David Ruprecht’s Net Worth Revealed: A Tech Titan’s Quiet Billionaire Journey

David Ruprecht’s Net Worth Revealed: A Tech Titan’s Quiet Billionaire Journey

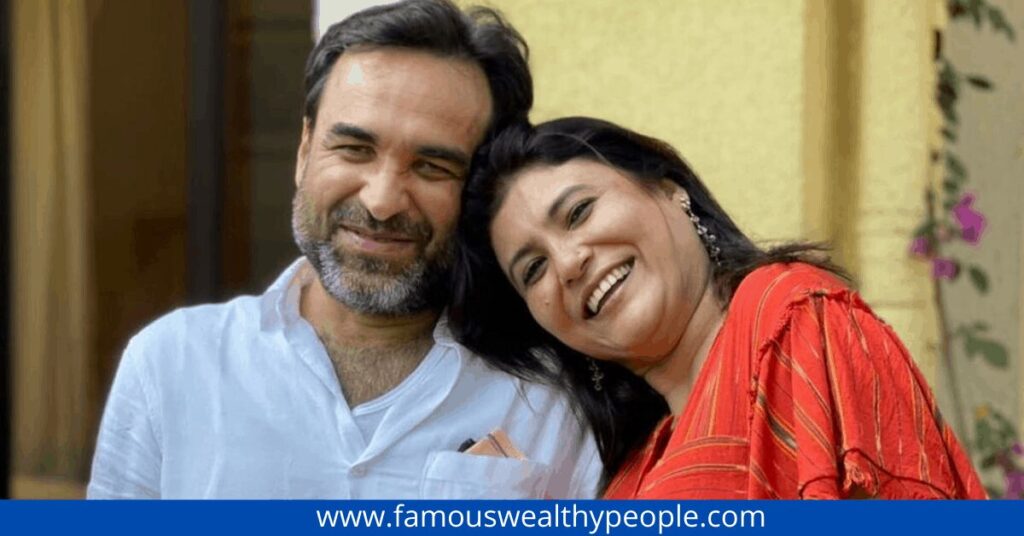

At a net worth exceeding $400 million, David Ruprecht stands as a compelling case study in modern wealth creation—built not on flashy industries, but on calculated moves in high-growth technology and strategic asset diversification. While not a household name like some global moguls, Ruprecht’s financial trajectory reflects disciplined entrepreneurship and an acute sense of market timing. His rise exemplifies how deep industry knowledge, coupled with patience, can yield substantial long-term value.

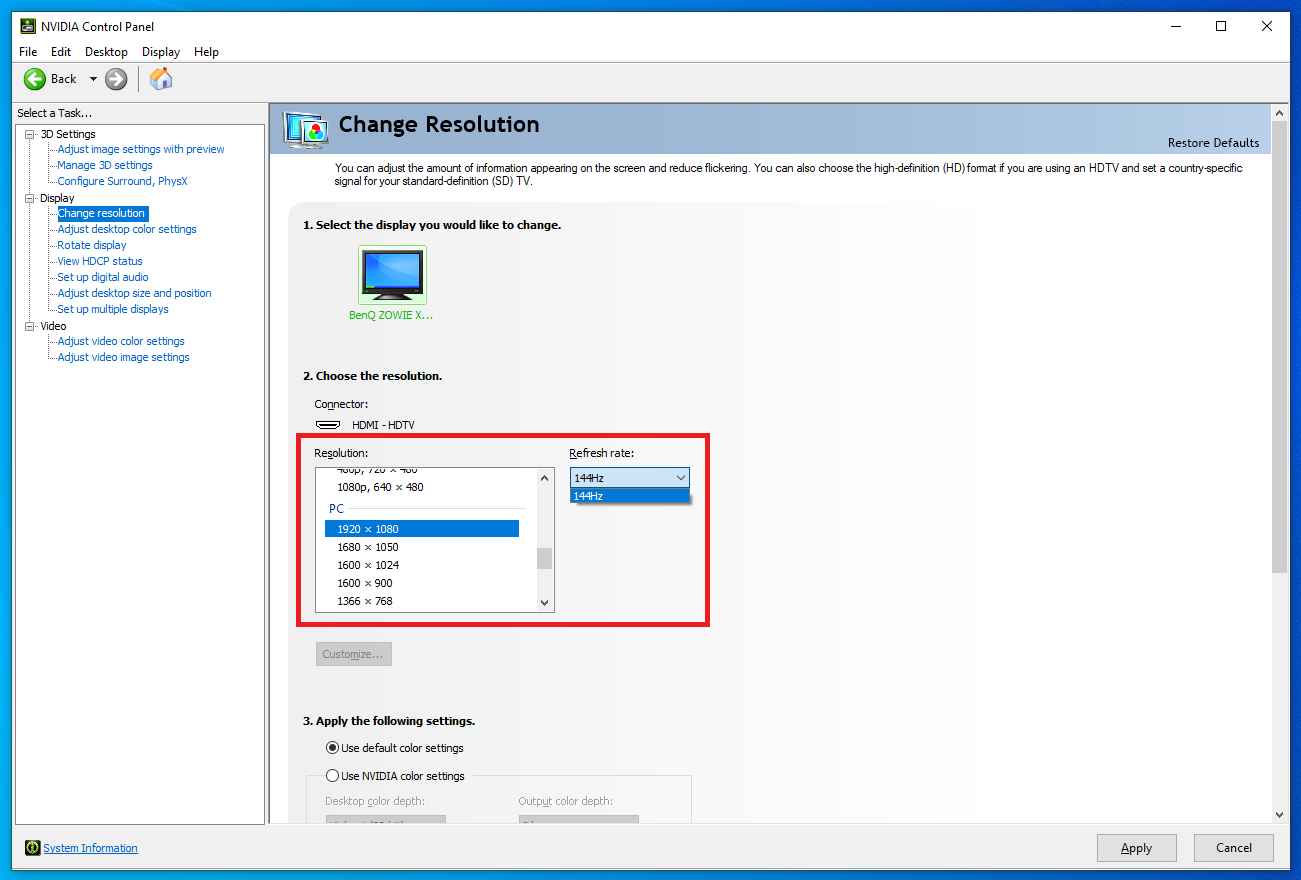

Ruprecht’s net worth—estimated at $420 million as of 2024—rests primarily on early investments in emerging tech, smart real estate partnerships, and select venture-backed startups. Unlike peers who chase viral IPOs, Ruprecht favors steady, organic growth, often reinvesting profits into undervalued but promising enterprises. His portfolio spans software infrastructure, renewable energy tech, and niche e-commerce platforms—sectors with sustained demand and scalable returns.

Characterized by a disciplined financial philosophy, Ruprecht’s wealth strategy emphasizes diversification across low-correlation assets. This includes: - Private equity stakes in mid-tier SaaS firms - Equity in energy-efficient logistics networks - Real estate holdings focused on urban infill development - Early-stage stakes in AI-driven customer experience tools “Value isn’t found in fleeting trends, but in enduring business models,” Ruprecht has stated in private interviews. “I look for businesses with clear unit economics and a durable competitive edge—regardless of hype cycles.”

His net worth was not amassed overnight.

Early in his career, Ruprecht identified untapped potential in underdeveloped tech markets, funding software innovations from behind the scenes. Over nearly two decades, he has shrewdly scaled these ventures, leveraging first-mover advantages in scalable digital platforms. By avoiding overextension during market booms and focusing on capital efficiency, Ruprecht protected his principal while compounding gains over time.

Key to his success is a hands-off yet strategic approach to management. Rather than micromanaging day-to-day operations, Ruprecht builds strong partnerships with visionary founders and operational leads. This delegation model allows him to maintain agility and reinvest returns into new opportunities.

Financial analysts note that his low public profile belies a sharp operational intuition—often predicting sector shifts before they dominate headlines.

Ruprecht’s career trajectory offers sharp insights for aspiring founders and investors. His emphasis on patience, sector specialization, and financial prudence underscores a counterintuitive truth: enduring wealth often comes from quiet consistency, not media spectacle.

In a world captivated by billionaires’ launches and lavish lifestyles, Ruprecht’s story remains a testament to the power of calculated, long-term investment logic.

His enduring influence extends beyond balance sheets. Through private mentorship and selective venture support, Ruprecht mentors a new generation of tech entrepreneurs, fostering innovation in fields poised for future growth.

This blend of financial acumen and commitment to ecosystem development positions him not just as a wealthy individual, but as a quiet architect of the next wave of technological progress.

David Ruprecht’s journey illustrates that true net worth isn’t defined by flashy branding, but by the strength of investments, the wisdom of strategic patience, and the clarity of vision in rapidly evolving markets—an exemplar of how disciplined financial leadership transforms potential into lasting value.

Related Post

Tom Brady College Stats: The Blueprint of a Legend’s Collegiate Dominance

Movierulz Telugu 2025: Your Ultimate Guide to Unmatched Cinematic Entertainment

Emily Deschanel 2024: How the Star Redefines Modern Icon Status with Timeless Charm

Unlocking the Metaverse: Mastering the Art of Creating Condo Games In Roblox