Cashapp: The Digital Wallet Revolutionizing How Americans Send Money

Cashapp: The Digital Wallet Revolutionizing How Americans Send Money

In an era defined by instant connectivity and cashless transactions, Cashapp has emerged as a dominant force in peer-to-peer payments, reshaping how millions move funds—especially among younger users and underserved communities. With over 80 million active users and consistent growth in transaction volume, Cashapp isn’t just an app; it’s a financial ecosystem built on speed, simplicity, and accessibility. From splitting dinner bills to sending emergency funds in seconds, Cashapp has become synonymous with modern money movement.

Launched in 2013, Cashapp began as a convenient way to split costs using a linked bank account or debit card but has since evolved into a multifaceted platform integrating banking services, stock trading, Bitcoin purchases, and even cash deposits—all within a single interface. This transformation reflects a broader shift in fintech: users now expect integrated financial tools that replace separate apps for payments, investing, and budgeting. According to a 2023 report by Statista, 65% of Cashapp users under age 35 rely on the app not just for transferring money, but as their primary financial gateway.

The Engineering Behind Cashapp’s Instant Transfers

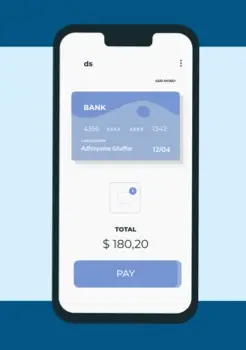

At the heart of Cashapp’s success is its focus on speed and reliability.Instant payments—capable of reaching a recipient’s Cashapp account in under three minutes—are powered by a proprietary real-time payment system that connects directly to the Federal Reserve’s FedNow Network. This integration ensures transactions process instantly, even across banks, eliminating the delays common with traditional ACH transfers.

Key technical features enabling this infrastructure include:

- Instant Link Technology: Users can send money using only a mobile number or an email, bypassing the need for manual bank account verification each time—critical for fast, frictionless transfers.

- Direct Bank Connectivity: Cashapp partners with major financial institutions through secure APIs, allowing real-time fund access and settlement without cash or physical checks.

- End-to-End Encryption: Every transaction is protected with military-grade security protocols, giving users confidence in the safety of their funds.

These advancements are not just incremental improvements—they represent a fundamental shift in payment expectations. As Cashapp co-founder and CEO James Li noted in a 2022 interview, “Speed isn’t a feature at Cashapp; it’s the core promise.

Users don’t want transactions—they want immediate connectivity.”

Cashapp’s Role Beyond Transfers: From Payments to Financial Empowerment

While Instant Transfer remains Cashapp’s flagship function, the platform has expanded aggressively into broader financial services. Cashappend Cash, the app’s debit-like offering, lets users hold and spend cash without holding a full bank account, filling a critical gap for unbanked or underbanked users who represent a significant demographic in the U.S. financial landscape.Equally transformative is Cashapp’s integration with investing and crypto: over 30% of users now allocate some portion of their linked funds to stocks or Bitcoin—transactions initiated directly within the app. This bundling of everyday payments with wealth-building tools positions Cashapp as a gateway to mainstream financial participation.

The platform’s Cash App Investing feature, for instance, enables fractional share purchases with no account minimum, lowering barriers for new investors. Meanwhile, the Cash App Crypto service allows seamless buying, selling, and holding of digital assets—all tracked and managed from one dashboard.

This convergence of utility and opportunity distinguishes Cashapp from traditional payment apps that silo transactions from growth.

“We’re not just sending money—we’re helping people build wealth, learn finance, and take control of their money in real time,” said a Cashapp product strategist in 2023. “Our goal is to make sophisticated finance accessible to everyone, not just those with complex banking relationships.”

Security, Compliance, and Regulatory Safeguards in Cashapp’s Operations

As financial activity moves increasingly online, trust remains paramount.Cashapp adheres to rigorous industry

Related Post

How Cash App Facilitates Instant Financial Flips – See Kattie Shay’s Cash App Screenshot Reveal the Secrets Behind “Flips” in Real Time

Lenore Dove: Unraveling the Enigma of a Literary Luminary

Watch the Charlie Kirk College Debates: Unfiltered Voice on Campus Authority and Student Autonomy