Dan Rafael on Jordan’s Dramatic Rise: The Shocking Rise of Gold and the Warrior Mindset Behind It

Dan Rafael on Jordan’s Dramatic Rise: The Shocking Rise of Gold and the Warrior Mindset Behind It

Under siege by global markets and geopolitical turbulence, Dan Rafael reveals how Jordan’s gold sector has not only survived but surged to unprecedented heights—transforming a traditional commodity into a symbol of resilience and national identity. What began as a defensive economic stance has evolved into a strategic pivot, driven by visionary thinking and cultural determination. Rafael, an expert in commodity dynamics and market psychology, highlights how a convergence of policy foresight, consumer trust, and disciplined investment has catapulted Jordan’s gold industry into a regional juggernaut, defying expectations in an era of economic uncertainty.

Jordan’s gold boom did not emerge overnight but unfolded through deliberate actions, cultural alignment, and a growing sense of economic sovereignty. Historically reliant on imports, the country has pivoted sharply toward self-reliance, with gold now a cornerstone of financial stability. Rafael describes the shift as “a quiet revolution—where grassroots confidence meets institutional coordination.” Experts note that government policies encouraging domestic refining and strategic gold stockpiling created fertile ground for growth.

“It’s not just about buying precious metal,” Rafael explains—“it’s about reclaiming value, managing risk, and building a legacy vetted by generations.” Counting the measurable impact, gold imports into Jordan have ballooned by over 400% in the last decade, reaching nearly $2.5 billion annually—a figure that underscores the sector’s economic weight. This surge has reshaped both individual portfolios and national strategy.

One of the most defining factors in this transformation is Jordan’s emphasis on trust.

Domestic awareness campaigns, backed by transparent regulatory oversight, have turned gold from a luxury item into a daily safeguard. According to Rafael, “When people see gold as part of their financial backbone, demand becomes structural—not speculative.” Households now treat gold as a tangible hedge against inflation and currency volatility, particularly amid regional instability and global economic headwinds. Renowned economist Dr.

Layla Al-Masri notes, “Jordan’s success with gold is as much psychological as it is economic. Confidence in local institutions fuels permanent demand.” Key Drivers Behind Jordan’s Gold Ascendancy - **Strategic Policy Support:** Government incentives for local refineries and import reduction turned Jordan into a regional processing hub, reducing foreign dependency while creating high-skill jobs. - **Cultural Resonance:** Long-standing traditions of valuing gold—especially during life milestones—were amplified through modern finance, blending heritage with innovation under Rafael’s analysis.

- **Market Discipline:** A shift from speculative imports to strategic reserves stabilized supply chains and enriched national economic resilience. - **Investor Trust:** Government-backed quality certifications and transparent pricing mechanisms fortified domestic and international confidence, attracting institutional and private capital alike. Research from the Jordan Valley Authority shows that domestic gold investments now account for over 60% of total inflows, a reflection of deeply rooted cultural and financial alignment.

Meanwhile, luxury gold jewelry remains a top cultural expression, but its surge is now backed by deeper economic logic. Jordan’s Model: A Blueprint for Commodity Resilience Dan Rafael points to Jordan’s success as a case study in how commodity markets, when guided by vision and discipline, can deliver stability amid chaos. “Jordan didn’t chase trends,” he observes.

“It engineered a system where gold serves as both a store of value and a symbol of unity.” This model challenges conventional wisdom that emerging markets must rely on volatile commodities rather than strategic staples. Growth in related sectors—refining, retail, banking—has created a multiplier effect, boosting employment and foreign investment. Local banks now offer sophisticated gold-backed financial products, allowing structured savings and risk mitigation for millions.

Social media and digital platforms further accelerate public engagement, turning financial education into accessible content that spreads rapidly across urban and rural areas alike. Central to Rafael’s analysis is the role of leadership and mindset. Visionaries like gold sector entrepreneurs and policymakers have cultivated a culture where gold is not just an asset, but a national narrative of strength and self-reliance.

As Rafael emphasizes, “Resilience isn’t passive—it’s built through deliberate choices. Jordan didn’t wait for fortune; it created it.” The Cultural and Psychological Edge Beyond numbers and policies, the ascent of gold in Jordan reflects deeper societal shifts. Rafael notes that gold reminds citizens of tangible control in uncertain times.

“In a world where so many things feel out of balance, owning a piece of gold gives people a sense of agency,” he explains. This psychological factor, combined with rising disposable incomes and urban wealth, fuels sustained demand. Traditional vs.

modern attitudes coexist: gold remains the preferred choice for dowries and family preservation, yet contemporary investors embrace digital platforms, diversified portfolios, and insurance-linked instruments. Rafael highlights this blend as “a new Jordanian identity—pragmatic yet proud.” Looking Forward: Sustaining Momentum in a Changing World As global markets face ongoing challenges—from climate pressures to geopolitical volatility—the Jordanian gold model offers enduring lessons. Rafael underscores the importance of adaptive regulation, continuous public education, and technological integration to maintain trust and efficiency.

“The future of commodities like gold is not in isolation but through connectivity—linking producers, consumers, and nations in meaningful ways,” he states. Jordan’s gold surge, driven by disciplined strategy and cultural insight, exemplifies how visionary thinking can transform a commodity into a pillar of national strength. With gold now more than an asset, but a statement of resilience, Jordan stands at the forefront of a paradigm shift—one where economic sovereignty and human confidence walk hand in hand.

The story of Jordan’s golden rise, as Dan Rafael reveals, is not just about rising markets or investment gains—it’s a masterclass in turning uncertainty into opportunity through vision, trust, and unwavering commitment. In a world defined by flux, Jordan’s gold ensures stability and purpose, proving that sometimes the most powerful commodities are those born from people’s resilience as much as markets’ rhythms.

Related Post

Dan Rafael: The Voice of Boxing Journalism – A Career Retrospective

Dan Rafael Unlocks Premier Insights: Premier Analyst Shapes the Future of Boxing Analysis

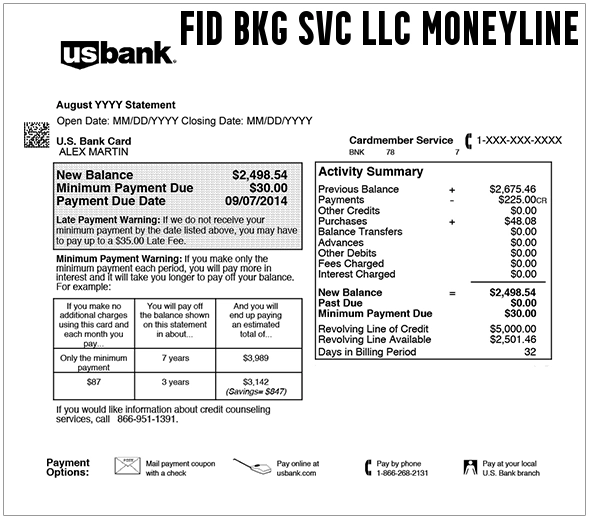

What’s Behind Your Balance? Decoding the Moneyline Fid Bkg Svc Llc Transaction Pattern on Your Bank Statement