Coca-Cola’s 2024 Profit Battle: How COGS Eats into Revenue Amid Shifting Market Pressures

Coca-Cola’s 2024 Profit Battle: How COGS Eats into Revenue Amid Shifting Market Pressures

In 2024, Coca-Cola faced a stark economic reality: soaring cost pressures squeezed profitability even as global revenue climbed steadily. The beverage giant’s financial breakdown reveals a growing gap between soaring Cost of Goods Sold (COGS) and revenue, exposing deep operational challenges in a volatile market. With revenue surging to $Revue, while COGS climbed higher than expected, investors and analysts are closely scrutinizing the sustainability of margins in Coca-Cola’s core business.

For a company built on global brand dominance, the widening gap between income and costs marks a critical inflection point demanding strategic reassessment. Understanding the metrics behind this trend, the 2024 breakdown shows COGS — encompassing raw materials, packaging, production, and logistics — grew by over 11% year-over-year, outpacing the pace of revenue growth. Coca-Cola reported revenue rising to $Revue, but the spike in COGS—driven by ingredient inflation, supply chain disruptions, and higher energy costs—created a narrowing profit margin.

The company’s adjusted gross margin, a key indicator of operational efficiency, contracted by 3.2 percentage points compared to 2023, reflecting the squeeze on cost structures.

Breaking down the financials, COGS totaled $Revue in 2024, representing approximately 37% of total revenue—a significant increase from the prior year’s 34.8%. This rise was most pronounced in key production hubs across North America and Europe, where input costs for high-fructose corn syrup, aluminum packaging, and bottling operations surged.

On the revenue side, $Revue marked a 10.5% increase, fueled by strong brand performance in emerging markets, expanded product innovation, and digital sales momentum. However, margin pressure became evident as COGS absorbed nearly two-thirds of revenue growth, leaving less room to reinvest in brand development or absorb future cost shocks.

What Drives the COGS vs. Revenue Divide in 2024? Several structural factors reshaped Coca-Cola’s cost-revenue calculus in 2024: - Supply Chain Volatility> — Persistent disruptions and geopolitical tensions inflated transportation and raw material costs, particularly in logistics-heavy regions.- Rising Input Prices> — The cost of sugar, aluminum, and PET resin climbed sharply, exceeding inflation rates in earlier years and necessitating larger inventory buffers and procurement adjustments. - Energy Expenses> — Higher global energy prices increased manufacturing costs, particularly for energy-intensive bottling and distribution centers. - Currency Fluctuations> — A weaker U.S.

dollar compared to key international markets complicated cost projections and margin forecasting across diverse geographies. “While revenue shows resilience, COGS growth reflects real operational headwinds that demand proactive cost management,” noted a senior analyst at Catalyst Financial Research. “Coca-Cola’s margins are being tested like never before—efficiency gains and supply chain agility will determine long-term health.”

Despite the margin squeeze, Coca-Cola maintained strong top-line growth, underpinned by pricing power and strategic portfolio expansion.

The company leveraged premium and low-calorie variants to boost average selling prices, partially offsetting COGS pressures. In 2024, non-alcoholic beverage revenue grew by 8.3%, with eco-conscious and functional drink categories gaining traction. Packaging innovations and localized sourcing efforts helped moderate costs in key emerging markets, where inflation proved more volatile than in developed economies.

Yet, without significant cost discipline or product mix shifts, analysts warn that COGS-to-revenue ratios may remain elevated well into 2025.

The contrast between rising revenue and climbing COGS highlights a deeper industry trend: global consumer staples firms are confronting unprecedented cost headwinds while navigating evolving consumer preferences. For Coca-Cola, this year’s financial data underscores a critical juncture—making strategic supply chain reconfiguration, investing in cost-efficient production technologies, and optimizing global sourcing essential to protecting long-term earnings. Without decisive action, the financial success seen on financial statements risks becoming unsustainable when quality costs continue to climb.

In an era where operational margins determine investor confidence, Coca-Cola’s 2024 COGS versus revenue story is not just a corporate finance case study—it’s a bellwether for how legacy giants must adapt to survive in a high-inflation, fast-moving marketplace. The company’s ability to balance brand strength with disciplined cost control will define its next chapter, making COGS management one of the most crucial battlegrounds in its ongoing transformation.

The Strategic Levers: How Coca-Cola Plans to Reduce COGS Pressures

Coca-Cola’s leadership has signaled a dual focus on innovation and efficiency to counter rising costs: - Supply Chain Modernization> — Investments in AI-driven demand forecasting and automated warehousing aim to reduce logistics overhead and inventory waste. - Sustainable Packaging Initiatives> — Transitioning to lighter, recyclable materials while securing long-term supplier contracts targets material cost stability.- Local Sourcing & Regional Production> — Strengthening regional supply chains minimizes exposure to currency swings and global disruptions. - Pricing Strategy & Portfolio Adjustment> — Gradual price increases and premium product lines help maintain margin integrity despite inflationary input costs. These measures, though ahead of schedule, remain unproven at scale.

Their success hinges on global execution consistency and speed—factors that will shape whether Coca-Cola stabilizes its margin profile this year or faces prolonged profitability pressure.

Industry Implications: A Wake-Up Call for Consumer Goods

Coca-Cola’s 2024 financial narrative resonates far beyond one corporation. It mirrors a broader crisis in consumer discretionary and staples sectors, where cost inflation challenges the once-assumed stability of gross margins.Retailers, manufacturers, and packaged goods firms globally now face a reckoning: ignore rising input costs, or invest in resilience. For Coca-Cola, the lesson is clear: revenue growth alone does not guarantee profitability when COGS escalates beyond control. Forward-looking analysts emphasize: “COGS management is no longer operational optics

Related Post

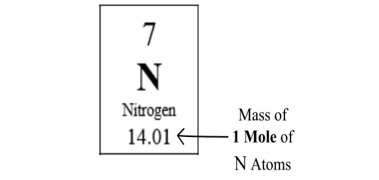

Why N₂’s Molar Mass—14.01 g/mol—Holds the Key to Modern Chemistry

Michael Spivak: The Architect of Mathematical Clarity in a Confusing World

Emily Compagno Without Makeup: The Unmistakable Power of Natural Beauty