Does Suncoast Credit Union Power Your Transactions with Zelle? A Deep Dive

Does Suncoast Credit Union Power Your Transactions with Zelle? A Deep Dive

Suncoast Credit Union has positioned itself as a forward-thinking financial institution serving Florida’s Gulf Coast communities, offering a suite of digital payment tools to keep members connected and competitive. Among the most practical questions Members ask is whether Suncoast Credit Union integrates Zelle — the real-time money transfer service trusted by millions across the nation. The answer is clear: yes, Suncoast Credit Union supports Zelle, enabling seamless peer-to-peer and bill payments directly from credit union accounts without banks.

Zelle has become a cornerstone of instant payments in America, processing billions of dollars monthly through integration with major U.S. banks and financial institutions. While not all credit unions participate, Suncoast Credit Union’s inclusion of Zelle reflects its commitment to matching or exceeding industry-standard digital conveniences.

“We launched Zelle to keep pace with how members want to manage their finances today,” says a Suncoast spokesperson. “It lets Members transfer funds instantly, pay bills, and send money to friends and family — all without delays or fees common with traditional methods.”

What Does Zelle Integration Mean for Suncoast Members?

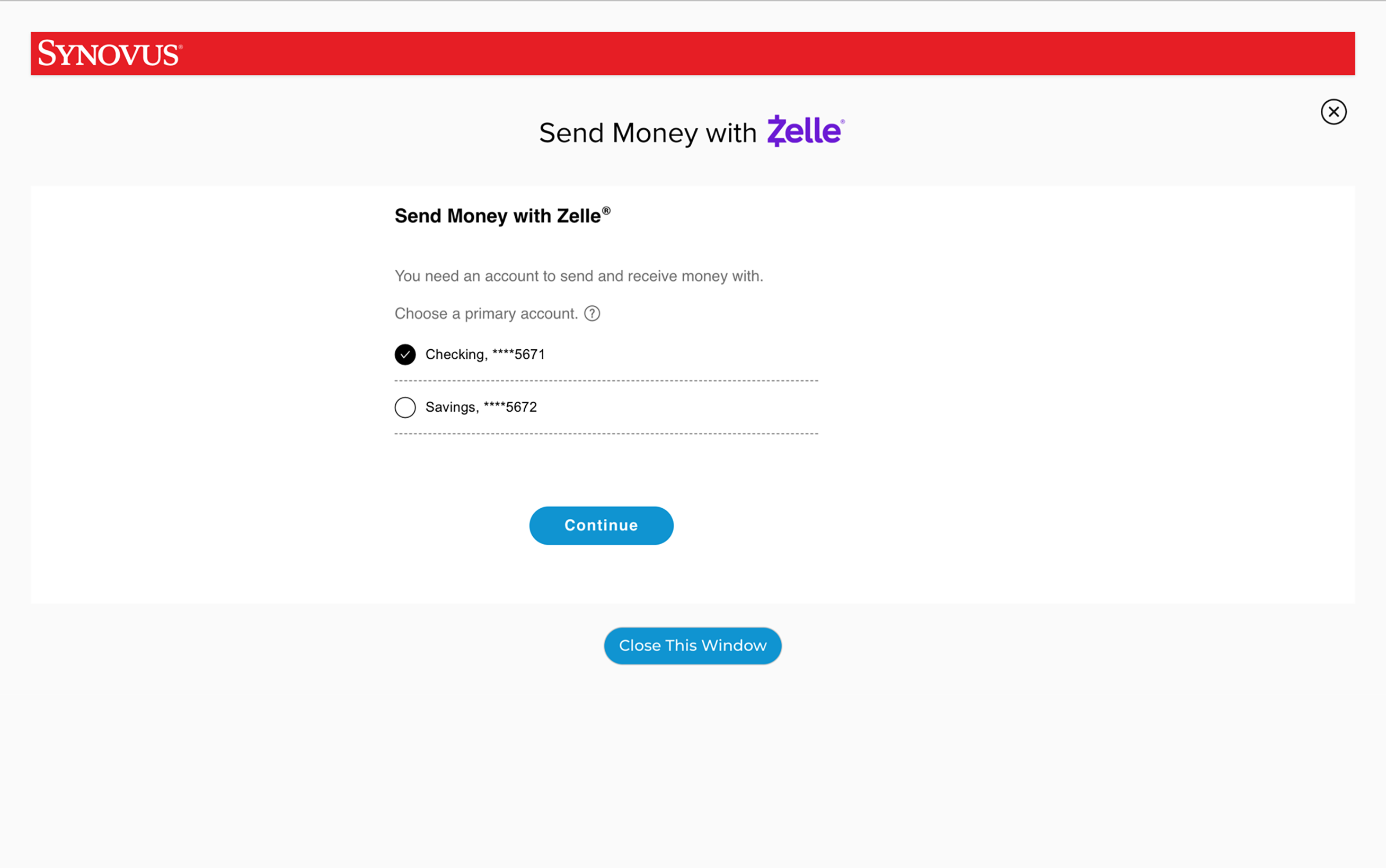

For Members, the integration of Zelle transforms daily banking. Acts of financial reciprocity — such as splitting dinner bills, sendingemergency funds, or disking utility payments — become faster, frictionless, and secure.Unlike bank transfer apps that may require routing numbers or experience waiting times, Zelle leverages ABA banking rails powered by The Clearing House, ensuring near-instant settlement — often within seconds — across participating institutions. Suncoast Credit Union allows Members to initiate Zelle transfers directly from their checking or savings accounts through its user-friendly mobile app and online banking platform. The process is straightforward: enter a recipient’s mobile number or Zelle email ID (no account numbers needed), enter the amount, review, and confirm — all within minutes.

This immediacy directly addresses a core consumer demand: financial responsiveness when it matters most.

During high-traffic periods — such as payday cycles or holiday gifting seasons — Zelle’s reliability becomes especially impactful. Suncoast has invested in infrastructure to handle peak transaction volumes, minimizing bottlenecks and maintaining service integrity.

Members report consistent success in sending and receiving funds without the delays or processing fees frequently tied to paper checks or debit card transfers. This functionality strengthens trust and aligns the Union’s service model with the expectations of digitally active consumers.

<>In essence, Zelle complements Suncoast’s broader digital transformation — a strategic shift designed to empower Members with tools that reflect modern financial habits. From mobile check deposit to Zelle, the Union creates a seamless ecosystem tailored for convenience, speed, and transparency. Standards for Zelle participation vary among credit unions, determined by relationships with Clearing House partners and compliance requirements.Suncoast Credit Union, classified as a cohort partner through its relationships with major bank fintech networks, remains tightly integrated. While Zelle access isn’t universal across all regional credit unions, Suncoast ensures robust availability, highlighting its focus on technology-driven member service.

Comparing Suncoast’s Zelle offering with banking alternatives, the key differentiator lies in cost and accessibility.

Unlike third-party apps that charge transfer fees or require cash-in deposits, Suncoast passes along Zelle benefits at no additional cost to Members. This fee structure, combined with real-time settlement, expands financial inclusion by removing barriers to timely payments. For many, this makes Zelle not just a convenience tool, but a practical lifeline in managing day-to-day liquidity.

Members also praise Suncoast’s responsive support ecosystem around Zelle.Whether troubleshooting failed transfers or learning the nuances of Zelle limits, the Union’s staff and digital resources provide clear, timely guidance. Peer discussions and online forums affirm that Zelle at Suncoast merges ease of use with reliability — a combination that sets a high bar among regional credit unions.

Suncoast Credit Union’s embrace of Zelle reflects a broader trend: financial institutions evolving to meet members where they are — in mobile use, speed, and choice.

By embedding Zelle into its core services, the Union strengthens its role as more than just a savings and loan partner, but as a digital ally in everyday life.

In a financial landscape increasingly defined by instant expectations, Suncoast Credit Union’s integration of Zelle positions it as a practical, user-first institution. For Members seeking real-time control over their money, Zelle offers peace of mind and precision — a capability now expected, not exceptional, and delivered reliably by a credit

Related Post

Investigating the Phenomenon of Fgteev Now: A Digital Content Realm

NCI Los Angeles Cast Meet The Team: A Frontline Force Ready to Take On L.A. Crime

Shocking Truths Revealed: Impactful Lessons From The Ronnie Mcnutt Vid A Detailed Insight That Changed Digital Safety Forever