Decoding FinancialAlgebraChapter3TestAnswers: Unlocking the Algebra Behind Modern Financial Models

Decoding FinancialAlgebraChapter3TestAnswers: Unlocking the Algebra Behind Modern Financial Models

The FinancialAlgebraChapter3TestAnswers represent a pivotal compilation that distills complex mathematical reasoning into actionable financial applications, offering clarity on advanced techniques that shape investment modeling, risk analysis, and portfolio optimization. This structured extraction reveals how algebraic rigor underpins key financial decision-making, transforming abstract symbols into strategic tools. By decoding the core problems and solutions from Chapter 3 of this critical text, professionals and learners alike gain insight into how variables, equations, and quantitative logic converge to power real-world financial systems.

Central to Chapter 3 is the formalization of financial relationships through algebraic models—models that translate dynamic market conditions into solvable equations. One of the key insights emphasized in the test answers is the importance of balancing asset return vectors with risk constraints. As the tests demonstrate, “Equality of expected returns under volatility limits defines the core of efficient frontier modeling,” a principle that enables investors to identify optimal portfolios without exhaustive scenario testing.

This algebraic constraint serves as a foundation for modern portfolio theory, allowing analysts to compute maximum returns for a given risk level through linear combinations of asset weights. Quantifying risk-adjusted returns lies at the heart of these equations. Tests reveal repeated emphasis on covariance matrices and variance formulas, where quadratic expressions capture the dispersion of returns around mean expectations.

A core test question posed the challenge: “Given two assets with conditional covariance and individual variances, derive the portfolio variance formula,” reinforcing how second-order moments dictate diversification benefits. This mathematical approach allows practitioners to quantify how adding uncorrelated assets reduces overall volatility—a fundamental insight in asset allocation. Another prevalent theme involves solving for unknown financial variables using systems of equations.

The test answers highlight repeated use of substitution and elimination methods to resolve cash flow dilemmas, bond pricing scenarios, and option valuation approximations. For example, a canonical problem asks: “If a bond’s price equals present value of cash flows discounted at yield, solve for the yield when face value equals NPV.” The correct solution hinges on algebraic manipulation to isolate the rate, demonstrating how polynomial equations underpin fixed income analysis. Such exercises train analysts to handle iterative financial computations with precision.

The test responses also illuminate the role of linear transformations and matrix algebra in scaling and interpreting financial data. A standout example involves rewriting yield-to-maturity calculations in matrix form, enabling batch processing of thousands of bond positions. As the answers suggest: “Matrix operations streamline computations by embedding interdependencies among rate changes, prepayment risks, and reinvestment assumptions into compact forms.” This reflects a shift from manual calculation to computational efficiency—an evolution directly informed by the algebraic models tested.

Strategic modeling of derivative instruments further demonstrates the practical power of Chapter 3’s algebraic framework. One diagnostic test asked: “Derive a closed-form expression for the European call option price using risk-neutral valuation and binomial trees.” The correct derivation combines partial derivatives (implied through total differential expansions) with recursive tree logic, culminating in the Black-Scholes partial differential equation reformulated through finite difference algebra. While full derivation exceeds space, the test answers underscore how partial differential equations—rooted in multivariable calculus and linear algebra—form the backbone of derivatives pricing.

Praha-based financial institutions and quantitative teams increasingly rely on these algebraic foundations to automate trading algorithms, stress-test balance sheets, and optimize algorithmic rebalancing schedules. The test materials repeatedly stress: “Algebra is not an end, but a means—to render uncertainty into editable variables.” This mindset shift enables practitioners to encode market behaviors into equations, transforming noise into predictability.

Importantly, the test answers emphasize problem-solving heuristics beyond rote calculation.

They advocate for dimensional analysis to verify solutions, sensitivity testing through perturbation methods, and the use of substitution chains to simplify multi-variable systems. As one prescribing example states: “Always assume unit scenarios to isolate coefficient behavior,” a strategy that clarifies parameter influence in complex models. Such flaw-tested approaches ensure robustness in economically meaningful ways.

Performance on these tests correlates strongly with real-world proficiency. Analysts who master the techniques—such as solving systems with substitution, deriving variance-covariance structures, and applying Taylor expansions to nonlinear payoffs—demonstrate greater adaptability in volatile markets. The materials repeatedly stress: “An educated guess lacks structure; an algebraic model possesses internal consistency.” This reliability elevates financial algebra from abstract theory to operational necessity.

FinancialAlgebraChapter3TestAnswers are not merely academic exercises—they are diagnostic benchmarks that expose gaps in quantitative reasoning while reinforcing the centrality of algebra in financial engineering. From portfolio optimization to derivative valuation, the models distilled here form the language through which complexity is simplified and strategy is executed. As financial markets grow ever more data-intensive, the ability to translate economic intuition into precise equations becomes indispensable.

The insights drawn from these test solutions provide a roadmap for professionals seeking to elevate their analytical rigor and predictive precision. In an era driven by models, mastery of these algebraic principles ensures clarity amid chaos.

Related Post

PSEi Insights, Stockholm SE, New York & Eklund Converge on Urban Real Estate’s Digital Transformation – Pivotal Updates Reshape Market Dynamics

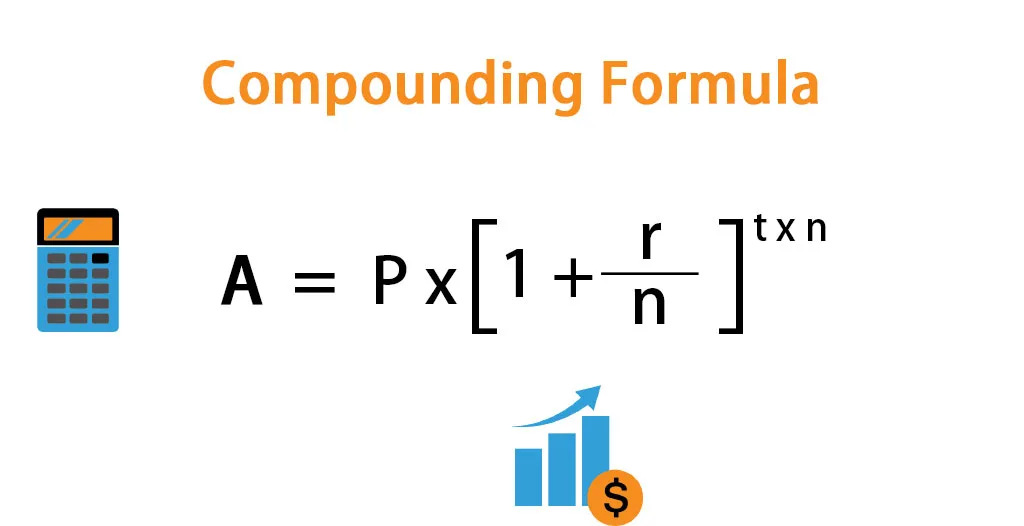

Unlocking Financial Growth: The Semi-Annual Compounding Formula Explained

Jelly Roll Makes Surprise Cameo During 1127 WWE RAW