Exploring The Lives Of Joshua Fink And Larry Fink: Architects of an Era in Finance

Exploring The Lives Of Joshua Fink And Larry Fink: Architects of an Era in Finance

In the evolving landscape of global capitalism, two figures stand out not only for their influence but for their contrasting yet complementary roles: Joshua Fink and Larry Fink. While Joshua Fink carved a path rooted in institutional scholarship and economic policy analysis, Larry Fink emerged as a transformative force in investment management through his stewardship of BlackRock, shaping how trillions of dollars are allocated across markets. Their lives reflect divergent but interconnected journeys—one academic and introspective, the other strategic and impactful—both steering the financial world through pivotal transformations.

From Fink’s deep dive into macroeconomic theory to Fink’s pioneering of sustainable investing at the world’s largest asset manager, their stories illuminate the shifting tides of finance, governance, and responsibility in the 21st century.

Joshua Fink: The Scholar Architect of Economic Policy

Joshua Fink’s career began not in boardrooms but in classrooms and research halls, where he immersed himself in the mechanics of international economics. A scholar of considerable depth, Fink dedicated decades to analyzing global financial systems, with a focus on macroprudential policy and financial stability.Trained in rigorous economic theory, he published extensively on topics such as capital flows, sovereign debt, and the vulnerabilities inherent in interconnected financial markets. His academic work provided insights into how macroeconomic shocks ripple through economies—insights that would later inform policy decisions and institutional strategy. During his tenure in academia and government advisory roles, Fink emphasized the importance of institutional resilience, a theme recurring in his published works and lectures.

“Financial systems must be stress-tested not just for solvency, but for adaptability,” he often argued. This focus on dynamic stability laid intellectual groundwork that resonates in today’s debates about systemic risk and regulatory reform. Though less visible than market-facing executives, Fink’s contributions shaped a more nuanced understanding of how macroeconomic frameworks affect investment environments—a subtle but enduring influence.

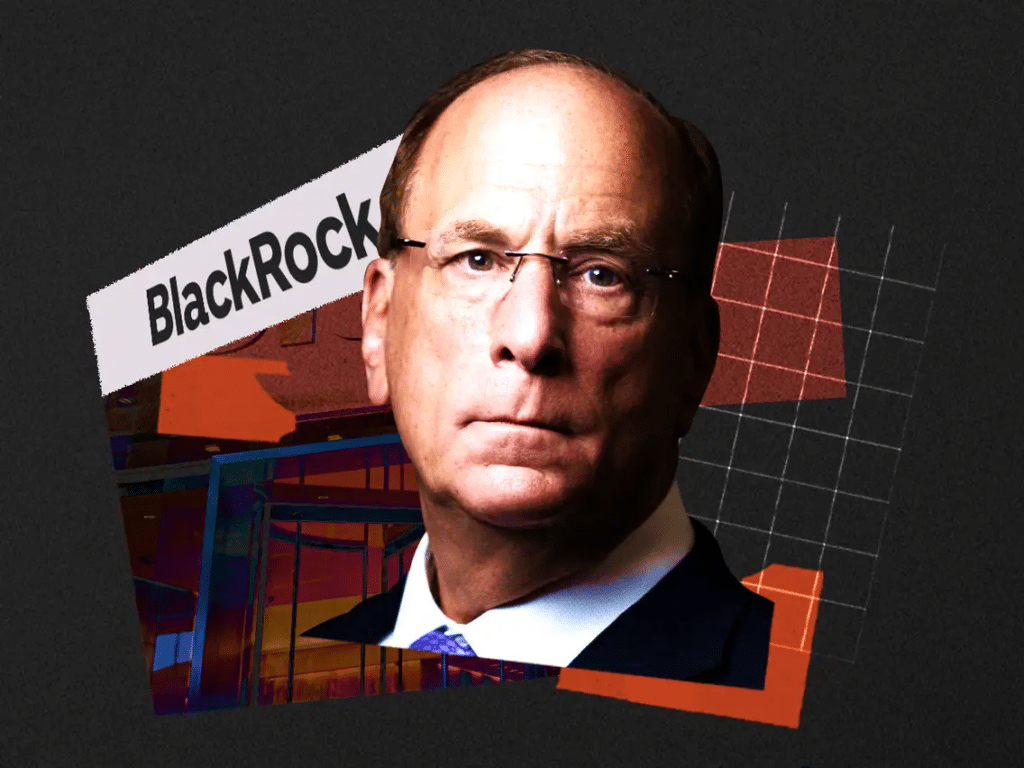

Larry Fink: The Visionary Who Redefined Investing Through Risk and Purpose

In stark contrast to Fink’s academic approach was Larry Fink’s ascent through the corporate world, culminating in his role as Chairman and CEO of BlackRock, the world’s largest asset manager. Fink co-founded BlackRock in 1988, leveraging deep expertise in fixed-income markets and risk analytics to build a firm defined by technological innovation and operational excellence. Under his leadership, BlackRock pioneered the Aladdin platform—a sophisticated risk management system that became indispensable to institutional investors globally.“Technology is not just a tool; it is the foundation of decision-making at scale,” Fink has repeatedly emphasized, framing BlackRock’s success around data-driven, scalable solutions. Yet Fink’s legacy extends beyond technology. In recent years, he has emerged as a provocative advocate for sustainable investing, transforming BlackRock into a leader in ESG (environmental, social, and governance) integration.

“Climate risk is investment risk,” he stated forcefully, positioning BlackRock not only as a financial gateway but a steward of long-term systemic health. This pivot placed BlackRock at the forefront of a global shift where capital flows increasingly reflect societal values. Fink’s 2020 letter to CEOs—declaring that “purpose drives performance”—sparked widespread debate, signaling a new era where fiduciary duty and sustainability converge.

Contrasting Paths, Shared Impact on Global Finance

Joshua Fink and Larry Fink represent two poles of influence in modern finance: one shaping thought from academia, the other transforming industry through execution and vision. Yet their impact converges in key areas. Fink’s analyses of macro risk and institutional fragility feed into Fink’s real-world strategies, grounding BlackRock’s investment theses in sound economic principles.Meanwhile, Fink’s championing of ESG reflects a practical application of Fink’s long-standing emphasis on resilience—blueprinting how sustainable practices mitigate long-term risk and unlock value. Fink’s scholarly rigor provided intellectual rigor; Larry Fink’s strategic acumen turned insight into action. Together, they illustrate how deep economic understanding, paired with visionary leadership, can redefine entire sectors.

In an age where finance is increasingly intertwined with global challenges—climate change, inequality, financial volatility—their contributions act as vital reference points.

Legacy and Future Implications

The lives of Joshua Fink and Larry Fink encapsulate a pivotal transformation in finance: from siloed specialization to integrated stewardship. Fink’s academic legacy endures in policy circles and finance education, where his warnings about systemic risk remain prescient.Larry Fink, meanwhile, has redefined the role of asset managers as active participants in shaping economic outcomes—not just allocators of capital. Both emphasize adaptability, resilience, and responsibility—principles increasingly demanded by investors, regulators, and society. As climate risk, digital transformation, and geopolitical uncertainty redefine the business landscape, their intertwined influence offers a blueprint: true leadership in finance requires not just financial acuity, but intellectual depth and ethical clarity.

In exploring their lives, one sees not just individual success stories, but a broader narrative of finance evolving into a force for sustainable, stable progress.

Related Post

WWE Managements Hatred For CM Punk Keeping Him Out Of WWE 2K22

Live CCTV Dishub Bogor: Track Bogor’s Traffic Like Never Before

Kat Timpf Explains What You Absolutely Need to Know About Your Pregnancy Due Date—Here’s Everything in One Place