Apples’ Billion-Dollar Empire: Unveiling the Macroeconomics Behind Its Billion-Dollar Net Worth

Apples’ Billion-Dollar Empire: Unveiling the Macroeconomics Behind Its Billion-Dollar Net Worth

Apple Inc. stands as a modern titan of global commerce, its net worth exceeding $350 billion and cementing its position as one of the most valuable companies on Earth. Far beyond a mere tech label, Apple represents a carefully cultivated ecosystem of innovation, brand loyalty, and market dominance that has driven its financial ascent for over a decade.

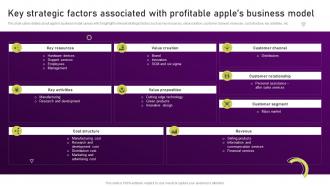

With each record-breaking quarter, the company’s financial health reflects not just product success but a strategic mastery of supply chains, customer engagement, and global markets. Operational Pillars Fueling Apple’s Financial Might At the core of Apple’s staggering net worth are four key business segments—each generating billions in recurring revenue: 1. iPhone sales, which still account for roughly half of total revenue, enable massive scale and recurring customer cycles.

2. Services—encompassing the App Store, Apple Music, iCloud, and Apple TV+—boasts over $85 billion in annual sales and boasts industry-leading margins. 3.

Wearables, Home, and Accessories now represent a fast-growing segment, driven by the Apple Watch, AirPods, and HomePod, contributing nearly $100 billion in annual revenue. 4. Enterprise solutions and Mac sales, rejuvenated by the M-series chips, maintain steady growth in professional and creative markets.

The discipline behind Apple’s product cadence and vertical integration allows it to maintain premium pricing while achieving economies of scale. “Apple’s ability to innovate while managing supply chain complexity is unmatched,” said financial analyst Linda Chen of Centennial Capital. “This efficiency directly strengthens gross margins and boosts long-term shareholder value.” Available to investors worldwide, Apple’s consistent profitability—reported over $99 billion in annual net income in fiscal 2023—drives sustained confidence.

Its stock, trading above $180 per share as of late 2024, reflects not only current earnings but expectations of future expansion into AR/VR, health-tech, and AI services. The Role of Brand Loyalty and Ecosystem Lock-In Apple’s billion-dollar valuation isn’t solely the product of hardware and services; it thrives on one of the strongest consumer ecosystems in history. Users drawn into iPhones, Macs, iPads, and Apple Watches often remain within the Apple Network, creating powerful network effects.

Dieses pro-customer loyalty results in industry-leading retention: over 90% of iPhone users stay with the brand across model generations. “Apple’s closed ecosystem isn’t just convenient—it’s strategic,” notes economist Raj Patel. “Once consumers invest emotionally and functionally in an Apple ecosystem, switching costs increase dramatically—insulating the company from competitive erosion.” This loyalty fuels predictable revenue and supports premium pricing, even in saturated tech markets.

Moreover, Apple’s App Store generates over $85 billion annually, with developers deeply integrated into its user base—proving that software and hardware synergies amplify overall profitability. Global Reach and Strategic Diversification With operations in over 100 countries, Apple’s net worth benefits from a diversified global footprint. The U.S.

remains paramount, but Asia—particularly China—plays a critical role, despite recent geopolitical and regulatory headwinds. Apple’s vertically integrated services infrastructure enables localized monetization while protecting margins. Investments in regional data centers, legal compliance, and localized customer support ensure resilience amid shifting global dynamics.

Looking ahead, Apple’s expansion into health technology—via advanced sensors on Apple Watch—and potential AI-driven features indicates strategic diversification beyond traditional devices. These moves could unlock new revenue streams, sustaining its billion-dollar valuation trajectory. A Model of Sustainable Growth Apple’s billion-dollar net worth is not merely a figure—it’s a testament to disciplined innovation, ecosystem strength, and global market penetration.

By balancing hardware excellence with high-margin services and fostering unwavering customer loyalty, the company has built a financial fortress capable of weathering economic cycles. As Apple continues to redefine personal technology and emerge at the forefront of emerging tech frontiers, its wealth position remains a benchmark for corporate success in the 21st century. In an era defined by volatility, Apple’s balance sheet stands as a signal: deep pockets paired with strategic vision create enduring value.

Related Post

Alan Jackson’s Gospel Fire Ignites a New Defining Sound for Country Music

The Impact of Alec Wildenstein Jr: A Legacy Etched in Controversy and Influence

Pacers vs. Mavericks: A Clash of Fiery Offense and Defensive Grit in the NBA Play-In Battle

Brittany Begley ABC10 Bio Wiki Age Husband 10TV Salary and Net Worth