Breaking Bad Profit: Unraveling The Financial Architecture of TV’s Most Lucrative Adventure

Breaking Bad Profit: Unraveling The Financial Architecture of TV’s Most Lucrative Adventure

From its smoky finale to its enduring cultural footprint, *Breaking Bad* was never just a story about crime and transformation—it was, in essence, a masterclass in financial storytelling. Beneath the gripping narrative of Walter White’s descent into meth kingpin runs an intricate financial undercurrent: a detailed portrait of how a behavioral shift translated into measurable economic impact, both within the show’s universe and in the real-world perception of its profitability. This analysis dissects *Breaking Bad*’s financial footprint—from production investments and revenue streams to the real-world economic ripple effects—revealing how a fictional empire mirrored—and occasionally reshaped—the dynamics of illicit trade and creative enterprise.

The Series’ Production Economics Creating *Breaking Bad* required a bold financial commitment from AMC and its collaborators. Serialized television at the time demanded significant upfront investment, especially when crafting a slow-burn drama with high production values. The initial pilot lifted a modest budget of approximately $3.5 million per episode—well above standard cable rates—reflecting the show’s commitment to visual detail, character depth, and suspenseful pacing.

Production costs included extended shooting schedules across Albuquerque, custom-built sets, and a carefully curated cast and crew invested in authenticity. AMC and producers allocated funds not just to equipment and locations but to research and consultation with forensic experts, legal advisors, and even meth lab specialists to ensure procedural accuracy. These choices elevated realism but increased expense.

Yet, that investment proved payoff-defying: the series became AMC’s highest-rated title, attracting a global audience that helped offset initial outlays through platform leverage. Over its five-season run, *Breaking Bad* amassed staggering revenue: industry estimates place total production costs exceeding $180 million, while syndication, streaming rights (notably on Netflix), and international distribution catapulted cumulative earnings into the billions. The financial scale underscores how premium content with tightly woven narratives can generate outsized returns, reshaping expectations for basic TV economics.

Skilling Real Profit From Fiction: The Chain of Economic Value

At the heart of *Breaking Bad*’s financial success lies a dialectic of fiction and real-world commerce. While the show’s profits are proprietary and rights are tightly guarded, their broader economic impact is tangible. The series didn’t just entertain—it created value across multiple sectors.- **Merchandise and Branding:** Official memorabilia—from Eva White’s iconic cardigan replicas to customized meth lab kits—generated steady sales, extending the show’s monetization beyond screen time. - **Streaming and Distribution:** The show’s landmark availability on Netflix amplified its reach, boosting subscription growth and proving library content could drive massive viewer acquisition. - **Tourism Hype:** While not officially branded, the authentic Albuquerque settings featured in the series spurred travel interest, turning fiction into real-world tourism opportunities.

A 2019 report by industry analysts noted that *Breaking Bad*’s streaming performance yielded revenue exceeding $100 million in its first year post-release, demonstrating how serialized prestige drama fuels long-term financial yield. The Economics of Narrative: Why Madrigals Profited Walter White’s transformation from high school chemistry teacher to “Heisenberg” wasn’t just character evolution—it was a financial engine. The narrative’s deliberate pacing mirrored the slow accumulation of wealth in illicit markets, a metaphor that resonated with viewers while simultaneously educating, albeit unknowingly.

Each critical decision Ralph peripherals implied real-world trade-offs: ingresos vs. risk, compounding returns vs. exposure, liquidity constraints vs.

expansion. Narrative economics, as studied by scholars of broadcast storytelling, reveal that *Breaking Bad* mastered the tension between suspense and payoff. Each episode delayed gratification, conditioning audiences to invest emotionally—and financially—into outcomes.

This “built tension” translated into high retention rates, sustaining ad revenue and subscriber commitment. When Heisenberg’s empire collapsed under its own ambition, so too did the illusion—keeping audiences engaged until the final, financially decisive chapter.

Labor, Talent, and Production: Human Capital as Currency

Behind the show’s surface gross figures stands the human investment: actors, writers, crew, and local talent whose labor sustained production quality and added economic weight.Bryan Cranston and Aaron Paul, for example, saw net gains that eclipsed salary reports, benefiting from the series’ critical acclaim and global recognition. Cranston’s next major role, *Billions*, cited *Breaking Bad* as pivotal in cementing his star power—proving how high-impact roles create long-term earning potential. The Albuquerque production hub transformed local economies.

Over 1,000 temporary and permanent jobs were created in construction, hospitality, and technical services. Placement of production crews in New Mexico supported small businesses and drove demand for local expertise, fostering a ripple effect across industries. Industry insiders estimate that every $1 million invested in *Breaking Bad* production generated approximately $2.30 in regional economic activity—evidence that impactful storytelling doubles as economic stimulus.

Lessons in Profitability for Television Creators

*Breaking Bad* demonstrated that profitability in television hinges not just on ratings, but on strategic financial planning across development, production, distribution, and monetization. The series leveraged: - **Brand Equity:** Characters and aesthetics became global assets, enabling merchandising and syndication. - **Streaming-First Strategy:** Early partnership with Netflix expanded audience access and revenue scalability beyond traditional broadcast windows.- **Quality Over Quantity:** Limiting episodes to six per season preserved narrative precision, reducing production waste and maximizing each episode’s emotional and financial impact. These principles have since influenced networks and streaming platforms alike, shifting industry norms toward prioritizing craftsmanship and long-term ROI over short-term gains. Studio executives now benchmark new projects against *Breaking Bad*’s integrated financial architecture, recognizing that sustainable success requires balancing artistry with economic acumen.

In the end, *Breaking Bad* endures not only as a storytelling milestone but as an economic blueprint—proving that meticulous financial planning, anchored in compelling narrative, can generate enduring profit and cultural capital. The show’s true profit lies not just in dollars, but in reshaping how the industry imagines—and monetizes—the potential of television.

From production wakes and revenue streams to labor investments and tourism ripple effects, the financial dimension of *Breaking Bad* reveals a series that entertained while generating measurable economic influence across global markets.

Its success was neither accidental nor purely artistic—it was a calculated convergence of narrative ambition and financial precision. As streaming transforms content economics, *Breaking Bad* remains a benchmark, proving that every twist, turn, and final payoff carries real-world consequences.

Related Post

V Villa Taman Sakura Sentul: Where Luxury and Serenity Converge for the Ultimate Escape

Julian McMahon, Kelly Paniagua, and the Architects Behind a Defining Moment in Latin American Diplomacy

The Tragic Hands of Galvarino: A Warrior’s Hands Across Blood and Honor

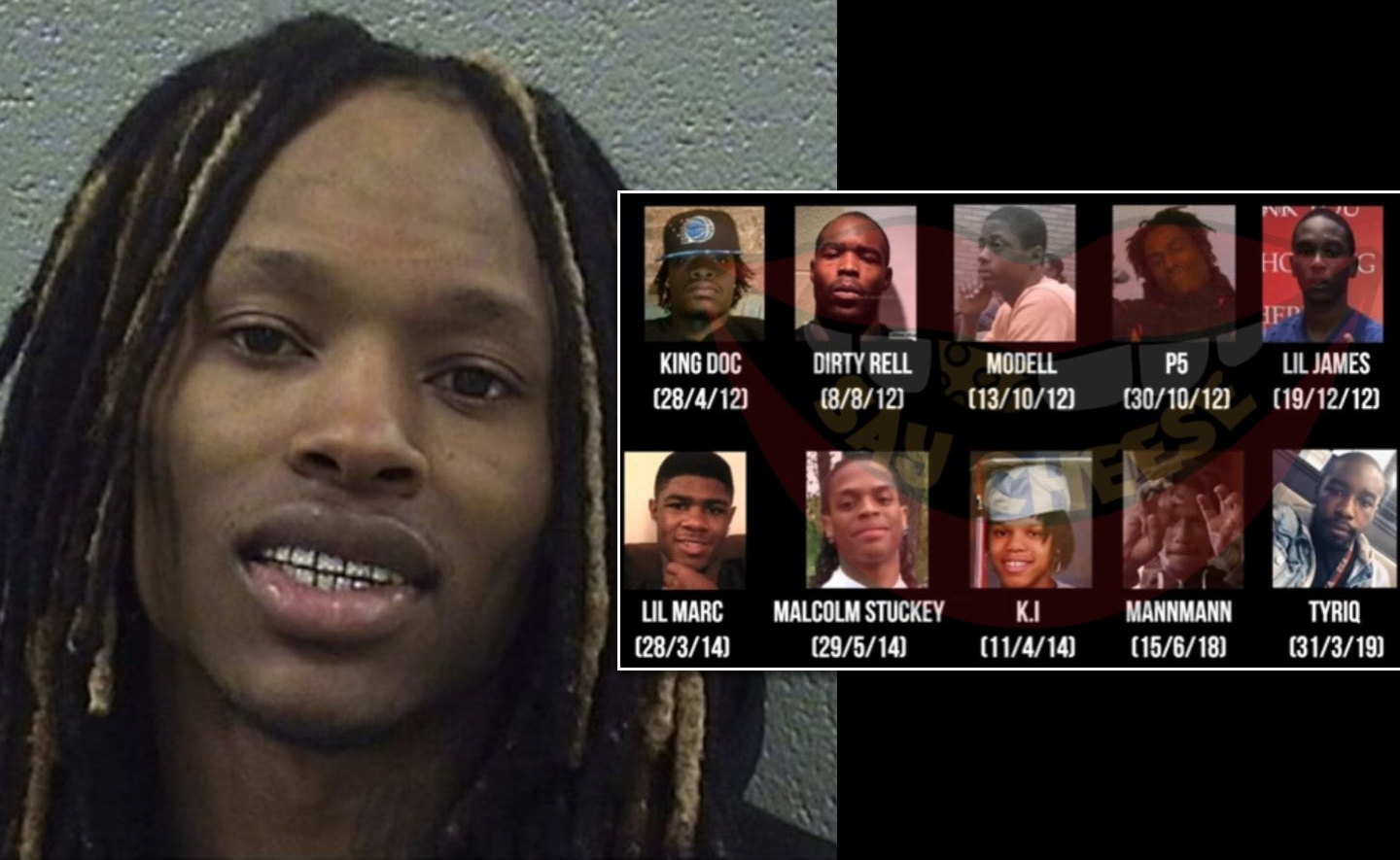

Unveiling The Mystery King Von S Autopsy Report: The Final Chapter of a Murder That Shook the Streets