Cash App For Direct Deposit: A Smart Move or Financial Risk?

Cash App For Direct Deposit: A Smart Move or Financial Risk?

For millions of Americans banking online, Cash App’s ability to receive direct deposit has become a game-changing feature—but is it truly a smart financial strategy? Direct deposit via Cash App allows users to receive paychecks, gig payments, and transfer funds directly into their linked account with speed and compatibility that traditional banking methods sometimes lack. As more employers begin adopting Cash App as a payroll option, understanding its pros, limitations, and potential pitfalls is essential for making informed decisions.

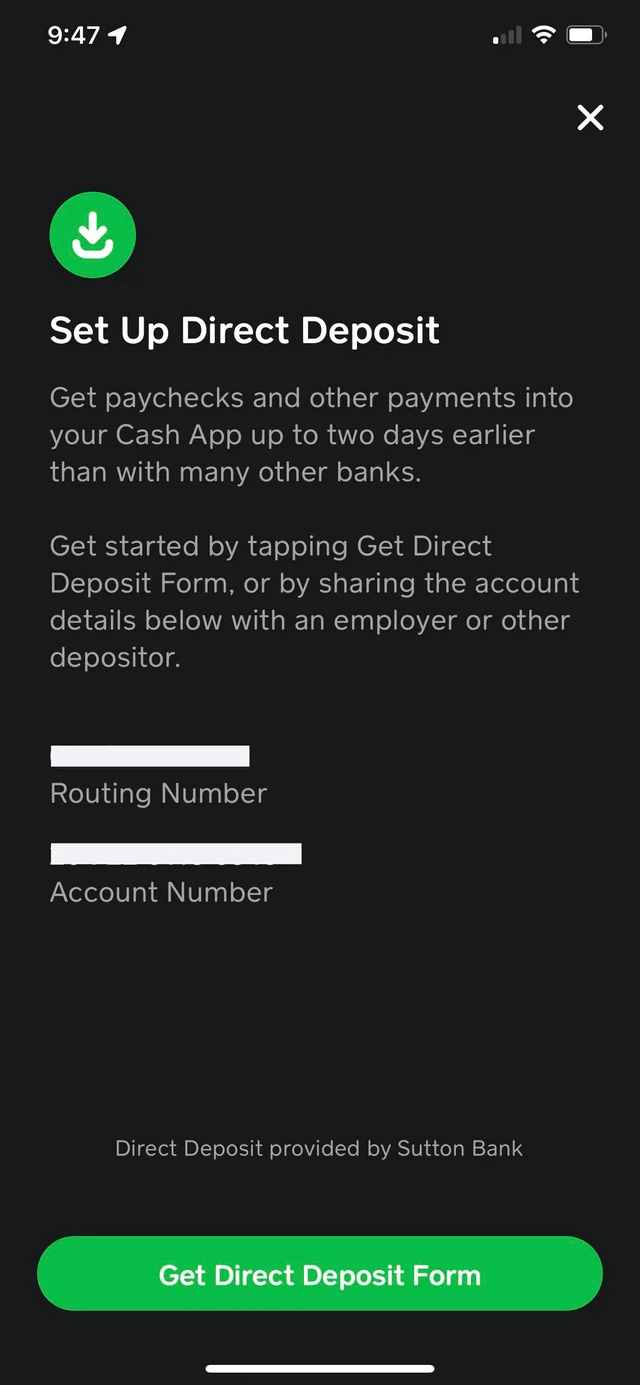

The mechanics behind direct deposit through Cash App are straightforward and user-friendly. Users request their employer or payor to add their Cash App handle as a deposit destination, typically by entering the app’s unique legacy payment format: XXXX-XXXX-XXXX-XXXX. Unlike bank transfers that may take 1–3 business days, direct deposit via Cash App often settles within 24 hours, enabling immediate access to funds when work ends.

This reliability transforms cash flow management for freelancers, gig workers, and students who rely on timely payments. As one Cash App user noted, “Getting my weekly Uber earnings instantly via Cash App meant I could pay rent on time the very next morning—no bank idle days.”

But extending direct deposit to Cash App introduces important financial considerations. One major advantage is convenience: eliminating physical checks reduces lost or misplaced payments and streamlines budgeting.

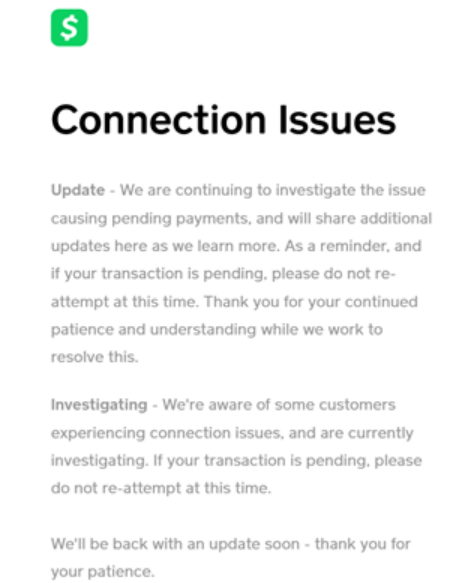

For self-employed individuals, connecting their Cash App to direct deposit functionalities offers an efficient way to standardize income receipt, making tax tracking and expense planning more accurate. Nevertheless, not all pay periods align perfectly with direct deposit schedules. Small fluctuations—such as a biweekly salary landing two weeks late—can delay fund arrival, potentially straining short-term cash flow.

This mismatch demands proactive monitoring to avoid missed payments on rent, utilities, or loan obligations.

Security remains a cornerstone of Cash App’s appeal and a key factor when evaluating direct deposit risks. Cash App employs industry-leading encryption, two-factor authentication, and real-time fraud alerts—features that protect user funds almost instantly in case of unauthorized access. However, the ease of linking accounts increases vulnerability if users share login details or store sensitive data outside secure environments.

Unlike established bank STEPS or ACH systems with deposit protection under federal law, Cash App operates as a third-party platform with its own security protocols. While no system guarantees full immunity, responsibility rests partially on user vigilance.

Another critical consideration is the absence of FDIC insurance. With direct deposits into traditional financial institutions, funds are protected up to $250,000 per depositor, per bank, by federal mandate.

Cash App does not hold these deposits in FDIC-insured accounts, meaning uninsured balances risk total loss—a stark contrast when quickly accessing funds should be a strength. Though the app protects sensitive transactions, the lack of deposit insurance means users must treat direct deposit through Cash App with heightened awareness, especially during early adoption or large payouts. As financial educator Jane Reynolds emphasizes, “Direct deposit convenience shouldn’t mask the true custody of your funds—know where your money resides.”

Functionally, not all pay periods or employment structures support seamless Cash App direct deposit.

Some employers, particularly smaller businesses or nonprofit organizations, may lack the infrastructure or policy to process Civic-based payments. Others may distribute irregular income—such as monthly bonuses or quarterly grants—more conveniently through bank transfers. This variability underscores the importance of aligning payment methods with income timing and spending habits.

Gig workers, freelancers, and contract laborers often benefit most, where immediate access directly correlates with enhanced financial agility.

- Employer Adoption: Major platforms like Uber, DoorDash, and postwave now support Cash App direct deposits, reflecting growing institutional acceptance.

- Deposit Speed: Typical 24-hour settlement outpaces bank transfers, reducing cash availability delays.

- Industry Targeting: Best suited for regular, predictable income streams—ideal for salaried workers but less flexible for irregular earnings.

- Fee Structure: Cash App offers limited free access to depositing funds but imposes fees for instant transfers, whereas employer-paid direct deposits often involve no cost.

Looking beyond immediate convenience, Cash App’s direct deposit capability integrates into a broader ecosystem of financial tools. Users combining Cash App with linked financial management apps enable real-time tracking of income inflows, smoother budgeting, and faster tax preparation.

Automated reminders for upcoming deposits further reduce the chance of payment gaps. This synergy enhances financial discipline without sacrificing speed—an increasingly valuable trait in fast-paced digital economies.

Yet long-term adoption demands careful planning. Relying solely on Cash App for direct deposit limits access to high-yield savings accounts or traditional bank benefits tied to broader financial relationships.

Diversification often serves as the smarter path—using Cash App for day-to-day liquidity while maintaining accounts at FDIC-insured banks for larger, stable balances. Financial advisor Marcus Cole advises, “Think of cash flow tools as responsibly managing short-term liquidity—Cash App is excellent for immediate needs, but your overall strategy should safeguard long-term security.”

Ultimately, using Cash App for direct deposit is a powerful convenience for many, especially frequent earn

Related Post

Gnula .Nu: Redefining Affordable, High-Performance Cloud Computing for Developers

Ittefaq Newspaper Epaper: Your Daily Dose of News That Powers Action and Awareness

Miro Accuses CJ Perry Of Bringing Out The Worst In Him

The Critical Role of the Army Height and Weight Table in Modern Military Fitness