Capital One Slashes Jobs: A Controversial Move Amid Shifting Financial Forces

Capital One Slashes Jobs: A Controversial Move Amid Shifting Financial Forces

In a decisive restructuring move reflecting broader challenges in consumer banking, Capital One announced significant job cuts earlier this year, eliminating hundreds of positions across operations, technology, and customer service. The decision, attributed to evolving market demands, margin pressures, and the need for digital transformation, marks a turning point in the company’s strategy—placing human resources under intense scrutiny as financial institutions recalibrate for an increasingly automated future. The announcement revealed, through internal communications and public filings, that Capital One plans to reduce its global workforce by approximately 2,000 employees.

This move follows earlier cost-cutting measures across multiple sectors, signaling a sustained effort to align operational scale with current economic realities. The affected groups span multiple functions including back-office administration, IT infrastructure, and regional customer support centers. Drivers Behind the Layoffs: Market Pressures and Strategic Realignment

Capital One’s restructuring is rooted in several interlocking factors shaping the financial services landscape.

The rise of fintech competitors, shifting customer behavior toward self-service banking, and sustained inflationary pressures have compressed profit margins across the industry. In a statement, CEO Richard partners highlighted, “In a dynamic environment, agility and efficiency define survival. This cut is not a reflection on our core mission, but a necessary step to future-proof Capital One.” Key focus areas of the reduction include: - Back-office operations requiring leaner administrative staffing.

- Legacy IT support roles as legacy systems are modernized. - Customer service units transitioning toward AI-driven platforms and omnichannel engagement. “Digital transformation isn’t optional—it’s urgent,” said a senior executive involved in the restructuring initiative.

“Reducing redundancy in overlapping functions allows us to redirect talent and investment toward innovation, security, and personalized customer experiences.” Some analysts interpret the moves as part of a broader industry trend: “Capital One’s actions mirror a wake-up call for traditional banks,” noted industry observer Elena Martinez. “But while layoffs are painful, the underlying shift toward tech-driven efficiency is irreversible. Companies that delay face deeper challenges in competitiveness.”

Impact on Employees and Workforce Dynamics

The layoffs have already triggered widespread concern among employees and industry watchers alike.

Thousands of workers at Capital One facilities across the U.S.—from overlapping regional offices in Texas to data analytics teams in Northern Virginia—face immediate job uncertainty. The company has committed to severance packages, career transition support, and opportunities for internal redeployment, though details remain limited. Former Capital One employees emphasize the emotional toll, described as both a personal setback and a symptom of industry upheaval.

“Losing colleagues who’ve spent their careers here hits hard,” said one long-time employee. “But many see the cuts as unavoidable—ignoring them would do little, and adaptation is inevitable.” Expert reviewers note the strain on workplace morale and recruitment pipelines. “Organizations that shed talent without rebuilding roles risk losing institutional knowledge and eroding trust,” said HR strategist Marcus Lin.

“Capital One’s challenge lies in managing this transition with transparency while maintaining its capacity for innovation.”

Related Post

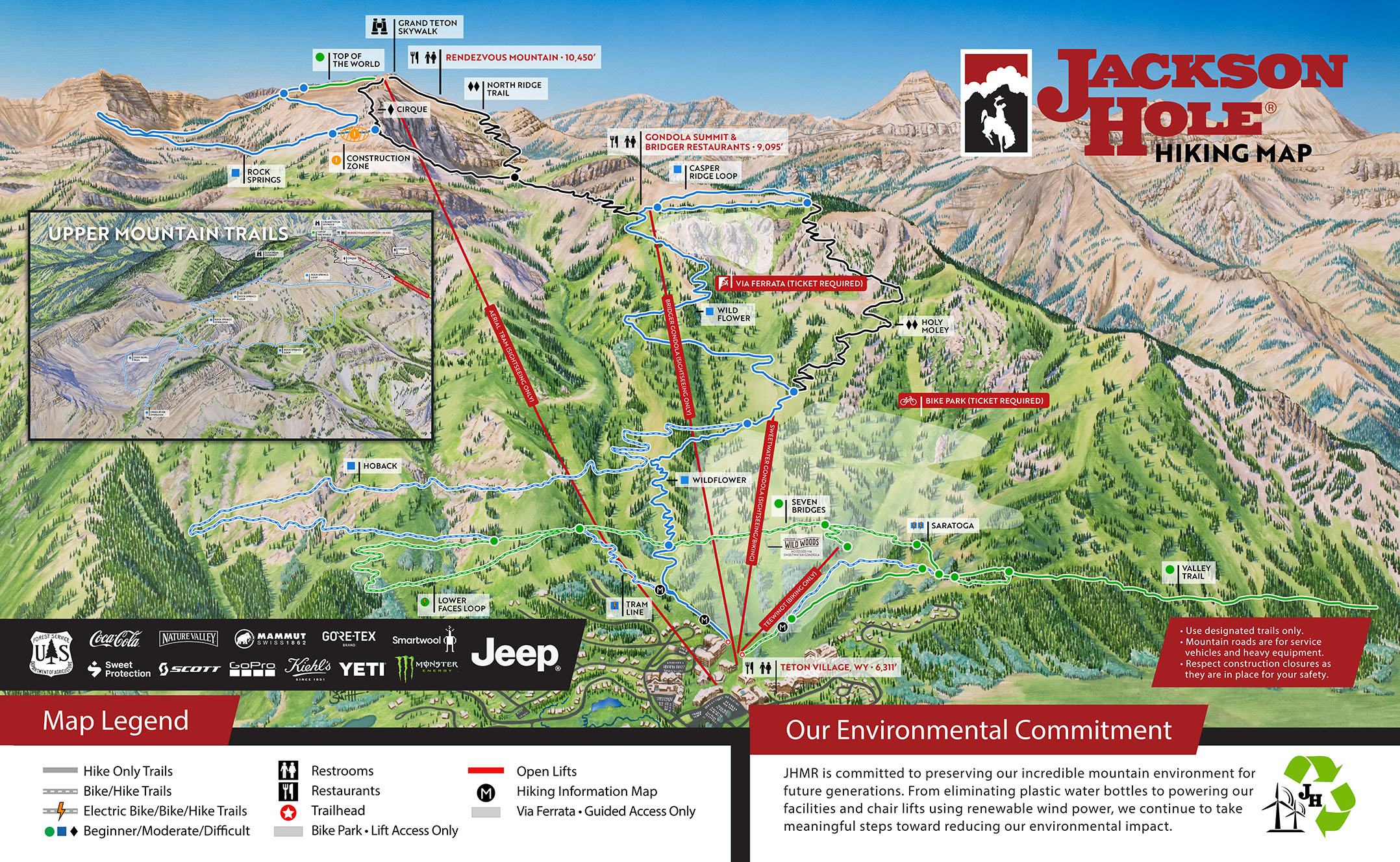

Summer in Jackson Hole: Where Rocky Mountain Splendor Ignites

Cristian Calderón: Architect of Judicial Integrity in a Turbulent Era

The Enduring Symbol of Resistance and Unity: The Philadelphia Phillies Emblem

Exploring The Life Of Matt Doherty's Wife: A Deep Dive Into Their Relationship