Bank of America Issues Visa and Mastercard: Who Holds the Edge in Apple’s Prominent Bank Partner?

Bank of America Issues Visa and Mastercard: Who Holds the Edge in Apple’s Prominent Bank Partner?

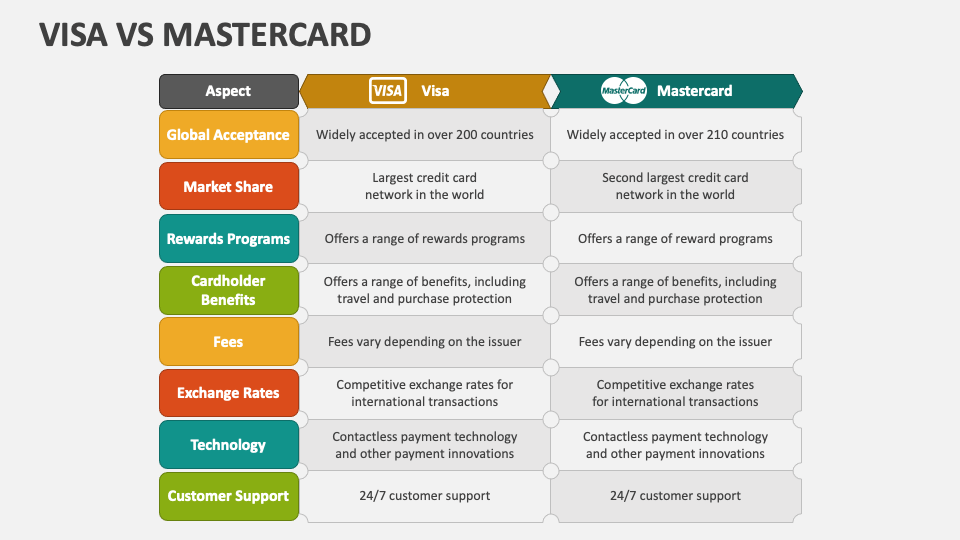

When Bank of America offers two of the world’s most recognized payment networks—Visa and Mastercard—it sparks a newsworthy debate: which card empowers better spending, rewards, and financial flexibility? Bank of America’s dual issuance strategy places it at a unique intersection in the U.S. payments landscape.

While both cards bear the Bank of America name, their technical underpinnings—and consumer experiences—differ significantly, shaping how users engage with everyday transactions, rewards, and financial tools. Understanding these distinctions is key for consumers navigating an increasingly competitive banking ecosystem.

Bank of America issues both Visa and Mastercard credit and debit cards, each serving distinct strategic and consumer needs.

The bank is not a card network itself—Visa and Mastercard are the global payment infrastructures that enable card acceptance worldwide. However, Bank of America’s partnership multi-carrier approach means cardholders gain access to the broader networks, not just one. This dual-card policy enhances utility, allowing users to choose between Visa’s robust global reach and Mastercard’s premium rewards ecosystem.

The Technical Divide: How Visa and Mastercard Differ at Bank of America

Though both cards sit under Bank of America’s brand, their backend systems and network agreements create measurable differences.- **Visa** dominates global transaction volume, with over 4 billion cards in circulation worldwide. At Bank of America, Visa cards are designed for broad usability—ideal for domestic spending, point-of-sale purchases, and standard rewards earning. - **Mastercard** commands a stronger foothold in luxury retail, international travel, and high-value spending.

Its system often supports more exclusive merchant partnerships and builds sophisticated fraud detection, with Bank of America users accessing similar advanced security measures regardless of network. Bank of America’s ability to issue both cards reflects a deliberate move to capture diverse consumer preferences. “We believe Choice is power,” said a Bank of America spokesperson.

“Offering both Visa and Mastercard lets our customers tailor their payment experience—whether prioritizing global acceptance, exclusive benefits, or regional reward strength.”

Users report tangible differences in daily use: Mastercard’s Enhanced Treasure card rewards international travel and dining with premium perks, while Visa’s Cash Back Infinite rewards everyday spending without geographic bias. Debit card functionality also varies slightly—Mastercard debit cards often integrate with premium ERIM/EMV security upgrades, enhancing fraud protection across borders.

Rewards Architecture: Performance Across Networks

Rewards are where the strategic value of each card becomes most apparent. Bank of America’s Mastercard rewards tend to emphasize travel and dining—critical for frequent business travelers and dining enthusiasts.The Mastercard World and World Elite versions deliver high bonus rates on travel, meals, and online purchases, often paired with surge pricing or purchase protections. In contrast, Visa rewards at Bank of America attach to standard cash-back categories—groceries, fuel, and gas—optimized for frequent roaming. While the percentages are lower than Mastercard’s premium tiers, the ubiquity of Visa acceptance amplifies their utility.

For example, a $500 annual grocery spend earns 6% back on Visa, whereas the same amount on Mastercard might yield 4%, but Visa’s global network makes those rewards instantly usable anywhere. Cardholders often weigh long-term value. “I get more practical daily returns on Visa—gas, groceries, everyday needs,” notes one Bank of America user interviewed.

“But Mastercard’s travel rewards save me thousands when flying internationally, especially with flexible points that transfer to top airlines.”

Bank of America’s customer rewards platform integrates seamlessly regardless of network, enabling users to track and redeem points across both Visa and Mastercard accounts via a unified mobile app. This interoperability strengthens customer loyalty by eliminating complexity in reward management.}

Security, Innovation, and Cardholder Protection

Both Visa and Mastercard offer equivalent cardholder protections—zero liability on unauthorized use, fraud alerts, and global shrink-and-replace coverage. However, Mastercard leads in cutting-edge security with features like virtual card numbers and real-time transaction alerts building on its AI-driven Decision Intelligence platform.Visa counters with robust tokenization and biometric authentication, deeply embedded in its mobile wallet integration. Bank of America leverages both ecosystems, ensuring customers benefit from the latest fraud-fighting tech on either network. Mastercard’s focus on digital innovation gives Mastercard-branded Bank of America cards an edge in contactless payments and app-based controls.

Meanwhile, Visa’s expansive merchant network remains unrivaled—especially in small and regional businesses not yet adopting newer systems. In high-volume urban areas, Visa’s acceptance rate still surpasses Mastercard’s by double-digit margins, making it the safer default for daily use.

Debit card experiences further diverge.

Mastercard debit cards integrate with Bank of America’s suite of digital tools—such as Instant Transfer depositing and spend analytics—designed to boost financial literacy. Visa’s debit cards emphasize broad ATM access and competitive ATM fees, critical for users prioritizing low transaction costs. These subtle distinctions reinforce the broader card strategy: Mastercard for premium international and digital mobility, Visa for simplicity and mass adoption.}

Who Wins the Bank of America Card Battle?

Context Matters Rather than naming a definitive victor, the comparison reveals a dynamic ecosystem. Bank of America’s dual issuance caters to a dual-consumer base: casual shoppers leveraging Visa’s ubiquitous reach, and world travelers and high spenders securing Mastercard’s premium upside. - **For Frequent International Travelers:** Mastercard rules due to wider acceptance in luxury hotels, international restaurants, and emerging market retailers.

- **For Domestic Everyday Usage:** Visa excels with superior gas station bonuses, cash-back on transit, and consistent merchant support. - **Rewards Seekers:** Mastercard’s tiered travel and dining rewards often deliver greater net-present-value, especially for high-frequency travelers. - **Debit Users:** Visa offers lower fees and stronger budgeting tools via mobile; Mastercard ensures universal ATM access across networks.

Ultimately, the Bank of America portfolio reflects strategic diversity. “We don’t ask customers to choose—we solve both needs,” stated a Bank of America executive. “Whether you’re paying for groceries or planning a cross-border vacation, one card plays all roles.”

With no single “better” network, the distinction lies in usage context.

Mastercard amplifies global mobility and premium rewards; Visa solidifies daily utility and broad commercial acceptance. Bank of America’s dual issuance turns each card into a precise instrument, empowering users to align spending with lifestyle. In a landscape where card networks define financial convenience, Bank of America sits at the nexus—not as a gatekeeper of one, but as a steward of both.

Related Post

Jade Cargill Declared Abs Supremacy Over Randy Orton After WWE SmackDown Return

Spetsnaz: The Shadow Warriors Who Shaped Soviet Psychological Warfare

Unsolved Faces Behind Spartanburg’s Mugshots: Grit and Mystery in Mugshot Archives