Dental Surgery Financing: Break Down the Options to Afford Life-Changing Care

Dental Surgery Financing: Break Down the Options to Afford Life-Changing Care

From correcting misaligned jaws to replacing missing teeth with lifelike implants, dental surgery remains among the most transformative—but often most financially daunting—oral health procedures. For millions grappling with complex dental needs, the cost barrier can feel insurmountable. Yet, a range of financing solutions now exists to turn spectacular smiles into achievable goals.

Understanding these options and how to secure affordable access is essential for anyone considering invasive dental work. This article unpacks the key financing pathways, evaluates eligibility and practicality, and provides clear guidance on affording urgent or elective dental surgery.

Dental surgery encompasses procedures such as oral implants, periodontal grafts, wisdom teeth extractions, and full mouth reconstructions—interventions that blend medical precision with cosmetic refinement.

These treatments often carry out-of-pocket costs ranging from several thousand dollars up to $20,000 or more, depending on complexity and materials involved. Without reliable payment planning, such expenses can trigger avoidance, worsening oral health and long-term costs. “Many patients delay vital care out of fear of price tags,” notes Dr.

Elena Marquez, a prosthodontist in Chicago. “But financing opens a real pathway—not just to better health, but to restored confidence.” The good news is that structured, patient-centered financing models now make these procedures accessible through manageable monthly payments and flexible terms.

Understanding Financing Options: Loans, Credit, Insurance, and More

Whether through direct dental financing plans, medical loans, personal credit, or insurance muscles, multiple vehicles exist to fund dental surgery.Each comes with distinct advantages and considerations that shape affordability and repayment.

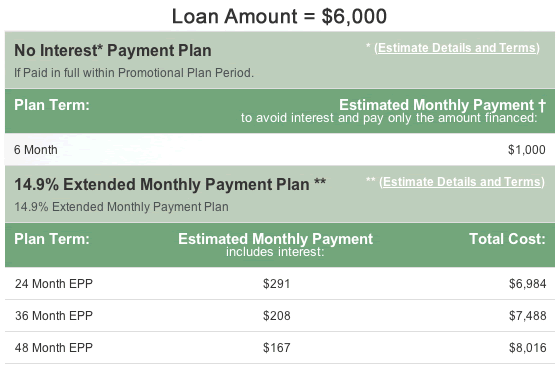

**Dental-Specific Loan Programs** Specialized dental financing, often offered through clinics, third-party lenders, or financing platforms like CareCredit, bundles loan repayment with the owning practice. These plans typically feature low interest rates—sometimes as low as 6% APR—in bespoke terms aligned with treatment duration.

Some plans even waive fees if full payments are made early, and offer grace periods post-surgery. The deliberate structuring of disbursements makes cash flow manageable, spreads financial risk, and enables immediate treatment access without depleting savings.

**Medical Credit Cards and Personal Loans** Though technically medical in nature, dental surgery loans frequently appear as “medical” credit cards or personal installment loans.

Offered by banks, credit unions, and fintech partners, these come with variable APRs (often 6–24%), requiring disciplined budgeting. The key is transparency: comparison shopping is crucial—shemporrope’, rates vary significantly. Many providers now offer zero-fiction financing for dental work, simplifying approval through income and credit checks rather than medical documentation.

**Insurance Benefits and Supplemental Coverage** Dental insurance remains a cornerstone for affordability, covering up to 50–80% of preventive or basic surgical procedures like cleanings and extractions, but often with limited proportional support for major surgery. Expanded plans—especially those bundled with dental implants or periodontal surgery—may offer partial coverage for advanced care. Patients are advised to review co-pays, deductibles, and annual maximums carefully, as surveys show average savings range from $100 to $2,000 depending on policy.

**Government Programs and Public Health Initiatives** For eligible individuals, government-backed initiatives such as Medicaid or state dental aid programs extend financial support. Eligibility varies by region and income level, but these programs reduce costs drastically—sometimes to $0 out-of-pocket for qualifying patients. Some public oral health clinics also accept voucher-based financing, especially for underserved populations, turning complex surgeries into community-accessible services.

Key Factors Influencing Affordability

Several practical elements determine how accessible financing transforms into real affordability: creditworthiness plays a major role—higher credit scores unlock lower rates and better terms. The timing of application matters: submitting documentation early accelerates approval. Procedure complexity directly influences financing packages—simpler root canals fit tighter budgets than full-mouth implant sets.Patient responsibility includes calculating total costs beyond upfront fees: additional expenses like anesthesia, follow-ups, and emergency care must factor into long-term planning. Finally, budgeting tools—such as loan calculators—empower informed decisions, revealing true repayment amounts and interest burdens.

For example, a $15,000 implant surgery financed over 24 months at 12% APR results in roughly $748 monthly payments plus $2,100 in interest.

This represents a manageable commitment for stable-income earners, while those with tighter budgets may benefit from shorter terms or grants from nonprofit dental foundations.

Strategies to Maximize Access Yet Minimize Cost

Navigating dental financing effectively demands proactive planning and strategic alignment with available resources. Prioritize early consultations with clinics that offer in-house financing—this streamlines approval and locks in rates before decisions are finalized.Gather all required documentation—proof of income, insurance cards, and treatment plans—upfront to avoid delays. Leverage third-party comparison tools to benchmark APRs and terms across lenders. Consider seasonal promotions: many providers undercut rates during fund-raising periods, especially ahead of annual dental health awareness months.

Don’t overlook cross- eligibility: some financing partners partner with employers offering flexible spending accounts (FSAs) or health reimbursement arrangements (HRAs), enabling tax-advantaged prepayment and faster reimbursement.

Equally vital: understand the full cost of care. Request itemized breakdowns from providers—hidden fees for lab costs, specialist consultations, or overnight stays inflate final bills.

Transparent pricing fosters trust and prevents budget shocks. For high-cost procedures, explore deferred payment plans tied to income, where realism about post-treatment earnings leads to sustainable repayment.

Making Informed Choices for Health and Wallet

Dental surgery financing transforms uncertain treatment into a structured, empowering journey—not just a financial hurdle.Selecting the right model hinges on clear knowledge: matching procedure scope with loan capacity, verifying insurer benefits, and leveraging tax-advantaged accounts. Patients equipped with these insights no longer face a stark choice between care and cost; instead, they walk a pathway where health progress and financial stability advance together. By activating financing with intention and foresight, durable smiles—and lasting confidence—are well within reach.

Final Thoughts: Dental Surgery Financing as a Pathway to Better Health

Dental surgery is more than a medical intervention—it’s a gateway to improved function, confidence, and long-term well-being. Financing options have evolved beyond simple loans to integrated, patient-centered solutions that ease financial strain and improve access. Understanding loan structures, insurance nuances, and repayment mechanics transforms daunting costs into manageable commitments.With careful planning and informed decision-making, patients today can access advanced dental care without sacrificing financial stability. The future of affordable dental transformation lies not in avoidance, but in empowerment—fueled by smart financing and a clear roadmap to better oral health.

Related Post

What Date Is Friday? Precision in the Calendar

Hold, Relive, Memorize, Chase: How Hold Rel Mem Cr Chase Is Reshaping How We Remember

PSEI Townhouses Taman Ayu: Your Dream Home Awaits

BLP Policy for Living Persons: Navigating Legal Rights and Responsibilities in Contemporary Governance