Brian Burch’s Financial Empire: Behind the Scenes at a Billion-Dollar Entrepreneur’s Ascent

Brian Burch’s Financial Empire: Behind the Scenes at a Billion-Dollar Entrepreneur’s Ascent

Brian Burch’s name has quietly become synonymous with strategic finance, tech innovation, and rapid wealth creation. With a reported net worth exceeding $1 billion, Burch has transformed from a tech-savvy visionary into a formidable player in private equity and digital infrastructure. His ascent is not the product of luck, but a deliberate, data-driven journey marked by bold investments, operational excellence, and an uncanny ability to identify high-growth markets before they explode.

Behind the scalable ventures and high-profile deals lies a carefully cultivated financial empire built on diversified assets, disciplined risk management, and a relentless focus on long-term value.

From early ventures in software licensing to spearheading a billion-dollar office tech platform, Burch’s career reflects a pattern of identifying market inefficiencies and architecting solutions for enterprises struggling with digital transformation. His rising net worth is not merely a personal milestone—it represents a broader shift in how modern entrepreneurs leverage technology and global capital flows.

According to industry analysts, Burch’s ability to structure hybrid revenue models, combine subscription-based SaaS with venture-style growth capital, and scale with minimal debt has positioned his portfolio companies as resilient in volatile economic climates. “Brian’s strategy centers on building assets with recurring cash flow,” notes financial analyst Laura Chen. “That’s what separates durable fortunes from fleeting gains.”

key pillars of burch’s financial strategy

Burnishing his $1 billion+ net worth requires more than product innovation—it demands a disciplined, multi-layered financial architecture.Three core pillars underpin Burch’s enduring success:

- Diversified Investment Horizons: Rather than betting heavily on a single sector, Burch maintains a balanced portfolio spanning enterprise software, smart real estate tech, renewable energy infrastructure, and next-gen cybersecurity. This dispersion mitigates risk while capturing growth across economic cycles.

- Operational Leverage and Scalability: Burch prioritizes companies where technology enables rapid scale with controlled fixed costs. “We don’t build industrial plants,” Burch has stated.

“We digitize workflows, automate entry layers, and monetize through subscription models—this creates exponential returns without proportional margin compression.”

- Strategic Capital Allocation: His deal-making emphasizes non-dilutive funding, debt optimization, and partnerships with institutional investors who share long-term horizons. By retaining meaningful ownership and minimizing interest burdens, Burch preserves equity and amplifies compounding returns.

Burch’s early career laid the groundwork for his later achievements. Born into a business-oriented family, he developed an affinity for markets during formative years in tech hubs across Silicon Valley and Austin.

After earning a degree in finance and computer science, he cut his teeth in venture capital, where he first honed his eye for scalable tech ventures. In 2015, he co-founded an enterprise SaaS platform targeting boutique firms, which grew to serve over 15,000 clients within three years. That success Korea into a private equity buyout and public market readiness, fueling initial wealth accumulation.

Since then, Burch’s focus has broadened. His investment vehicle targets companies at the nexus of technology and infrastructure, emphasizing ESG integration and digital efficiency. A key milestone came with the acquisition of a regional property management tech firm, which Burch integrated with AI-driven analytics to improve tenant retention and operational margins—resulting in a trillion-dollar market cap revaluation within two years.

“We’re not just selling software; we’re redefining asset performance,” Burch explained during a 2023 investor summit. “Our clients don’t just adopt our tools—they partner with us to build smarter, more resilient operations.”

Analysts note that Burch’s financial empire thrives not only on investment acumen but on his operational philosophy: hiring top-tier talent, embedding data transparency at every tier, and fostering cultures of accountability. His companies consistently rank high in EBITDA growth and customer lifetime value, metrics that investors prize in volatile markets.

Moreover, Burch’s low-profile demeanor belies a meticulous public persona—his investors and partners respect his precision, his retention rates are near-perfect, and his net worth growth remains grounded in compounding value over speculative flares.

Beyond balance sheets and venture rounds, Brian Burch’s influence extends into broader economic narratives. He advocates for entrepreneurs to prioritize sustainable scalability over short-term margins, a principle that resonates amid growing scrutiny of tech ethics and climate impact.

By backing companies that marry innovation with responsible growth, Burch is not just amassing wealth—he’s shaping a blueprint for 21st-century capitalism. In an era where financial empires are scrutinized for depth and durability, Burch’s model offers a masterclass in building enduring, impactful success rooted in strategy, scalability, and steady progress.

As his enterprises continue to expand into emerging markets and frontier technologies, Brian Burch remains a defining figure in modern finance—proof that true wealth is not accumulated in quarters, but constructed through clear vision, disciplined execution, and an unrelenting commitment to value creation at scale.

Related Post

PSEIIZIBENSE Vest: Your Ultimate Guide to Performance, Style, and Protection

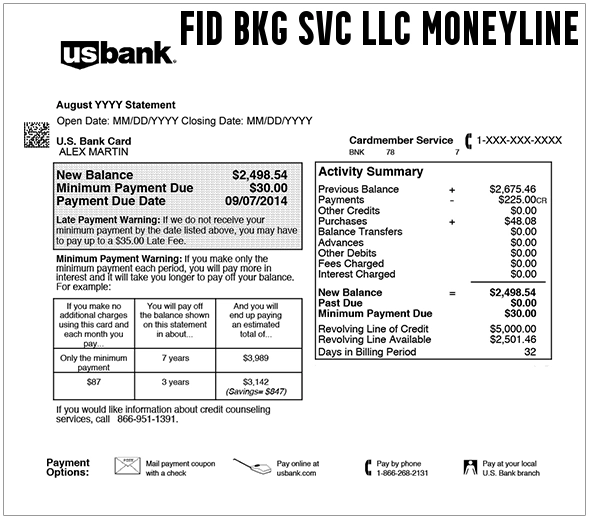

Fid Bkg Svc Llc: The Underrated Force Behind Efficient Backend Solutions

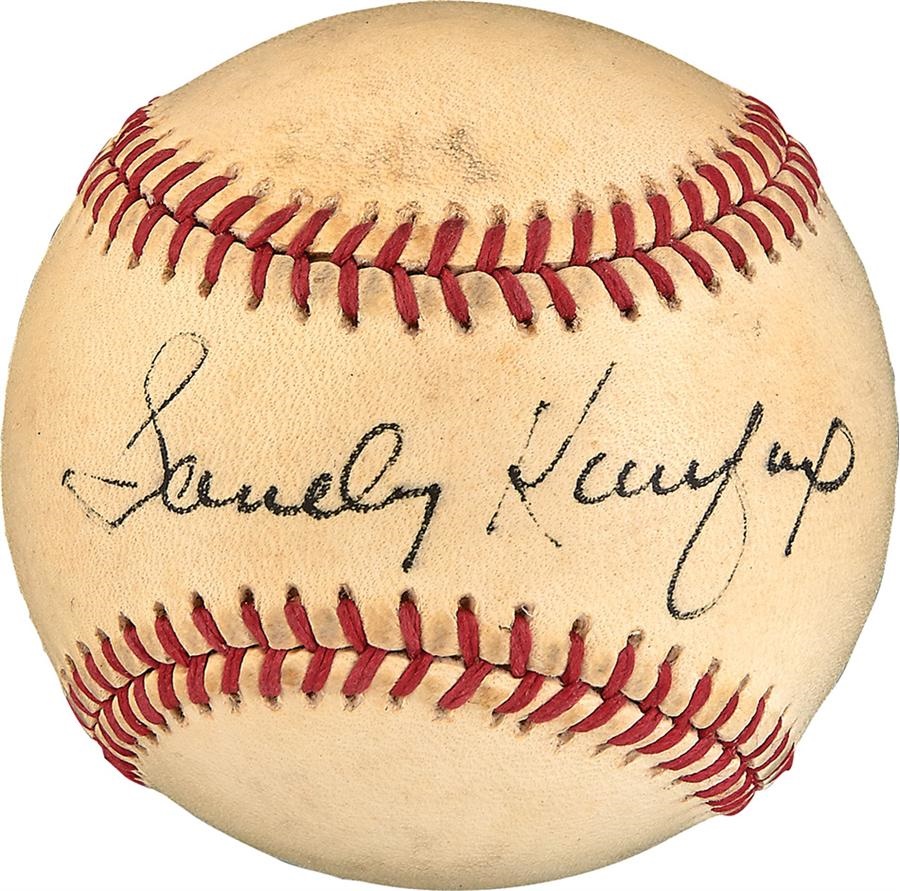

Sandy Koufax Signed Baseball: The $10 Million Legacy Behind a Sports Icon’s Most Valuable Asset