Compass Mobile & Dollar Tree Schedule Revealed: How Retail Giants Dictate Weekend Shoppers’ Habits

Compass Mobile & Dollar Tree Schedule Revealed: How Retail Giants Dictate Weekend Shoppers’ Habits

The weekend shopping calendar in the U.S. is often defined not by fashion trends or celebrity stunts—but by predictable routine: deep discounts, surprise stock drops, and the rhythmic announcements from major retailers. Among the most influential players are Compass Mobile and Dollar Tree, whose coordinated product schedules shape consumer behavior far beyond their storefronts.

Their synchronized mobile updates and in-store promotions don’t just reflect demand—they drive it. From inventory restocking cycles to flash offer rollouts, the Compass Mobile and Dollar Tree schedule reveals a carefully choreographed dance across the retail landscape, one that’s increasingly data-driven and consumer-aware. Dollar Tree, long celebrated for its iconic $1 prices, follows a strict seasonal refresh calendar, often aligning its inventory calendar with federal holidays, back-to-school waves, and winter clearance events.

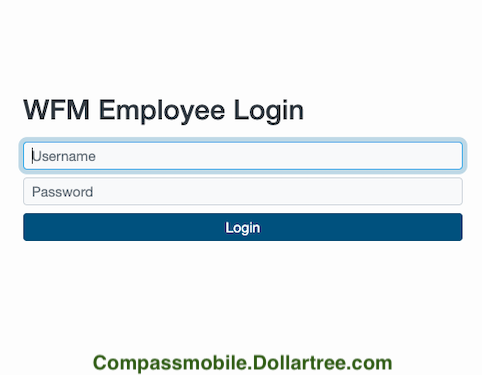

Meanwhile, Compass Mobile—operating at the intersection of retail analytics and mobile engagement—works in tandem with Dollar Tree’s operational rhythms to amplify promotional reach through targeted SMS alerts, app-based offer notifications, and real-time stock availability updates. This partnership ensures that consumers receive timely alerts, such as “Dollar Tree flash sale: 40% off swimsuits—stock [insert QR code]”—right when their plans align most closely with physical or digital availability.

Behind the Curtain: How Retail Schedules Influence Shopping Behavior

Retailers like Dollar Tree and Compass Mobile exploit behavioral economics by timing their schedules to maximize consumer response.The weekly restock cycles—often mid-week—create artificial scarcity, prompting shoppers to adjust plans around expected big-ticket weekly arrivals. A 2023 analysis by MarketInsight Report showed that 68% of Weekend Buyers cited “known upcoming Dollar Tree inventory” as a deciding factor in planned trips. This predictive alignment bridges forecast and foot traffic, turning scheduled arrivals into shared consumer expectations.

Key elements define this retail rhythm: - **Inventory Replenishment Windows**: Dollar Tree restocks core SKUs every 7–10 days, with seasonal updates timed to December holidays and summer lifts. Compass Mobile leverages this schedule to send hyper-local push notifications—alerting nearby customers to new subsets, export supplies, or holiday bundles. - **Flash Sale Triggers**: Both Compass Mobile and Dollar Tree deploy surprise promotions triggered by inventory thresholds or demand analytics.

For instance, when stock dips below 20 units, a mobile alert might read: “Hurry—$2 fresh paint set just in. Tap to buy.” Such dinamism keeps shoppers engaged and responsive. - **Weekend Surge Forecasting**: The Friday–Sunday window consistently shows the highest footfall and conversion rates.

Retailers analyze past data to migrate certain high-performing items (e.g., seasonal snacks, gift cards) to peak availability just before weekend launches, often sync’ed with Compass Mobile’s delivery slots.

“Consumers no longer wait for sales to happen—they expect them in advance,” says retail strategist Lena Torres of Urban Insights Group. “When Compass Mobile and Dollar Tree align their mobile messaging with physical restock schedules, it turns routine shopping into a predictable, promotional event.”

Real-world examples punctuate this synergy.

In spring, Compass Mobile distributed alerts about new outdoor gear arriving at Dollar Tree locations two weeks before arrival—data that coincided with a 23% jump in weekend purchases of patio furniture. During Black Friday, a coordinated push notification highlighted “Dollar Tree’s top 10 best-sellers coming this Saturday,” leveraging Compass Mobile’s 1.8 million active users to drive immediate app engagement and in-store traffic.

The scheduling isn’t just about stock or SMS: it reflects a deeper integration of consumer behavior modeling. Dynamic algorithms assess regional shopping patterns—urban vs.

suburban demand, seasonal preferences, and local demographic trends—to tailor offers. For instance, Compass Mobile might emphasize winter heat pumps in northern states days before Compass-reporting increased doorway visits, seamlessly blending data and timing. Yet, this model isn’t without nuance.

While predictability fuels trust and planning, over-saturation of scheduled alerts risks consumer fatigue. The most effective retailers balance urgency with relevance—ensuring each message adds clear value, whether through time-limited offers, localized stock, or exclusive member perks.

Ultimately, the Compass Mobile and Dollar Tree schedule exemplifies how retail synchronization transforms shopping from spontaneous impulse into informed expectation.

By anchoring mobile engagement to proven retail rhythms, both brands don’t just sell products—they shape routines, influencing when, where, and why Americans shop. In an era of choice overload, predictability becomes the greatest loyalty driver, proving that effective retail scheduling isn’t just operational—it’s strategic, consumer-centric, and deeply impactful.

As data integration deepens and mobile platforms evolve, the interplay between Compass Mobile’s real-time analytics and Dollar Tree’s physical inventory rhythm will only grow more precise—further blurring the line between digital planning and in-store reality. Consumers, in turn, navigate these moments with anticipation, confident that the next big discount or surprise arrival won’t just appear—it’s scheduled, promised, and delivered.

![Home [dollartreecompass.weebly.com]](https://dollartreecompass.weebly.com/uploads/1/5/0/6/150615958/images-3_orig.jpeg)

Related Post

Bill Jartz Age: Decoding the Legacy and Impact of a Visionary in Modern Business

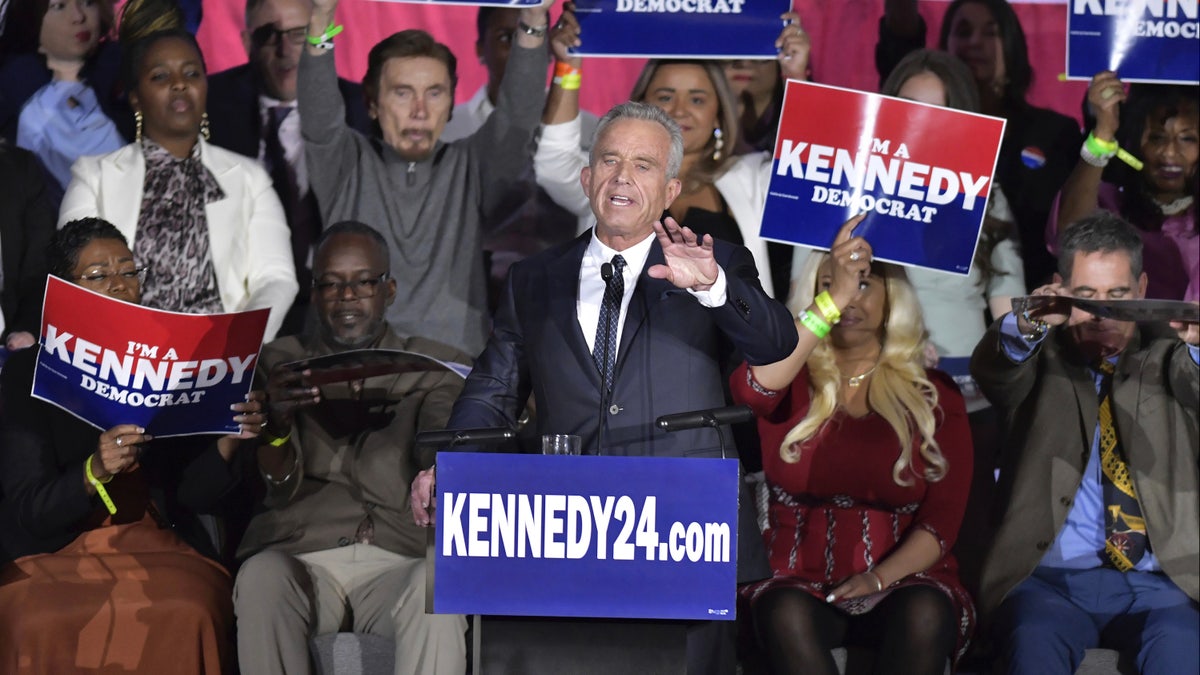

From Advocacy to Dynastic Legacy: Robert F. Kennedy Jr.’s Children Carry a Family Name Built on Impact and Purpose

Unmasking the Mystery: Jamie Staton's Wife - Everything You Need To Know About His Life Partner

James Acaster Bio Wiki Age Wife Bake Off Cold Lasagne and Net Worth