Boost Your Asset Value: The Critical Role of Tokenization in Modern Financial Ecosystems

Boost Your Asset Value: The Critical Role of Tokenization in Modern Financial Ecosystems

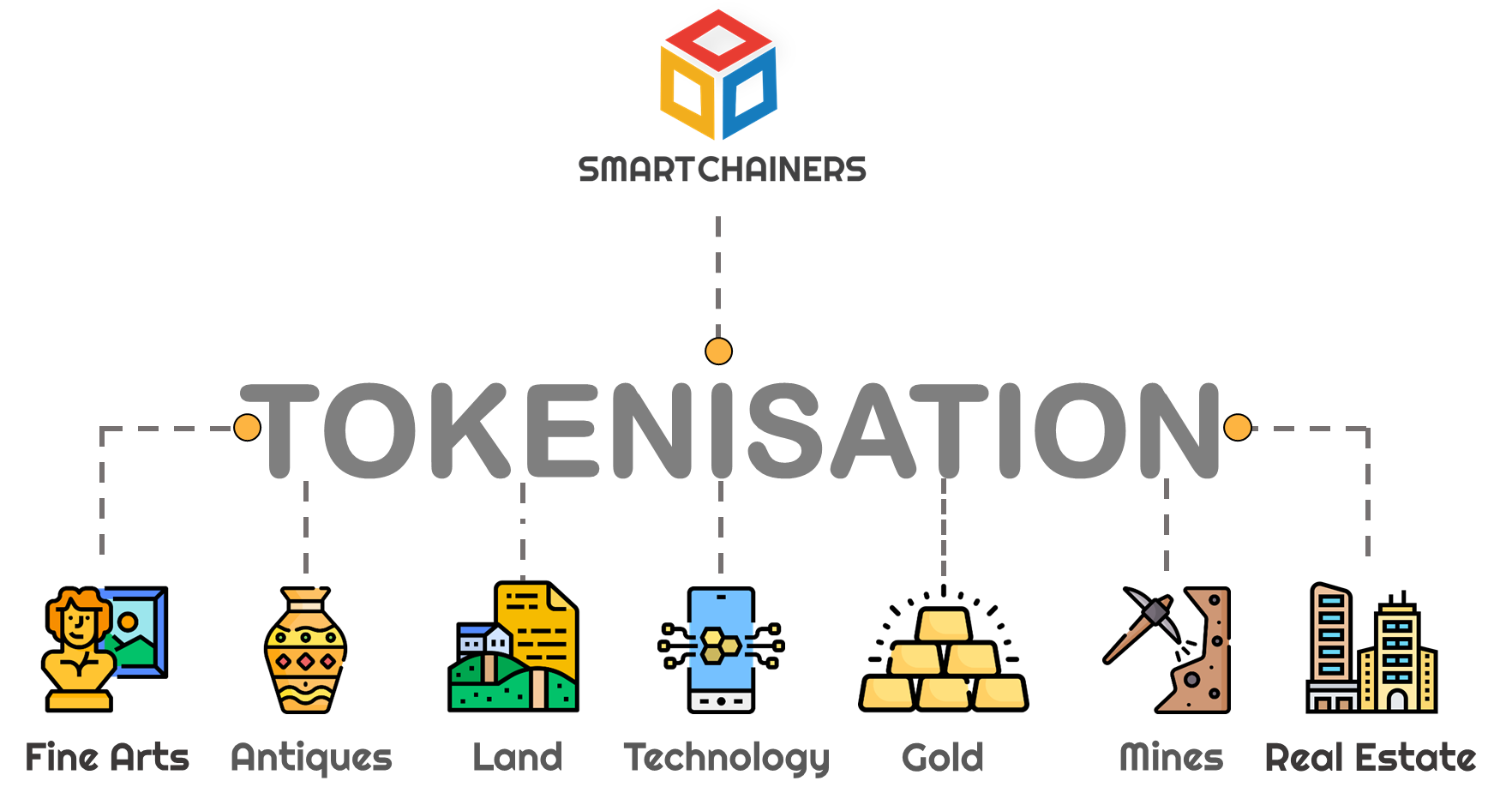

In an era defined by digital transformation, the term "token" has transcended its niche crypto roots to become a cornerstone of modern financial infrastructure—driving unprecedented liquidity, accessibility, and value acceleration. Tokenization, the process of converting real-world assets into digital tokens on blockchain, is reshaping how markets operate, expanding participation, and unlocking new economic potential across industries. When deployed thoughtfully, tokenization functions as a powerful "boost"—a catalyst that amplifies asset utility, transparency, and global reach.

But what exactly is a token, how does it generate value within a digital ecosystem, and what are the real-world applications and implications across finance, real estate, art, and logistics? This article unpacks the evolution, mechanics, and strategic importance of tokenization and its transformative impact on asset management.

The Essence: What Exactly Is a Token in Financial and Digital Ecosystems?

A token is a digital representation—often built on blockchain technology—of value tied to a physical or intangible asset.Unlike cryptocurrencies such as Bitcoin or Ethereum, which are primarily independent digital currencies, tokens derive their worth from the rights, assets, or services they represent. “Tokenization means assigning a digital fingerprint to an asset—be it a piece of property, a fraction of art, or even future revenue streams—so that ownership and transaction become seamless, verifiable, and programmable,” explains blockchain analyst Marcus Reeves. Tokens exist across multiple standards—ERC-20 for fungible utilities, ERC-721 for unique digital collectibles, and ERC-1155 for multi-asset smart contracts—each designed to meet specific functional and regulatory needs.

What unites them is their ability to stand as digital proxies, enabling instant, borderless transfer without reliance on intermediaries. This estructura… not only reduces friction but enhances auditability, as every transaction is immutably recorded on the blockchain.

The core innovation lies in fractionalization: any high-value asset, even a $10 million artwork or a commercial real estate property, can be split into hundreds or thousands of tradable tokens.

This opens access to a broader investor base, democratizing what once was exclusive to wealthy institutions or elite collectors.

How Tokenization Boosts Asset Value and Ecosystem Dynamics Tokenization serves as a multi-dimensional growth engine for asset performance. Its impact ripples through liquidity, market accessibility, transparency, and operational efficiency—transforming static holdings into dynamic, tradable instruments. - Fractional Ownership and Inclusion: “Tokenization allows fractional shares in traditionally illiquid assets—turning a $5 million skyscraper into 5,000 tokens priced at $1,500 each,” notes finance consultant Elena Torres.

“This lowers entry barriers, enabling retail investors to participate in markets once out of reach.”

- Liquidity Revolution: Assets like real estate or fine art, historically slow to sell, now gain daily marketability. Tokens can be traded 24/7 on regulated platforms, drastically reducing the typical months or years required for traditional exits.

- Transparency and Trust: Every token transaction is permanently recorded on a tamper-proof ledger. This immutability reduces fraud risk and streamlines audits, as provenance, ownership history, and usage rights are verifiable at a glance.

- Programmable Rights and Automation: Smart contracts allow embedded rules—dividends, voting rights, or revenue splits—to execute automatically, eliminating manual intervention and improving compliance.

“This lowers entry barriers, enabling retail investors to participate in markets once out of reach.”

Beyond these direct benefits, tokenization fosters ecosystem synergies.

Platforms integrating tokens can interlink diverse asset classes—real estate, commodities, intellectual property—creating liquid, interconnected markets where data and value flow seamlessly.

Real-World Applications Across Key Industries The versatility of tokenization anchors its growing adoption across sectors, each leveraging digital tokens to unlock unique value propositions.

In real estate, tokenization is revolutionizing ownership structures. Platforms like RealT and Propy enable fractional ownership of residential and commercial properties, allowing global investors to stake small but meaningful claims without relocating or navigating complex cross-border laws.

For art and collectibles, non-fungible tokens (NFTs) have created new revenue models.

Artists now tokenize digital masterpieces or even physical works, retaining royalties on secondary sales—a shift that empowers creators and deepens collector engagement. $173 million in NFT art sales in 2022 underscored this trend’s scale.

Supply chain and logistics benefit from tokenizing assets like commodities or high-value goods, offering real-time tracking, provenance verification, and streamlined payments. Each unit or shipment becomes a traceable, tradable token, reducing inefficiencies and enhancing trust across networks.

Even financial instruments such as bonds and equities are being reimagined via tokenization.

Institutional-grade tokenized securities improve access to capital markets, accelerate settlement times from days to minutes, and reduce counterparty risk through automated execution.

The Strategic Imperative: Embedding Tokenization into Modern Finance As global markets grow increasingly interconnected and digital, tokenization is no longer optional—it is strategic. Financial institutions, corporations, and regulators are uniquely positioned to harness its power. Banks and asset managers integrating tokenized products reach new clients, improve margin structures, and future-proof operations.

Meanwhile, regulators are crafting frameworks to balance innovation with investor protection, ensuring trust and scalability. Tokenization’s true strength lies in its ability to bridge tangible and digital worlds, creating fluid, inclusive, and efficient markets. “The token is not just a symbol of ownership—it’s the foundation of a new economic layer built on trust, transparency, and inclusion,” argues blockchain visionary Zara Khan.

As adoption accelerates, the distinction between physical and digital will blur, propelling a financial ecosystem where every asset finds its voice in the token economy.

Tokenization is not merely a technological upgrade—it is a paradigm shift ready to redefine how markets work, how brands connect, and how value flows. By embedding tokens into assets, economies unlock hidden liquidity, empower communities, and ignite growth across every sector.

Related Post

Behind the Wall: Alejandro Mayorkas Shapes America’s Homeland Security at a Crossroads

Ulta Make a Payment: Mastering Seamless, Secure Transactions in a Fast-Paced Retail World

Unveiling The Best Spy World Movies: Thrills, Action, And Intrigue

Top 10 South African Dishes Youll Love This Year