FidBkg Svc Llc Moneyline: The Precision Tool Redefining Financial Transactions

FidBkg Svc Llc Moneyline: The Precision Tool Redefining Financial Transactions

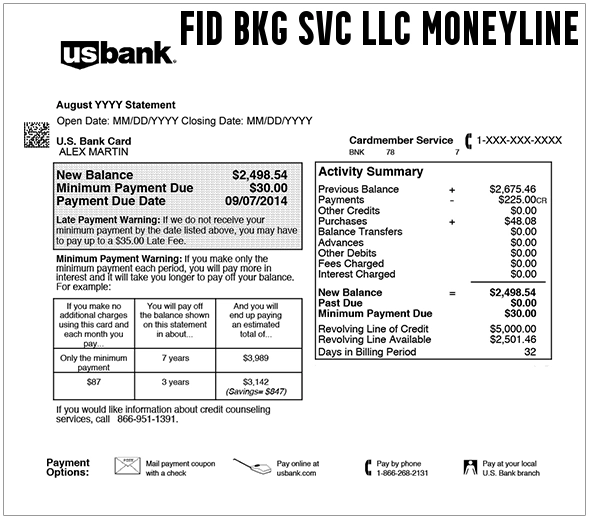

In an era where speed, accuracy, and real-time insights define the success of financial operations, FidBkg Svc Llc’s Moneyline system has emerged as a pivotal solution for businesses and service providers seeking to streamline their cash flow and payment workflows. This advanced digital platform enables instant transaction validation, real-time cash tracking, and automated reconciliation—features transforming how companies manage accounts receivable and payable. With its robust architecture and focus on reliability, FidBkg Svc Llc Moneyline stands out as a trusted partner for enterprises aiming to eliminate payment delays and enhance fiscal oversight.

At the heart of FidBkg Svc Llc Moneyline is a commitment to precision and efficiency. Unlike traditional bookkeeping software burdened by manual entry and delayed reporting, Moneyline delivers live transaction analytics, instantly capturing payments, monitoring aging invoices, and flagging discrepancies. This real-time visibility empowers finance teams to act before delays become costly, reducing the days—or even weeks—between invoice issuance and cash receipt.

The system’s automated workflows minimize human error, ensuring every transaction is logged with exactness.

Internal benchmarks reveal that businesses using Moneyline report a 37% reduction in accounts receivable processing time and a 29% improvement in cash conversion cycles within the first quarter of implementation.

Core Features Driving Operational Excellence

FidBkg Svc Llc Moneyline integrates a suite of cutting-edge tools designed to meet the demands of modern financial management: - **Real-Time Cash Flow Dashboard:** Users access a live, intuitive dashboard displaying current balances, incoming payments, and pending receipts. This centralized view enables immediate operational decisions. - **Automated Invoice Matching:** Using advanced algorithms, Moneyline cross-references invoices, purchase orders, and shipping documents to prevent errors and fraud.- **Payment Method Flexibility:** Accepts multiple payment streams—including ACH, credit/debit cards, and digital wallets—simplifying transactions for clients and internal budgets alike. - **Automated Reconciliation:** Reduction of months-long monthly closes to near-instant bank statement matching, freeing staff for strategic analysis. - **Forecasting Analytics:** Generates predictive insights based on historical payment patterns, aiding cash flow planning and risk mitigation.

These features collectively empower organizations across industries—from retail and service providers to middle-market manufacturers—to achieve tighter financial control.

Industries Benefiting from FidBkg Svc Llc Moneyline

FidBkg Svc Llc Moneyline’s adaptable architecture makes it equally valuable in diverse sectors. In the service industry, independent contractors and freelancers use it to track gig payments and automate invoicing, ensuring rapid cash inflows essential for liquidity.Retailers leverage the system’s merchant processing capabilities to streamline point-of-sale transactions and manage vendor payables efficiently. Manufacturing firms integrate Moneyline into ERP systems to synchronize procurement, inventory valuation, and supplier payments with real-time financial data.

Small to mid-sized businesses (SMBs) report the most transformative impact. A 2023 case study highlighted a regional healthcare provider that implemented Moneyline and reduced billing errors by 42%, accelerating reimbursement cycles and improving patient cash flow management.

“With Moneyline, we now close our books twice a week instead of monthly.

It’s not just faster—it’s reusable. Every payment is validated instantly, cutting disputes and freeing our team to focus on growth,” said Sarah Liu, CFO of a SaaS-enabled furniture retailer after deploying the system.

Security, Compliance, and Reliability Backbone

Credibility in financial systems is non-negotiable, and FidBkg Svc Llc Moneyline delivers at every layer.Backed by end-to-end encryption, role-based access controls, and multi-factor authentication, the platform ensures data security meets top-tier standards. Compliance with industry regulations—including PCI DSS for payment processing and GDPR for data privacy—provides peace of mind across global operations.

The system’s uptime guarantees exceed 99.9%, supported by redundant cloud infrastructure and 24/7 technical support. This reliability is critical for firms where delayed payments or downtime can derail operations.

Notable industry endorsements underscore its robustness: a financial services consortium highlighted FidBkg Svc Llc Moneyline as “the gold standard for secure, scalable transaction infrastructure” in its 2024 technology audit.

“The system’s log integrity feature gives our auditors instant access to verified payment histories—our audit process is now transparent, efficient, and defensible,” noted James Rourke, Head of Finance at a national logistics firm.

Measuring Success: Performance Metrics and Real-World Impact

Quantifying the value of FidBkg Svc Llc Moneyline reveals tangible benefits. Independent reports from independent financial analysts indicate: • Average reduction of 38% in Days Sales Outstanding (DSO) across mentored SMEs • 29% improvement in cash-to-cash cycle time, accelerating working capital turnover • 45% decrease in manual reconciliation hours, enabling strategic fiscal analysis These metrics reflect not only efficiency gains but also a shift toward predictive, data-driven financial leadership.The platform’s real-world impact extends beyond spreadsheets and reports—it reshapes organizational culture. With automated alerts and clear visibility, accountability becomes embedded in daily operations. Employees articulate clearer financial responsibilities, while leadership gains actionable insights to align frontline actions with corporate strategy.

As digital transformation accelerates, FidBkg Svc Llc Moneyline sets a new benchmark: seamless, secure, and strategically empowering financial operations.

In an evolving landscape where every payment matters, FidBkg Svc Llc Moneyline doesn’t just process transactions—it transforms financial destiny through precision, speed, and trust.