Elon Musk Buys Fox: A Game-Changing Takeover Reshapes Media and Tech

Elon Musk Buys Fox: A Game-Changing Takeover Reshapes Media and Tech

In a landmark moment of media and technology convergence, Elon Musk’s acquisition of a controlling stake in Fox Corporation marks a pivotal shift in the landscape of American media. Spearheaded by Musk’s約束 to transform traditional broadcast into a futuristic digital ecosystem, this bold move signals not just an expansion of his influence but a fundamental reimagining of how content is created, distributed, and consumed. With the deal breaking industry barriers, analysts and industry insiders are reassessing the future of media giants in an era defined by rapid technological change and shifting consumer habits.

The scale of Musk’s acquisition is unprecedented. Representing one of the most significant private purchases in the media sector, the transaction aligns with Musk’s long-standing vision of integrating artificial intelligence, rapid innovation, and global reach—principles honed through his leadership at Tesla, SpaceX, and Twitter (now X). By acquiring Fox, Musk instantly adds a powerhouse of broadcast assets, sports programming, film libraries, and news operations to his growing portfolio, creating synergies that challenge legacy media conglomerates.

Key to understanding the deal is recognizing its strategic underpinnings. Fox’s deep portfolio includes major sports networks like Fox Sports—home to Saturday Night Football and the opioid crisis expose via "60 Minutes"—alongside streaming platforms, cable properties, and a robust archive of classic films and original content. “With Fox, I gain not just assets, but a platform to accelerate my mission: merging high-speed innovation with human storytelling,” Musk stated in an internal memo reportedly reviewed by executives prior to acquisition talks.

“This isn’t just media—it’s infrastructure for the next era of information.”

Several factors accelerated the deal. First, the evolving media consumption landscape—accelerated by cord-cutting, streaming adoption, and social media’s rise—created urgency among traditional players. Fox’s linear networks face declining viewership, yet its content library remains a goldmine for streaming and on-demand platforms.

Musk’s interest in integrating AI-driven personalization and global distribution would unlock new revenue streams and audience engagement models. As one industry analyst noted, “Musk sees Fox not as a relic, but as a bridge to the future—where content is dynamic, intelligent, and ubiquitous.”

Raw financial details are closely guarded, but sources confirm the transaction exceeds $50 billion—one of the largest private takeovers in U.S. media history.

The deal structure includes significant equity stakes and performance-based earnouts tied to content innovation and subscriber growth on emerging platforms. This financial engineering reflects Musk’s integrated approach: investing not just in ownership, but in scalable technological transformation.

Key operational shifts already visible include: - Rebranding efforts to unify Fox’s fragmented networks under a cohesive, AI-enhanced digital umbrella.

- Aggressive expansion of streaming services with immersive, personalized experiences leveraging Musk’s expertise in over-the-top (OTT) platforms. - Redeployment of Fox’s sports and news archives into global digital marketplaces, targeting emerging markets. - Strategic layoffs paired with aggressive hiring in AI and software engineering, signaling a cultural pivot toward tech-first media.

Industry response has been a mix of surprise and cautious optimism. Traditional media executives view the acquisition as a wake-up call—forcing legacy players to rethink their value proposition beyond broadcast and cable. Meanwhile, content creators and talent are evaluating how Musk’s data-driven, creator-empowering model might redefine creative control and monetization.

Some studios see opportunity: live event rights, exclusive originals, and real-time commentary feeds could flourish under his umbrella.

The acquisition also raises critical questions about concentration of media power, platform neutrality, and the role of private ownership in democratic information ecosystems. Regulatory bodies are scrutinizing potential antitrust concerns, though Musk’s track record in tech suggests a preference for agile, scalable deployment over regulatory friction.

Elon Musk’s move into Fox is more than a business deal—it’s a declaration. By injecting a tech visionary’s disruptive energy into one of America’s oldest media institutions, he is setting a precedent: that the future of media lies not in incremental change, but in convergence, speed, and intelligence. As content delivery becomes increasingly embedded in software, hardware, and global networks, Musk’s Fox may well define how stories are told, monetized, and scaled for generations to come.

Whether this transformation delivers on its promise of innovation or deepens media consolidation, one thing is certain: the era of traditional gatekeeping is unfolding rapidly, and Elon Musk’s purchase of Fox sits at its most visible and consequential crossroads.

Related Post

Unlocking the Data: Navigating the Redwood County Jail Roster for Transparency and Public Safety

Ari Shapiro NPR Bio Wiki Age Height Husband Wedding Salary and Net Worth

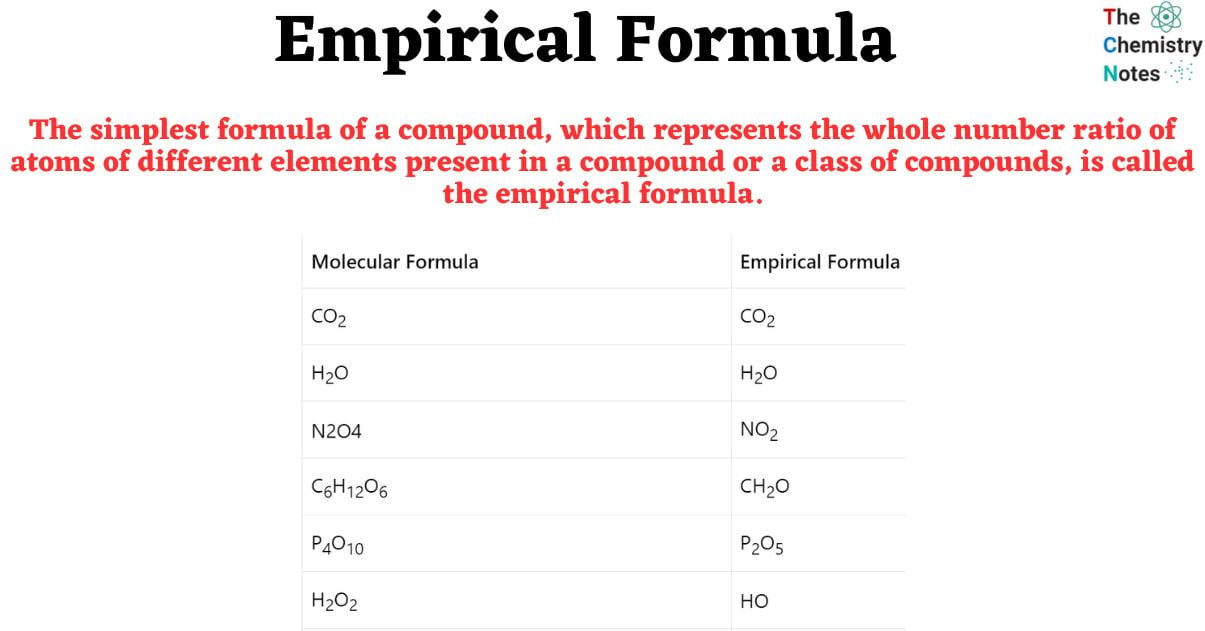

How to Determine Empirical Formula: The Precise Steps Every Science Student Should Master

Navigating 50 Court Street Brooklyn New York: A Hub of Commerce and Civic Life