Arbitrum Ethereum Bridge: Your Ultimate Guide to Seamless Cross-Chain Mobility

Arbitrum Ethereum Bridge: Your Ultimate Guide to Seamless Cross-Chain Mobility

The Arbitrum Ethereum Bridge stands as a pivotal innovation in the decentralized finance ecosystem, enabling fast, secure, and cost-effective transfers of assets between the Ethereum mainnet and Arbitrum’s optimistic scaling layer. For developers, users, and enterprises navigating the evolving blockchain landscape, understanding this bridge is no longer optional—it’s essential. As Ethereum’s transaction demands surge, Arbitrum’s bridge solves scalability bottlenecks while preserving trust through Ethereum-compatible smart contracts and robust security protocols.

This guide unpacks the mechanics, benefits, use cases, and future of the Arbitrum Ethereum Bridge, equipping readers to harness its full potential.

The Arbitrum Ethereum Bridge functions as a trusted conduit, connecting Ethereum’s vast ecosystem with Arbitrum’s high-throughput environment. Built on Arbitrum’s optimistic rollup architecture, the bridge enables users to bridge ERC-20 tokens, ETH, and other digital assets across chains without compromising integrity.

Unlike older blockchain bridges riddled with vulnerabilities and delays, the Arbitrum bridge leverages multi-phase verification and economic incentives to secure user funds. “We designed the bridge to minimize slippage, reduce congestion on Ethereum, and keep composability intact,” explains a core developer involved in the project’s expansion. “Every transfer is validated through a secure, commit-revert handshake and reinforced by collateralized deposit mechanisms.”

At its core, the bridge relies on Arbitrum’s Layer 1 scalability, processing transactions dozens of times faster than mainline Ethereum while maintaining full compatibility with Ethereum wallets and smart contracts.

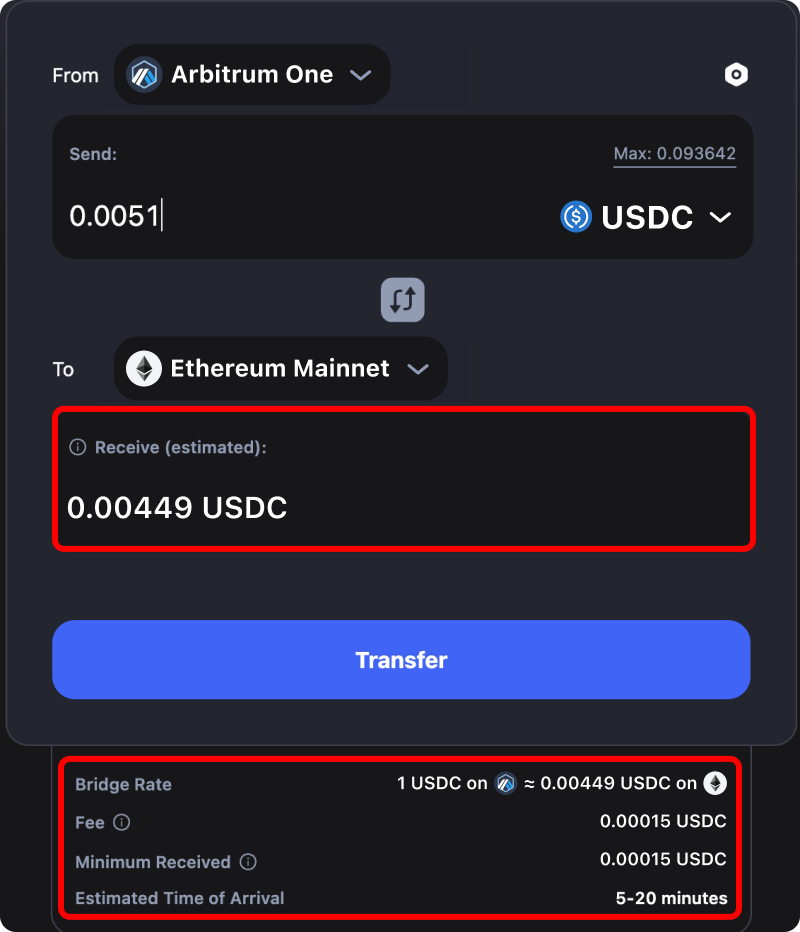

Users initiate a bridge transaction by locking assets in Ethereum’s smart contract, generating a cryptographic proof that is then verified off-chain by Arbitrum’s sequencers. Once validated, equivalent assets are minted at the Arbitrum endpoint, ready for immediate use. This process is nearly invisible to end users, who experience seamless transfers with minimal latency—as short as seconds—across networks.

Key Features Driving Adoption

The bridge’s architecture incorporates several underrated yet transformative features:

- Low Fees:** By utilizing optimistic rollups, users benefit from transaction costs often below $1—which is a fraction of Ethereum’s gas fees during peak times. This cost efficiency fuels microtransactions and native integration into decentralized applications (dApps).

- Multi-Asset Support:** While ERC-20 token Bridges are standard, Arbitrum’s implementation supports extended token standards, enabling real-world assets (RWAs), NFTs, and custom ERC-22 tokens to cross chains securely.

- Ethereum-Compatible Smart Contracts:** The bridge maintains full compatibility with Solidity and OpenZeppelin contracts, empowering developers to deploy bridged dApps without code overhauls.

- Security by Design:** Funds are locked automatically, with no hidden smart contract risks. Fraud detection systems and regular audits by independent firms like ChainGuardian reinforce trust.

- High Throughput:** Arbitrum processes around 2,000 transactions per second (TPS), making it capable of handling enterprise-scale workloads without compromising speed.

For developers building decentralized applications, the Arbitrum Ethereum Bridge eliminates a critical friction point.

Marrying Ethereum’s massive ecosystem with Arbitrum’s efficiency unlocks new product possibilities—from cross-chain DeFi protocols and liquid stablecoins to multi-chain gaming economies. “Developers now build once, deploy anywhere,” notes a leading dApp founder utilizing the bridge. “The bridge reduces operational overhead and accelerates time-to-market.”

Real-World Use Cases and Impact

The bridge is already transforming how users and protocols interact across ecosystems.

Consider institutional asset managers moving tokenized bonds or equities between Ethereum and Arbitrum to reduce settlement times. Or flash trading bots that execute cross-chain arbitrage, cashing in millionths with speed and precision unimaginable on mainnet.

Even within DeFi, the bridge fuels innovation: lending platforms now accept bridged ETH and wrapped tokens, expanding liquidity pools. Cross-chain NFT marketplaces enable creators to showcase digital art on multiple chains while preserving provenance on Arbitrum.

“The bridge isn’t just about speed—it’s about expanding the composability of value,” says a crypto researcher analyzing next-gen wallet integrations. “It enables trust-minimized, instant asset swaps that redefine financial interoperability.”

Security and Trust: The Foundation of Scalability

Reliability remains paramount. Unlike earlier bridge models vulnerable to hacks or fund loss, the Arbitrum Ethereum Bridge introduces safeguards that prioritize user safety.

Funds are locked in multi-signature wallets before transfer, and a unique locktime specification prevents replay attacks. “Drug-tested smart contracts and transparent on-chain validation ensure users can verify every step,” a network integrity officer emphasized. “Security isn’t an afterthought—it’s engineered into the bridge’s DNA.”

Furthermore, Arbitrum’s governance model allows reliant parties to review and approve future protocol upgrades, maintaining decentralized oversight and long-term trust.

This collaborative framework minimizes single points of failure and reinforces decentralized accountability.

Setup, Usage, and Developer Tools

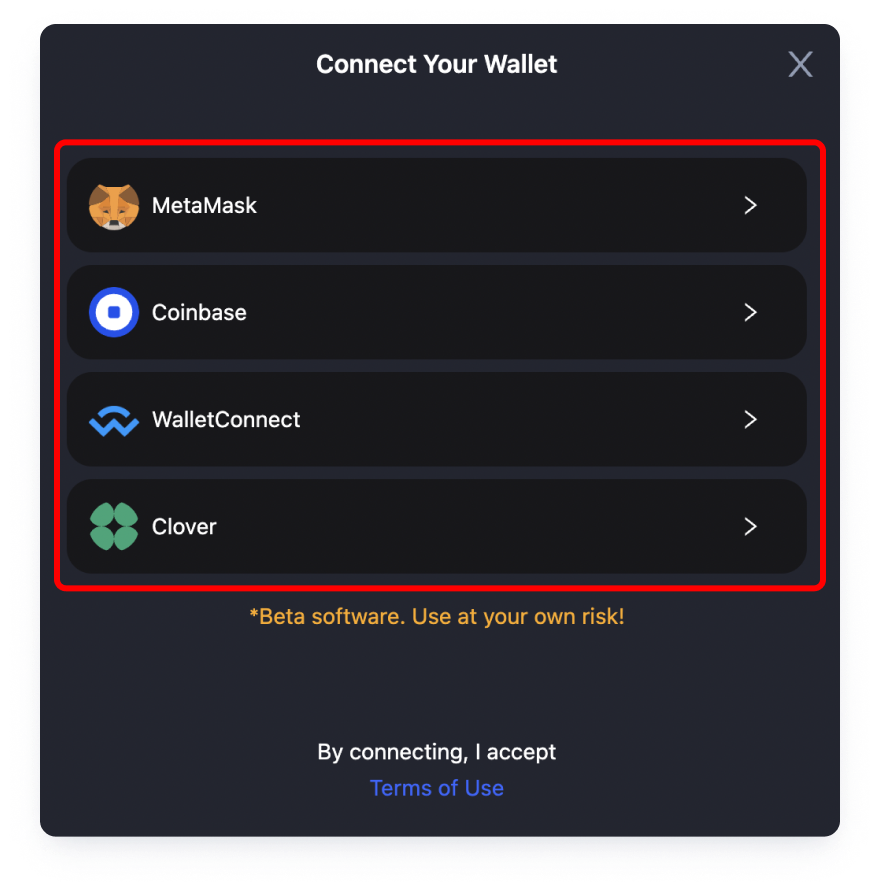

For beginners, deploying the bridge is straightforward: users interact via popular wallet interfaces like MetaMask, supported through Arbitum’s SDKs and API integrations. Developers benefit from comprehensive tooling—including testnets, wallet plugins, and cross-chain bridge test frameworks—that simplify deployment and debugging.

Integrating the bridge into projects requires:

- Implementing Arbitrum’s Genesis Bridge protocol via official SDKs.

- Signing transfers using ERC-20 bridged token standards.

- Handling gas-free mint/burn via Arbitrum’s native fee model.

- Testing with Arbitrum’s Layer 1 testnet to validate cross-chain flows.

Major projects already leverage these tools: from DeFi protocols minting bridged tokens for yield farming to NFT marketplaces enabling instant cross-chain resale.

Developer forums and lengthy documentation ensure minimal ramp-up time for teams entering the ecosystem.

Looking ahead, the Arbitrum Ethereum Bridge is set to evolve with Layer 2 innovations and expanding asset compatibility. With Layer 3 enhancements and potential integration with zk-rollups, transaction finality may shorten even further.

Meanwhile, partnerships with major wallets—such as Argent, Trust Wallet, and WalletConnect—ensure widest reach and user-friendly access. As Ethereum’s scaling ambitions intensify, Arbitrum’s bridge remains a blueprint for secure, scalable, and inclusive cross-chain infrastructure.

For issuers, developers, and users alike, the Arbitrum Ethereum Bridge isn’t merely a technical bridge between chains—it’s a bridge to a more interconnected, efficient, and accessible decentralized future.

In solving Ethereum’s scalability challenges through robust design and real-world utility, it accelerates the vision of universal interoperability, one transfer at a time.

Related Post

Mother’s Warmth Chapter Three – Jackerman: Where Love Meets Resilience

Unveiling the Charm of the Skirby Dog Video: Why This Pet Phenomenon Captured the Global Heart