Calculate Roi: The Essential Guide to Measuring Investment Success

Calculate Roi: The Essential Guide to Measuring Investment Success

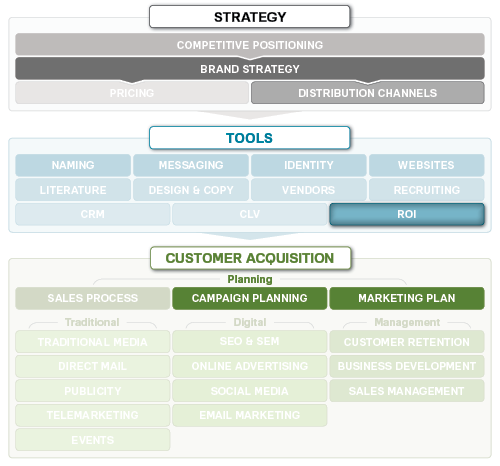

In an era where every business dollar counts, calculating Return on Investment (ROI) stands as the cornerstone of strategic decision-making. ROI transforms abstract financial data into clear, actionable insights, enabling leaders to evaluate performance, justify expenditures, and steer resources toward high-impact initiatives. Whether scaling a startup, optimizing marketing campaigns, or upgrading technology infrastructure, mastering ROI calculation empowers organizations to move from guesswork to precision.

>

Understanding ROI: Beyond the Basic Formula

ROI quantifies the financial return generated from an investment relative to its cost, expressed as a percentage. The fundamental formula—(Net Profit / Investment Cost) × 100—provides a simple yet powerful snapshot of efficiency. When ROI is positive and outpaces benchmark thresholds, it signals value; when negative, it flags inefficiency.But true ROI insight goes deeper than a single number. Smith & Associates’ 2023 benchmark report reveals that top-performing organizations integrate multi-dimensional ROI analysis, factoring in both direct monetary gains and indirect benefits such as customer retention, brand equity, and employee productivity. “ROI isn’t just about profits snowing in—the GPU upgrades we funded last quarter boosted data speed, cutting operational delays and increasing client satisfaction,” explains Dr.

Elena Torres, CFO at Innovatech Solutions. “That indirect impact now forms part of our holistic ROI model.” >

The Core Components of ROI Calculation

To calculate ROI accurately, three precise elements must be measured: - **Net Profit**: This is the total revenue generated by the investment minus all associated costs—including direct expenses, labor, materials, and overhead. Precise tracking ensures no revenue stream is overlooked and no cost remains hidden.- **Investment Cost**: The total funds deployed, including upfront outlays, maintenance, training, and implementation fees. A comprehensive view here prevents underestimating true expense. - **Time Frame**: ROI must be measured over a defined period to reflect relevance and context.

Short-term projects may show rapid returns, while long-term ventures reveal sustained value—context is king. > “A miscalculated time frame alone can distort ROI by up to 40%,” cautions Mark Levine, a financial analyst at Strategic Metrics Group. “Investments with delayed returns need annualized ROI to fairly compare against quick-turnaround initiatives.” >

Step-by-Step: How to Calculate ROI Like a Pro

Applying ROI with rigor requires a structured approach, step by step: 1.**Define Objectives and Costs**: Outline the investment goal and compile every dollar spent—procurement, staffing, time, technology. 2. **Project Net Gains**: Estimate revenue uplift, cost avoidance, or value creation with conservative, data-driven projections.

3. **Apply the Rigorous Formula**: Divide net profit by initial investment cost. Example: if $50,000 is invested and $75,000 in net profit is realized, ROI = ($75,000 / $50,000) × 100 = 150%.

4. **Normalize the Result**: Express ROI as a percentage for easy comparison across opportunities. Adjust for inflation and risk where material.

5. **Interpret Within Context**: Benchmark results against industry averages. A 12% ROI may be stellar in retail finance but mediocre in SaaS.

Tools like financial modeling software and CRM analytics deepen accuracy—automation reduces variance, enhances consistency, and accelerates decision timelines. >

Real-World ROI in Action: Case Studies and Insights

Consider a mid-sized e-commerce firm that allocated $100,000 to a personalized email marketing campaign. After six months, conversion rates rose by 35%, and customer lifetime value increased by $45 per client.With additional operational overhead of $20,000 (tools, labor), net profit reached $125,000. Applying the formula: ROI = [($125,000 – $120,000) / $120,000] × 100 ≈ 4.17%—a modest gain, but strategically vital. Yet, when spread across 70,000 engaged clients, the campaign fostered retention that lowered customer acquisition costs by 22% over two years.

In hindsight, ROI was not just a closing score but a catalyst. Tech companies frequently leverage ROI to justify cloud infrastructure investments. A healthcare provider’s $250,000 migration to Azure reduced data processing time by 60% and cut annual IT maintenance costs by $90,000.

Year-over-year ROI: ($90,000 / $250,000) × 100 = 36%—justifying scaling across facilities. > “ROI isn’t just meant for boardrooms—it informs frontline teams too,” says Raj Patel, COO at CloudEdge Systems. “When engineers see their toolkit’s ROI improving, they invest smarter and innovate faster.” >

The Evolving Nature of ROI: Beyond Financial Profit

Modern business demands a broader interpretation of ROI.While financial returns remain foundational, forward-thinking organizations integrate non-monetary metrics to capture full value. These include: - **Customer Lifetime Value (CLV)**: Long-term relationships thrive on retention, advocacy, and repeat revenue. - **Operational Efficiency Gains**: Streamlined processes lower friction, often doubling ROI over time.

- **Sustainability Impact**: ESG-aligned investments, though initially costly, increasingly drive customer loyalty and regulatory resilience. The Standish Group’s 2024 study notes that enterprises adopting “total value ROI” frameworks report 29% higher return consistency over three-year horizons. “ROI today must be multidimensional,” observes Dr.

Lina Cho, an organizational strategist. “It’s about balanced value—profit, purpose, and growth.” >

Maximizing ROI Calculation: Best Practices and Tools

To ensure ROI analysis drives real impact, organizations should adopt structured best practices: - **Set Clear KPIs Early**: Define primary and secondary success metrics before investment. - **Leverage Automation**: Use ERP systems, BI dashboards, and AI tools to collect accurate, real-time data.- **Perform Scenario Analysis**: Model best-case, worst-case, and base projections to assess risk tolerance. - **Review Post-Investment**: Compare projections to actual outcomes to refine future calculations and improve forecasting accuracy. Tools such as Tableau for visualization, QuickBooks for cost tracking, and specialized ROI calculators streamline workflows, reducing human error and saving critical time.

Business leaders who master ROI calculation don’t just measure success—they engineer it. By grounding aspirations in data, they turn volatile markets into predictable growth, and uncertainty into opportunity. In a world where every investment decision shapes the future, calculating ROI isn’t a bookkeeping afterthought—it’s the compass guiding sustainable success.

:max_bytes(150000):strip_icc()/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

Related Post

Unlock Freedom and Self-Mastery: How *The Four Agreements* Redefine Personal Responsibility and Human Interaction

Gutfeld Cast Tonight’s Episodee280A6 Explodes: “Prepare to Be Outraged” as Cultural Tipping Point Unfolds

Mastering the Art of Rico Suave: Gerardo’s Guide to a Flavor-Focused Legacy

Kanya Grammy: The Festival Electricity Behind India’s Most Anticipated Youth Award