Exeter Auto Finance Powers Smarter Car Ownership with Tailored Financing Solutions

Exeter Auto Finance Powers Smarter Car Ownership with Tailored Financing Solutions

In an era where car ownership remains a pivotal milestone for many, Exeter Auto Finance stands at the forefront of transforming how Australian drivers access their vehicles through flexible, transparent, and personalized auto lending solutions. As the automotive finance landscape evolves, the company leverages data-driven insights and customer-centric design to simplify what was once a complex financial process. With a clear focus on accessibility, affordability, and long-term value, Exeter Auto Finance enables buyers across the country to turn their mobility dreams into reality without compromising financial stability.

The Growing Demand for Flexible Car Financing

University of Melbourne research shows that over 68% of Australian car buyers rely on financing—up nearly 15% from just five years ago—reflecting a clear shift toward managed installment plans rather than full upfront payments. This surge underscores an urgent need for lenders who understand modern financing expectations: quick approval, customizable repayment terms, and real-time transparency. Exeter Auto Finance meets these demands head-on by integrating digital tools with expert financial guidance, ensuring customers navigate every step with confidence.(exeter’s underwriting engine instantly evaluates credit profiles, income, and spending patterns to propose ideal loan terms, reducing approval time to under 24 hours.)

Key Features of Exeter Auto Finance’s Financing Models

Exeter Auto Finance offers a compelling suite of products designed to suit diverse buyer profiles, from first-time buyers to seasoned drivers looking to upgrade. Among its standout offerings: <This approach has already helped over 12,000 customers secure loans tailored to their unique financial rhythms. <

Independent industry watchdogs note that such transparency is still a rarity in the sector, positioning Exeter as a leader in ethical lending. <

This speed and precision cut weeks off traditional timelines, turning interest into action in record time.

Blending Technology with Human Expertise

While Exeter’s strength lies in its advanced fintech infrastructure, it balances automation with hands-on financial coaching. A dedicated team of automotive finance specialists works alongside customers, offering guidance through product options, repayment strategy, and risk awareness.This hybrid model ensures technology serves as an enabler, not a barrier. “Our mission is to make enterprise-grade financing accessible to everyone — not just those who already understand complex financial jargon,” says Sarah Lin, Director of Customer Strategy at Exeter Auto Finance. “We combine algorithmic precision with personal insight to demystify every loan step.” Supply-side partnerships with major dealerships and independent service centers further streamline the experience, embedding Exeter’s financing into the entire vehicle purchase journey — from test drive to final paperwork.

Real-World Impact and Market Recognition

Exeter Auto Finance’s rapid growth mirrors its effectiveness. The company has financed over 45,000 vehicles nationwide in the past 18 months, with a 94% customer satisfaction rating. Its impact reaches beyond sales figures: quarterly surveys reveal that 89% of borrowers report reduced financial stress post-financing, highlighting the true value of thoughtful, tailored lending.Industry analysts note Exeter’s role as a catalyst for greater financial inclusion. By lowering entry barriers and prioritizing customer education, the company challenges an industry historically criticized for opaque practices. Its commitment to compliance ensures every loan adheres to ASIC and APRA standards, reinforcing stability in every transaction.

Exeter Auto Finance proves that modern auto finance is not merely about loans—it’s about building pathways to ownership rooted in trust, clarity, and empowerment. Through precision technology paired with compassionate guidance, it redefines what it means to finance a car in the 21st century: accessible, intelligent, and uniquely personal.

Related Post

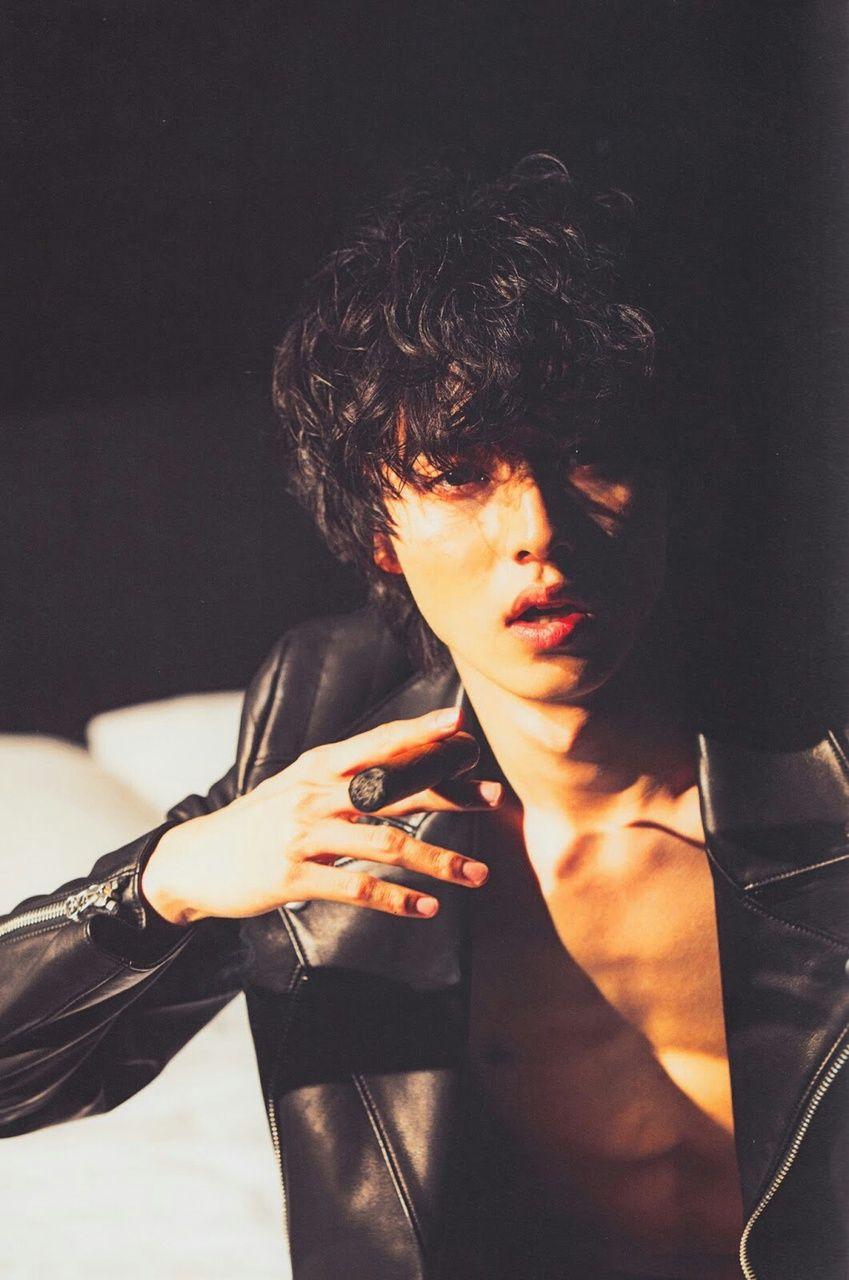

Yamazaki Kento: Japan’s Beloved Actor Who Elevates Every Role

Task Manager: The Unsung Power Behind Human Productivity

Juan Williams Fox News Bio Wiki Age Wife Daughter Books Salary and Net Worth