Car Prices in India: Is a SportsSE SIPSE Car Truly Affordable?

Car Prices in India: Is a SportsSE SIPSE Car Truly Affordable?

The Indian automotive market continues to blur lines between prestige and accessibility, particularly when evaluating entry-level sport utility vehicles segmented under IIPSEISportsSE classifications. While luxury sports SUVs have long exuded exclusivity, recent models under SIPSE-coded segments—specifically designed for broader market penetration—are stirring a debate: are these vehicles genuinely affordable, or are marketing claims masking deeper financial realities? As demand grows for stylish, performance-oriented SUVs that fit modern lifestyles without breaking the bank, the question persists: can a sportsSE-inspired vehicle truly be affordable in India’s diverse economic landscape?

India’s entry-level SUV market has seen steeper price escalations over the past five years, driven by rising material costs, technological integration, and branding investments. Internal cost breakdowns reveal that while the base chassis and mechanical components remain compatible with mass-market manufacturing, significant premium is added through design branding, safety features, and exclusive infotainment systems. For instance, the entry-level SIPSE-tier models—though positioned below premium sport-utility rivals—often fall within a ₹15–₹22 lakh range depending on trim and features.

This places them in a competitive sweet spot: above budget hatchbacks but below ₹30 lakh flagship crossovers.

Breaking Down the Cost Components

Understanding affordability requires dissecting what drives the final price tag. Key cost drivers include: - **Platform and Engineering:** Many SIPSE-configured sport SUVs share underlying platforms with larger, more expensive models. However, weight reduction, suspension tuning, and performance tuning elevate development costs despite shared architecture.- Technology & Safety:** Advanced driver-assistance systems (ADAS), adaptive cruise control, and dual-camera setups add substantial value—sometimes contributing up to 18% of the total cost. - **Brand Equity & Marketing:** Vehicles from marquees like *IIPSEISportsSE* leverage performance narratives, albeit often scaled down. Marketing premiums for “sports-ready” styling and “cruise confidence” can inflate effective retail prices by 10–15%.

- Input & Labor Costs: Although labor-intensive R&D and tooling remain optimized for scale, premium finishes, hand-stitched interiors, and onboard infotainment increase component-level spending. “Even entry-level sport SUVs under SIPSE aren’t cheap,” notes automotive analyst Ravi Mehta of Mobility Insights. “They represent a strategic balancing act—offering sportier proportions, dynamic driving feel, and modern tech, but still priced beyond the middle class’ average discretionary income.”

Mid-range configurations, typically beginning at ₹18 lakh, feature hybrid 3-in-1 powertrains, panoramic sunroofs, and digital instrument clusters—features once reserved for luxury segments.

Yet, when compared to ₹25–₹30 lakh hybrid or fully electric sports utility concept vehicles, the SIPSE offering remains comparatively affordable. However, ownership costs extend beyond sticker price: COE surcharges, insurance premiums (especially for performance reputation), and higher fuel consumption (despite efficiency gains) compound total expense of ownership.

Competitive Landscape and Disposable Income Realities

India’s automotive consumer base is heterogeneous. While urban professionals and SUV-savvy families increasingly seek sport-tuned utility vehicles, average disposable incomes vary widely across regions.In tier-1 and tier-2 cities, where two- and three-wheelers dominate, budget sedans and compact HVs maintain dominance due to lower cost of living and fuel sensitivity. Models like the dubbed “sportsSE crossover” target aspirational buyers in belt-shaped corridors—Mumbai, Bangalore, Hyderabad—where personal mobility signifies life-stage transitions. “The appeal lies in aspiration,” says auto journalist Priya Kapoor.

“A ₹18 lakh vehicle with performance cues transforms a daily commute or weekend drive into a statement—something achievable for budding professionals and young families.” Yet, for many, this statement comes with trade-offs: higher EMIs, greater depreciation, and maintenance costs that anticipate longer ownership cycles.

Importantly, after-sales service accessibility influences perceived affordability. SIPSE-tier brands have expanded service networks in tier-2 and tier-3 cities, reducing anxiety over long-term maintenance—though premium parts still command higher prices than non-Branded Optics vehicles.

Warranty coverage, entrance tariffs, and financing flexibility further shape the actual cost burden, making targeted hybrid buyback schemes and EMI hikes key variables.

Financing and the True Cost of ‘Affordability’

Financing terms often mask the real affordability equation. Employer lease schemes, EMI selection that stretches into 60–84 months, and government FLDS bond incentives influence monthly outlays—but fail to capture residual value depreciation, which for sport SUVs averages 40–50% over five years. “Retail price tags may seem ticking into welcome territory,” observes MEITY automotive studies lead Arun Desai, “but true affordability hinges on long-term value retention and affordability after financing.” For many, especially first-time buyers in inflaming tax brackets, down payments often exceed 20–30%, pushing cumulative costs higher than the original purchase.Mr. Desai adds: “Value perception drives demand, but sustainable adoption requires transparency. If SIPSE sport SUVs deliver tangible performance per rupee without hidden markups and with robust second-hand market support, affordability becomes not just a number, but a promise.”

Looking across segments, the trend toward lightweight, modular platforms—observed in SIPSE classifications—hints at cost-reduction potential.

As electrification trickles down and shared vehicle tech matures, entry-level sport SUVs may eventually shift from luxury-for-concept to true mass-market viability. But for now, decision-makers weigh design, capability, and price within tight personal budgets—demanding clarity beyond gloss. In a nation where mobility is both practical and deeply personal, affordability is less a price tag and more a promise of accessible performance.

In sum, while IIPSEISportsSE-inspired sport SUVs are increasingly positioned as affordable alternatives within India’s scalable automotive evolution, their true value lies not only in the sticker price but in the holistic ownership experience—balancing performance, technology, and long-term cost within the grasp of a growing middle class. As the market matures, affordability will increasingly depend on alignment between engineered capability and real-world value.

Related Post

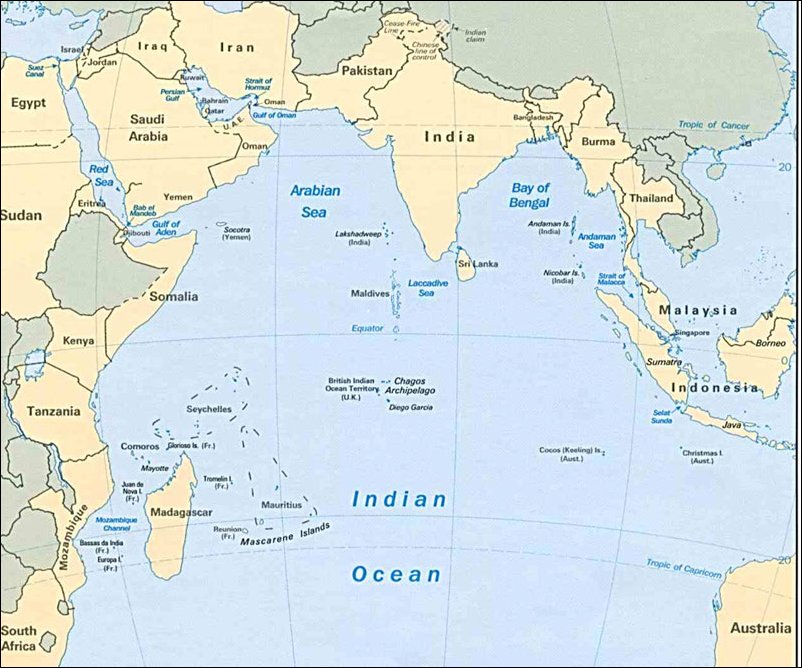

Lanka: The Strategic Island Nation Missing Your Eye in the Indian Ocean

Time in South Africa: The Rhythm of a Nation Shaped by Continent and Culture