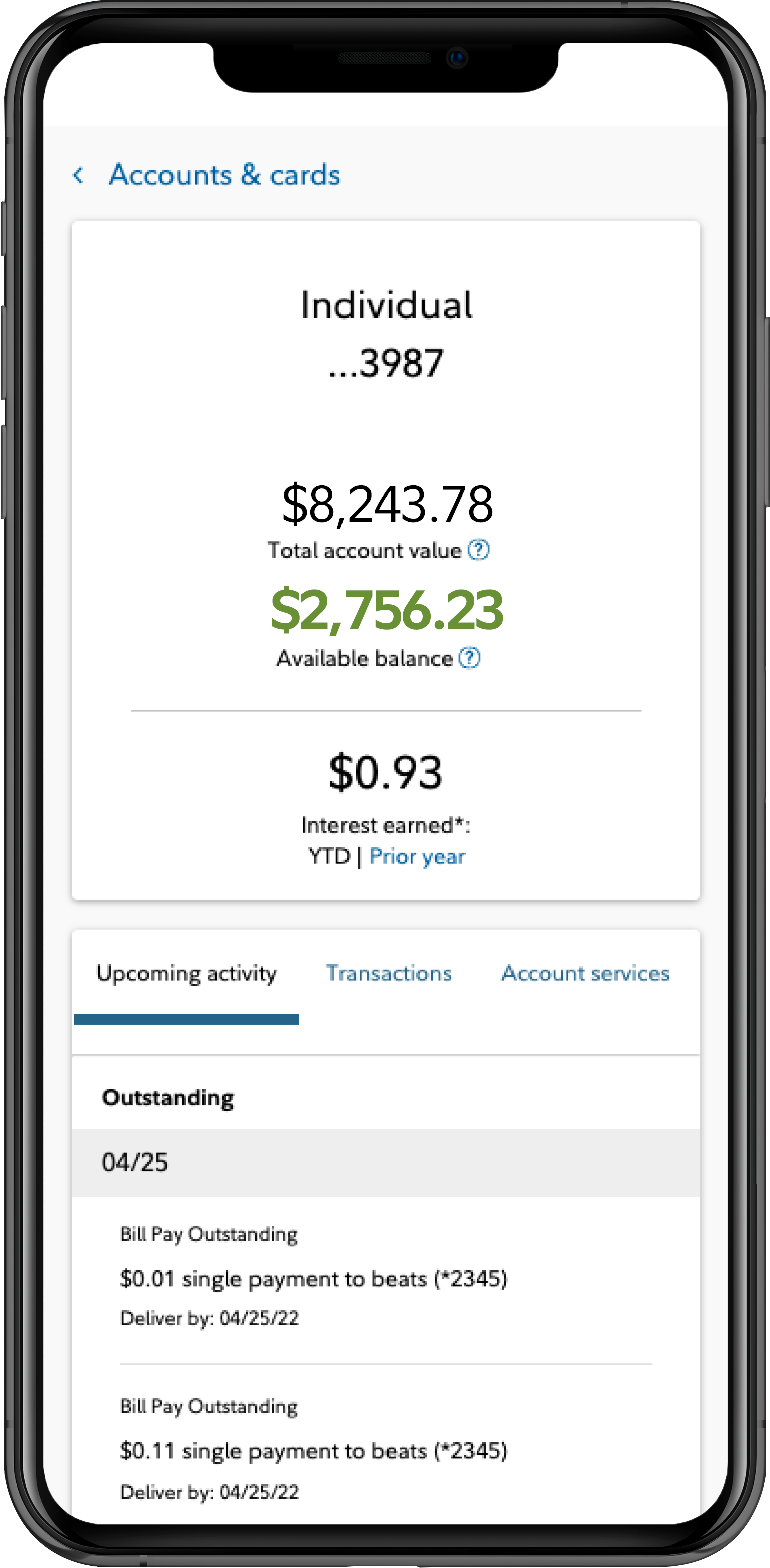

Day-to-Day Tracking and Customizable Reporting Transparency is central to Fidelity’s value proposition. The account integrates with enterprise resource planning (ERP) systems and financial platforms, delivering granular, real-time reports that track cash balances, interest earned, and allocation trends. Customizable dashboards allow treasury teams to monitor performance by region, business unit, or investment type—all within one intuitive interface.

Investors benefit from the same clarity, receiving detailed breakdowns of how their capital is deployed and paid. “We understand that timeliness equals control,” says Fidelity’s product lead Emily Rechtschafner. “Our reporting features transform raw financial data into actionable insights.”

Regulatory Compliance and Risk Mitigation Fidelity Cash Management Accounts operate under strict regulatory oversight, ensuring adherence to banking standards, anti-money laundering protocols, and fiduciary best practices.

For businesses subject to stringent internal controls and external audits, this compliance reduces operational risk and strengthens internal governance. Additionally, Fidelity provides robust cybersecurity measures and segregated accounts, protecting client assets from fraud and cyber threats. “In an age of rising financial complexity, we prioritize not just performance but also peace of mind,” Patel adds.

“Our platform is engineered to deliver both results and resilience.”

Use Cases Across Industries and Investor Profiles

Corporate Treasury: Optimizing Working Capital Efficiency Public and private companies with significant daily operational expenses leverage Fidelity’s account to maintain liquidity buffers while generating returns. For example, a retail chain with turbulent monthly cash flows uses the account to pool regional cash vaults, instantly transfer funds to high-yield instruments during peak seasons, and reduce reliance on costly lines of credit. CFO Sarah Chen reports a 12% increase in working capital efficiency since onboarding the service, attributing success to reduced idle time and automated rebalancing.

Wealth Management: Balancing Security and Return for High-Net-Worth Clients Affluent investors increasingly seek alternatives to traditional fixed-income products that offer both safety and measurable upside.

Fidelity’s Cash Management Account provides a hassle-free conduit to explore short-term yield strategies without dissolving portfolio integrity. Instead of buying individual securities, clients gain diversified exposure through low-volatility instruments. “This account gives my clients a transparent, low-risk buffer to reinvest or deploy elsewhere,” says Emily Rechtschafner.

“It’s not just about holding cash—it’s about growing it in safety.”

Young professionals managing personal savings also benefit from the account’s flexibility. Rather than earning near-zero interest in standard bank accounts, users earn

Related Post

Unlock Expert Cash Control: Key Features and Benefits of Fidelity Cash Management Accounts

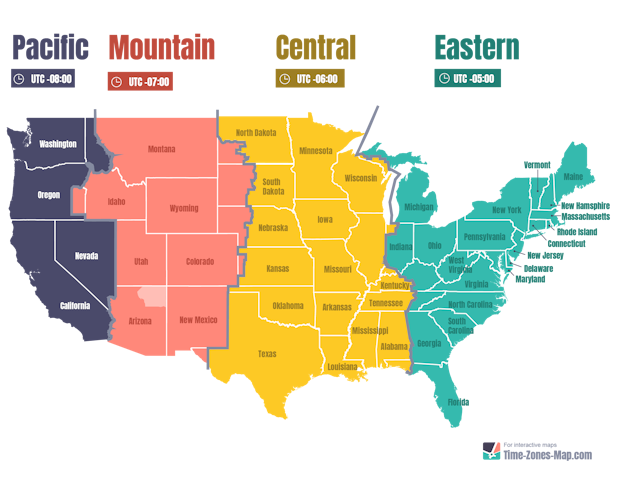

Virginia Time Your Guide to USA Time Zones

Im Blue Da Ba Dee Unveils the Enigma of “Blue Da Ba Dee”: Decoding a Modern Love Anthem

Graciebon Before and After Surgery: A Transformative Journey of Healing and Renewal