Driving Security and Accountability: How Reliance Inmate Wallet Device Systems Revolutionize Correctional Asset Control

Driving Security and Accountability: How Reliance Inmate Wallet Device Systems Revolutionize Correctional Asset Control

In correctional facilities nationwide, the challenge of managing financial transactions, tracking internal procurement, and maintaining inmate order has evolved with the deployment of Reliance Inmate Wallet Device Systems — a cutting-edge digital solution transforming how prisons manage inmate financial mobility. These secure, cmpos-based wallet platforms offer a fusion of cashless transactions, behavioral regulation, and real-time monitoring, offering correctional staff unprecedented control while reducing security risks. As modern prisons shift from cash-based economies to digital economies, Reliance’s systems stand at the forefront, integrating technology with operational discipline.

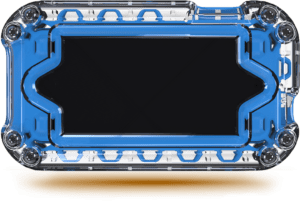

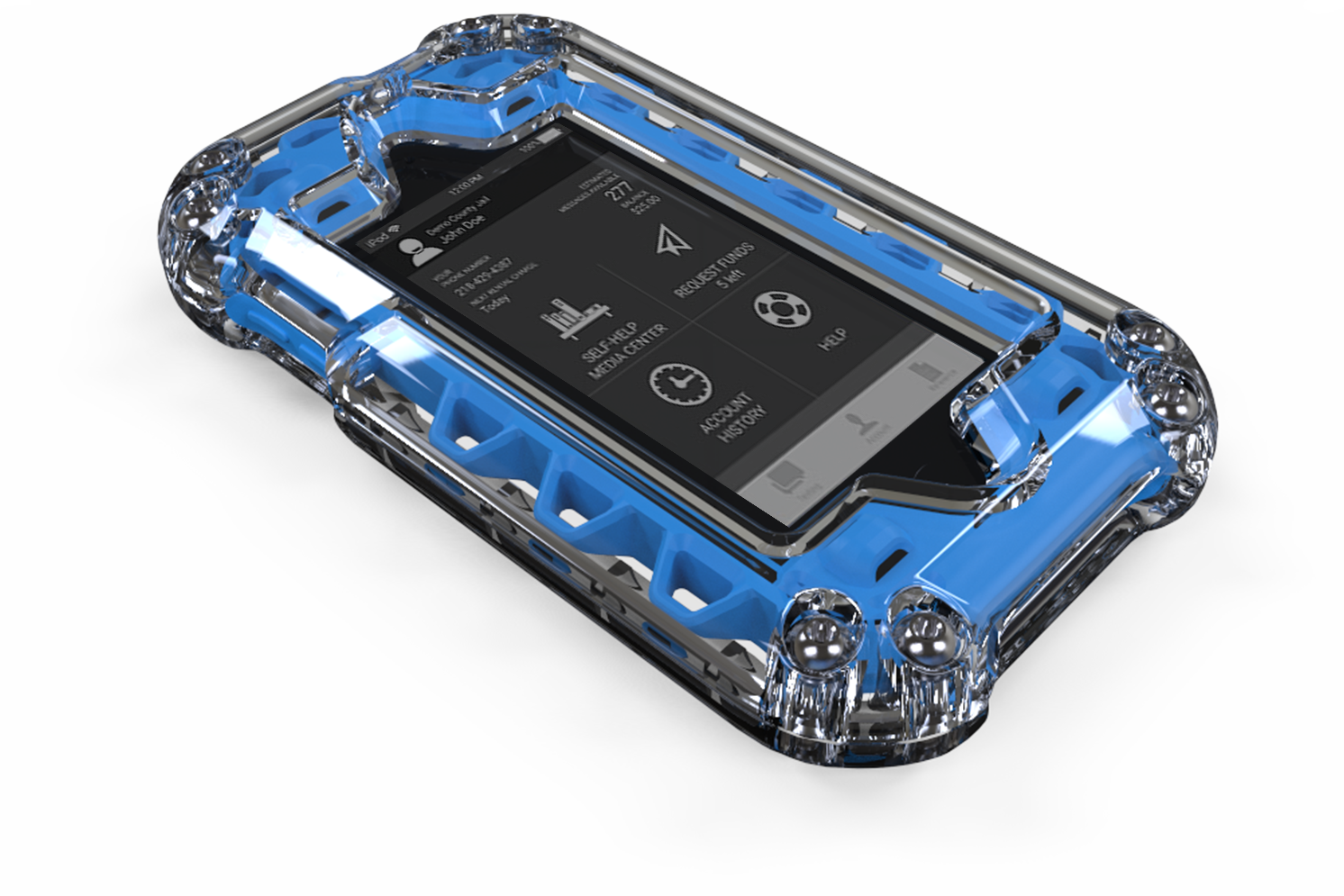

Reliance Inmate Wallet Device Systems are portable, tamper-resistant devices designed specifically for correctional environments, enabling inmates to access prepaid digital wallets within secure facility boundaries. Unlike traditional cash, which poses risks of contraband, theft, and misdistribution, these systems permit controlled, traceable transactions exclusively for essentials like commissary purchases, phone top-ups, medical payments, and commissary credits. This digital switch not only enhances accountability but also streamlines transaction logs, allowing corrections officers to monitor spending in real time.

The Core Components of Reliance’s Inmate Wallet Technology

Reliance’s system architecture is engineered around three pillars: security, usability, and integration.Each wallet device is hardened with military-grade encryption, biometric authentication (such as fingerprint scanning), and remote wipe capabilities—ensuring compromised devices are instantly neutralized. The accompanying infrastructure includes centralized command software that aggregates transaction data, sets daily spending limits, and flags suspicious activity patterns. Officers receive live dashboards with geographic and temporal transaction tracking, enabling rapid intervention when anomalies arise.

- **Secure Device Hardware**: Tamper-proof construction prevents physical breach or data extraction; solid-state storage ensures durability in harsh environments.- **Mobile Access via Foil-Style Devices**: Lightweight, plug-and-play devices function like secure smart cards, reducing human interface vulnerabilities. - **Centralized Management Software**: Cloud-based analytics platforms process transaction histories, identify risk indicators, and generate compliance reports for audits. - **Dynamic Spend Controls**: Administrators configure daily transaction caps per inmate, restrict high-risk merchants, and automate reimbursements for approved purchases.

Operational Impact: Enhancing Safety and Efficiency

Prior to digital wallet integration, correctional facilities struggled with cash flow mismanagement, accounting for up to 18% of daily operational disruptions due to lost or misused funds. Reliance’s systems directly address these inefficiencies by creating a closed-loop financial ecosystem. Inmates manage transactions through a transparent interface, reducing disputes over commissary balances and eliminating cash-handling bottlenecks.- Real-time Monitoring: Officers observe transaction flows from a secure console, allowing proactive responses to anomalies such as bulk purchases or unauthorized merchants.

- Reduced Contraband Risk: Disposable cash is largely eliminated from daily operations, minimizing its diversion into illicit markets or criminal networks.

- Behavioral Accountability: The linkage of funds to specific purchases discourages misuse, reinforcing disciplinary expectations.

- Enhanced Auditing: Every transaction is timestamped, encrypted, and traceable—streamlining internal audits and external oversight with precision.

Broader Implications for the Future of Correctional Finance

Reliance Inmate Wallet Device Systems represent more than a security upgrade—they signal a paradigm shift in how correctional institutions manage autonomy and accountability. By digitizing financial interactions, these systems strengthen institutional control while promoting dignity through structured choice.The scalability of the technology allows adaptation across facility

Related Post

Kelly Preston and John Travolta: Portrait of a Legacy Forged in Hollywood Glamour and Financial Resilience

You Won’t Believe What We Found About the Blahgigi Onlyfans Scandale280A6 That Shattered the Industry’s Trust

Jeff Fuqua Blvd: The Artery Driving Orlando International Airport

Level Up Your Game: FIFA 23 Gameplay Secrets That Upgrade Every Match