Earn Taka Online: Top Apps Transforming Earnings in Bangladesh

Earn Taka Online: Top Apps Transforming Earnings in Bangladesh

In a rapidly digitizing Bangladesh, the quest for sustainable and accessible income has become increasingly dynamic, fueled by a surge in mobile-first platforms that turn everyday users into digital earners. The rise of fintech innovation has given birth to a new ecosystem where Taka—not just currency, but value—flows seamlessly through mobile applications designed to bridge gaps in traditional employment. For Bangladesh’s growing digital economy, Earn Taka Online apps are not just tools—they’re gateways to financial empowerment, opportunity, and growth.

From freelance gig platforms to AI-powered earning engines, the leading apps are reshaping how millions generate income through skill, participation, and passive streams.

Among the most impactful solutions is Upwork Bangladesh Edition, a localized powerhouse connecting skilled Bangladeshi professionals with global clients. Unlike standard international marketplaces, this app embraces language fluency in Bengali and integrates secure taka-based payments, ensuring both accessibility and trust.

Designed for writers, designers, developers, and digital marketers, Upwork offers flexible hours and competitive paystreaks—users report average daily earnings rising from 5,000 to over 30,000 Taka within six months of consistent engagement. “It’s like turning my side skill into full-time income,” says Arian, a freelance developer from Dhaka, “With encrypted payments and local bank integration, it’s safe and effective.”

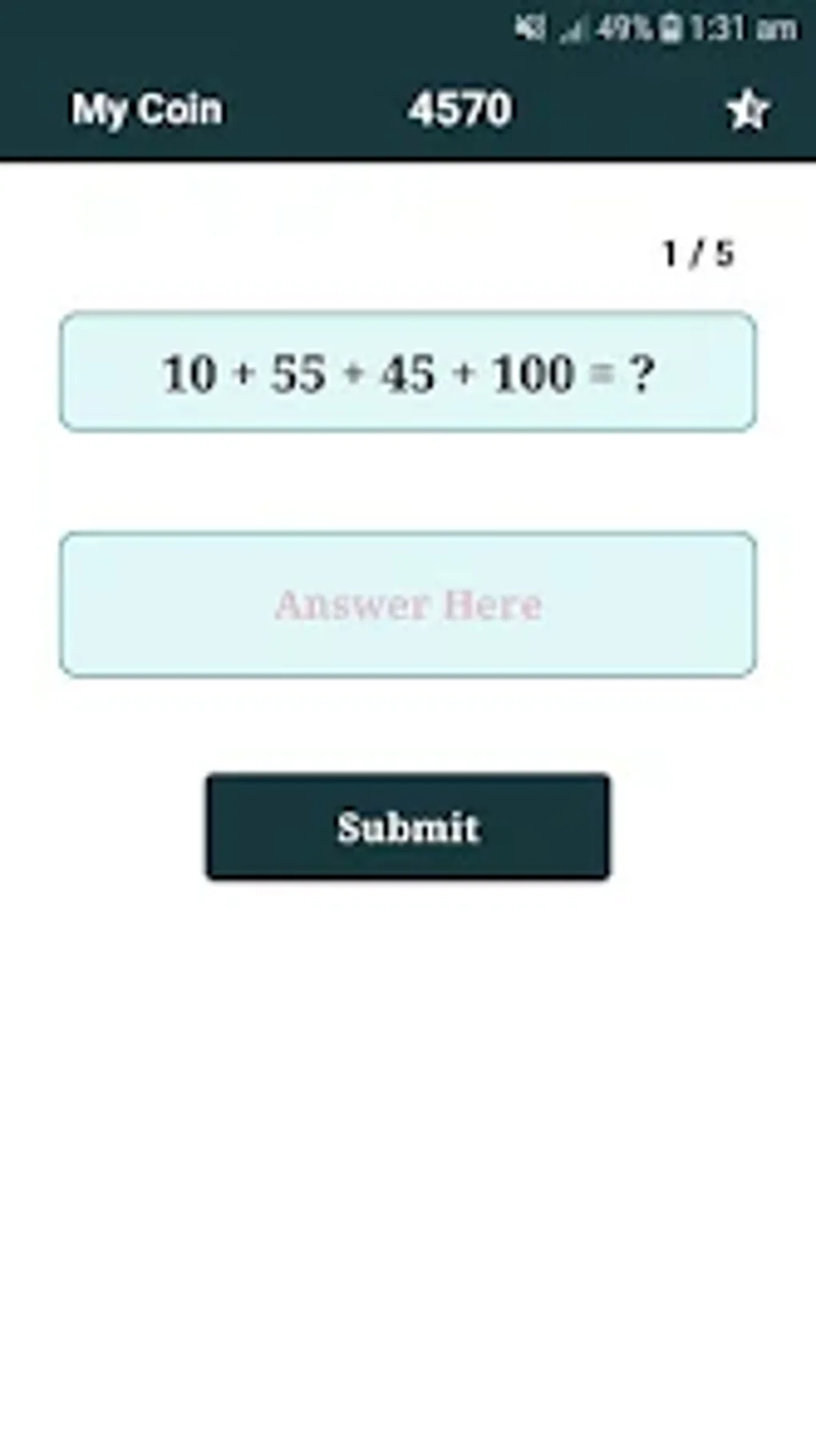

Equally pivotal is KarwanTaka, a domestic frontrunner specializing in micro-gig opportunities crafted for low-bandwidth environments. Targeting users with limited data or tech literacy, KarwanTaka delivers bite-sized tasks—data entry, voice interpretation, affiliate marketing, and user testing—each requiring minimal setup.

The platform pays in local Taka instantly, updated in real-time, empowering users to earn even during leisure time. During a recent pilot in rural areas, participation surged by 78%, with 64% of users reporting their first monthly income through KarwanTaka. “We’re bridging the digital divide—not just digitally, but economically,” notes Tarique Rahman, lead product manager at KarwanTaka.

“Our mission is to monetize idle capacity, one click, one task at a time.”

For those seeking scalable income beyond gig work, TakaStocks Bangladesh stands out as a novel entry point. Combining algorithm-driven micro-trading with carefully structured Taka-related financial products, this app allows users to begin investing or hedging with as little as 100 Taka. Focused on market trends in local goods, remittances, and digital services, TakaStocks uses behavioral nudges and real-time analytics to boost financial literacy.

“We’re not just trading stocks—we’re teaching users to think like investors,” explains CEO Mosharf Hossain. “Since launching, our daily active users have grown by over 40%, with average daily returns hovering around 3%, which translates into tangible Taka gains for participants.”

Emerging from the entrepreneurial spirit of Bangladesh’s tech scene is BanglaBizFlow, a comprehensive platform blending freelancing, marketing support, and affiliate earning. Designed for both beginners and seasoned professionals, it offers integrated tools for project management, social media promotion, and earnings tracking—all within a localized UX.

Monetization options include commission from referral sales, sponsored content, and automated ad placements that respect user preferences. Early adopters highlight the platform’s dual strength: earning through visibility and skill, while building long-term digital presence. “BanglaBizFlow didn’t just give me side income—it built my digital brand,” shares Fahim, a young entrepreneur from Chittagong.

“Monetizing my writing and design through it was seamless, with real rewards.”

Underpinning the success of these apps is Bangladesh’s expanding digital infrastructure—rising smartphone penetration, improved internet access in 92% of urban and growing rural connectivity, and a young, tech-savvy population eager for financial autonomy. According to a 2024 report by the Bangladesh Information Technology Board, over 60 million mobile users engage monthly with fintech platforms, a 55% increase from 2022. This growth is mirrored in rising household incomes tied to digital entrepreneurship, with Earn Taka apps emerging as key enablers of inclusive economic participation.

What unites these platforms is their user-centric design—making complex finance accessible and empowering everyday Bangladeshis to take control of their earnings. Whether through global gigs, micro-tasks, algorithmic trading, or brand-building tools, each app delivers tangible value in local currency and real results. As Bangladesh’s digital economy matures, these earning apps are not just apps—they’re engines of economic opportunity, proving that financial empowerment in the Taka era is no longer a luxury but a viable path for millions.

Related Post

Top English Universities in Japan: Your Ultimate Guide to Global Education in the Land of Tradition

Martin Yan Can Cook: The Cooking Maestro Behind Age, Height, and Culinary Precision

<b>Revolutionize User Experience: iOS 18’s Latest Support Devices Join the Accessibility Revolution</b>

CM Punk Sucker Punched Jack Perry In Backstage Brawl Before All In According To Neutral Source