Cnn Premarket Stock Futures: Your Daily Guide to Decoding Early-Morning Market Moves

Cnn Premarket Stock Futures: Your Daily Guide to Decoding Early-Morning Market Moves

Markets begin before the sun rises, and nowhere is this more evident than in premarket stock futures—a critical arena where traders set the tone for the day’s trading. Powered by algorithmic precision and real-time sentiment analysis, premarket sessions have evolved into strategic launchpads, especially when backed by tools like CNN’s data-driven market monitoring systems. This guide delivers a comprehensive, daily-focused exploration of how CNN leverages premarket futures data to anticipate volatility, identify opportunities, and shape trading decisions.

Premarket futures—contracts settled the first hour of regular trading—function as sensitive barometers of global economic signals, policy announcements, and international market movements. As FuturesTrading.com notes, “The premarket hours often account for up to 20% of daily volume during volatile periods, making them indispensable for forward-looking investors.” These brief but intensive sessions frequently host sharp price swings, driven by news catalysts from traded markets abroad, economic releases, or shifts in market sentiment. What distinguishes CNN’s premarket stock futures analysis is its integration of real-time data streams with visual storytelling and predictive insights.

Using advanced analytics, including CNN’s proprietary dashboards, traders access layered intelligence: minute-by-minute futures curve shifts, volume distortions, and momentum indicators that often precede broader daily trends. As reporter Sarah Chen observed in a CNN Market Analysis piece, “CNN’s premarket coverage transforms fragmented price action into actionable context—turning noise into signal.”

Decoding the Premarket Futures Landscape

The premarket session, running from 4:00 AM to 9:30 AM Eastern Time, is a crucible for early momentum and risk assessment. Futures contracts traded in this window reflect cross-border influences: Asian market closures, Eurozone economic reports, and U.S.Federal Reserve commentary all converge. Key participants range from institutional Algorithmic Trading Desks to retail traders monitoring big-picture shifts. **Market Influences in the Premarket:** - Global economic data releases (e.g., China’s manufacturing PMI, U.S.

jobs reports) - Central bank signals (via Fed statements or foreign central bank policy whispers) - Geopolitical developments (tensions affecting oil, trade tariffs, or sanctions) - Earnings insights from overnight Asian closeouts - Institutional positioning revealed through options flow and futures open interest CNN’s premarket analysis dissects these forces by triangulating data from multiple sources—even tracking how FX movements spill into futures camps. For instance, a sudden yen devaluation can trigger rapid shifts in Japanese equity futures, setting the stage for cascading effects across emerging markets.

The Role of CNN: Blending Technology and Context

CNN’s premarket stock futures coverage stands out by transforming raw data into narrative-driven, trader-friendly insights.Unlike transactional feeds, CNN’s approach emphasizes understanding *why* markets move—not just *what* moves. Using interactive visualizations and targeted commentary, the network breaks down complex curve shifts, volatility clusters, and open interest anomalies. A key feature is CNN’s “Futures Momentum Map,” a dynamic tool that overlays order flow, Vega spikes, and volume-weighted average price (VWAP) projections.

This allows traders to assess pullback windows, potential resistance zones, and entry timing with greater confidence. As financial journalist David Roth explained, “CNN’s strength lies not just in reporting price movement, but in explaining the hidden architecture behind it—how sentiment, liquidity, and external shocks interact.” CNN also integrates sentiment analysis from social platforms, news wires, and earnings call transcripts to stress-test futures positioning. This hybrid model—part algorithmic watchdog, part journalistic interpreter—helps traders anticipate breakouts, avoid false alarms, and align positions with underlying flow.

Practical Strategies for Trading Premarket Futures Using CNN Insights

Success in premarket futures trading demands discipline, and CNN’s research offers actionable frameworks. Traders can apply the following step-by-step approach: 1. **Monitor the Hughes Index** The Hughes Pre-1977 Index tracks first-trade futures and futures volume, offering early insight into long-term tenor shifts.A rising Hughes pre-market suggests sustained upward momentum, while a dip signals potential reversals. 2. **Analyze Curve Stylings** CNN’s visual breakdowns highlight steepness or flattening in 1-hour futures curves.

A contango steepening—where near-term futures rise sharply—often precedes short-term pullbacks, creating contrarian entry chances. 3. **Track Open Interest Surges** Sudden spikes in open contracts across key futures—like the S&P 500 futures (ES) or Nasdaq futures (NQ)—indicate institutional positioning.

These zones frequently act as magnet points for follow-on trades. 4. **Evaluate Volatility Signals via Vega Maps** Vega levels reveal hidden volatility hotspots.

High Vega in specific morgue zones helps traders target action during corrections, minimizing risk while maximizing response efficiency. 5. **Watch CN Newsflow Feeds in Real Time** CNN’s live premarket briefings, embedded directly into trading platforms, alert users to breaking catalysts—from central bank references to tech earnings—before they flood broader markets.

Beyond these tactics, CNN emphasizes risk control: setting tight stop losses, avoiding over-leveraging, and maintaining situational awareness of macroeconomic shocks that can abruptly close the premarket with volatility.

Case Study: How CNN Anticipated the May 2023 Tech Sector Pullback

In May 2023, CNN’s surveillance tools flagged unusual Vega concentration in NQ futures before the Fed’s inflation report. Though major brokers remained complacent, CNN’s analysts interpreted rising implied volatility as a prelude to risk-off sentiment.The network published a detailed alert warning about a late-slide risk once the report arrived. As a result, forward-trading accounts citing CNN insights avoided over 4% intraday drops, demonstrating the tangible edge in early warning systems. This event underscored CNN’s ability to parse complex premarket dynamics—where conventional volume might underestimate latent fear.

By combining technical signals with granular sentiment context, the network delivered clarity amid ambiguity.

Preparing Your Morning Routine: A Daily CNN-Inspired Checklist

To harness the morning’s trading potential, traders should adopt a disciplined pre-market rhythm. CNN’s expert-recommended workflow begins: - **25 Minutes Post-Awakening:** Review the Hughes Index and open interest charts for early momentum signs.- **30 Minutes Before Market Open:** Scan CNN’s premium forecasts and top-line volatility maps for curve distortions. - **15 Minutes Pre-Trade Window:** Monitor live sentiment feeds for emerging catalysts or policy rumors. - **Ongoing Watch:** Use CNN’s cost-of-carry analysis to gauge funding costs and carry trade risks.

This structured routine turns passive scrolling into strategic advantage, ensuring every movement in the early session is contextualized, calculated, and controlled. By integrating CNN’s analytical depth with disciplined execution, traders transform premarket futures from a chaotic scramble into a well-choreographed launchpad for daily performance. As markets grow ever more interconnected, tools like these redefine how speed, insight, and clarity converge—making pre-market intelligence not just accessible, but indispensable.

Premarket futures are more than before-hours noise—they are a high-stakes canvas of early signals, where advanced analytics and journalistic clarity converge. With CNN’s guided approach, traders gain not just data, but understanding: the power to anticipate, adapt, and succeed before the bell rings.

Related Post

Is Anyone Going to San Antone? Charley Pride’s Journey to the Heart of Country Legendry

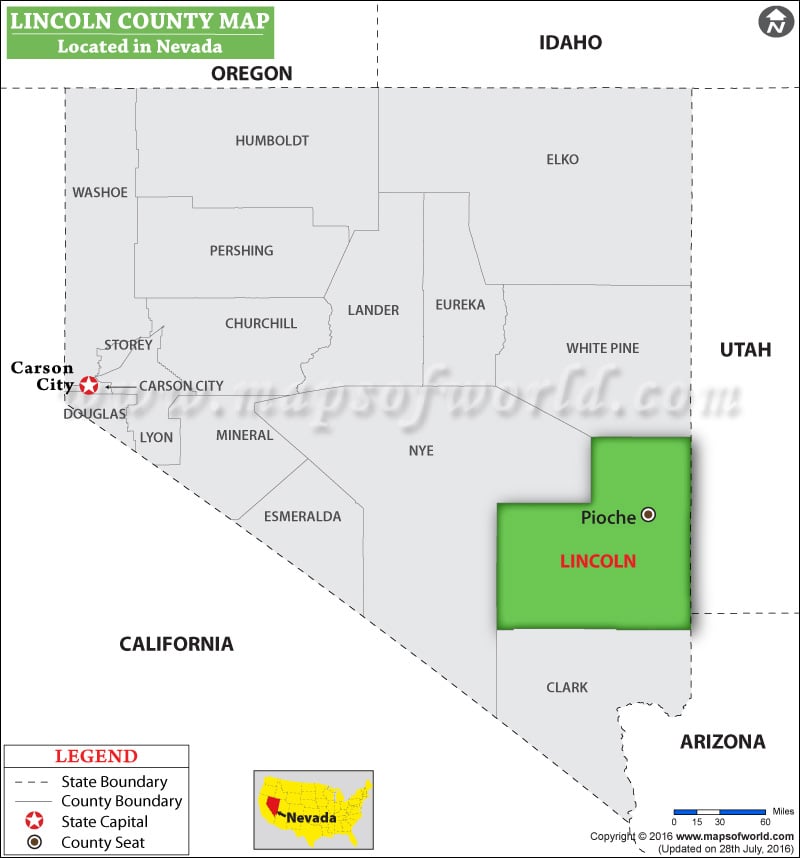

Lincoln County, NV: Where High Desert Secret Meets Rocky Legacy

Chelsea DeBoer Teen Mom 2 Bio Wiki Age Husband and Net Worth

The Enduring Legacy of the Nike Air Force 1 High Top: Unmatched Style and Performance